Galaxy Entertainment Group Selected Unaudited Q1 2016 Financial Data

PR Newswire

HONG KONG, April 26, 2016

HONG KONG, April 26, 2016 /PRNewswire/ -- Galaxy Entertainment Group Limited ("GEG" or "the Group") (HKEx stock code: 27) today reported selected unaudited 2016 first quarter financial data for the three months ended 31 March 2016.

Dr. Lui Che Woo, Chairman of GEG said:

"We experienced a solid start to 2016 with first quarter Adjusted EBITDA of $2.4 billion, as we adjust to changes in the Macau market. We continue to see signs that the market is potentially stabilizing in the near term and remain confident in the long term prospects of Macau.

"We remain focused on executing operationally as we continue to drive our mass business while diligently managing our cost structure. Since launching our $800 million cost control program in early 2015, we have realized savings of approximately $650 million up to 31 March 2016 with the balance to be delivered over the remainder of this year. We have achieved these cost savings without adversely impacting our 'World Class, Asian Heart' customer service standards for which we are renowned or pursuing local labor redundancies.

"As always, we continue to drive each and every segment of the business and allocate resources to their highest and best use.

"Our exciting development plans for Galaxy Macau™ Phase 3 are progressing and will include a range of unique and differentiated offerings that will support the Macau Government's objective to develop Macau into a World Center of Tourism and Leisure. These include significant MICEE facilities, a range of hotel options, a unique retail and lifestyle precinct and a truly differentiated family themed entertainment offer. We look forward to unveiling our plans in the near future.

"As previously announced we will be paying another special dividend of $0.15 per share on 29 April 2016. This will bring total dividends paid since July 2014 to approximately $7.3 billion. Our balance sheet remains exceptionally strong and liquid with net cash of $8.0 billion and we remain virtually debt free.

"We continue to believe that Macau has a very bright future. Unchanged long term fundamental growth drivers such as rising domestic consumption in China and a rapidly expanding middle class that aspires to travel more frequently supported by major infrastructure improvements, underpin our belief that Macau will register strong visitor growth in the years ahead.

"Finally, I would like to take this opportunity to thank all of our committed and hard-working staff, who deliver exceptional customer moments and are committed to our renowned 'World Class, Asian Heart' service philosophy."

Market Overview

Over the last eight quarters the Macau market has experienced a number of strong headwinds that have impacted revenues. After this extended period we are encouraged by the fact that first quarter 2016 gaming revenue grew 2% sequentially to $55 billion. Visitor arrivals, whilst slightly down over the past twelve months, have remained robust at approximately 30 million visitations per year, where recent policy changes hopefully serve as a catalyst for future growth.

Group Financial Results

The Group posted quarterly revenue of $13.4 billion in the first quarter of 2016 and Adjusted EBITDA of $2.4 billion. Galaxy Macau™'s Adjusted EBITDA was $2 billion, flat sequentially and up 12% year-on-year. StarWorld Macau's Adjusted EBITDA was $512 million, decreased 8% sequentially and 15% year-on-year. Broadway Macau™ reported an Adjusted EBITDA of $3 million. GEG's Construction Materials Division and City Clubs made solid contributions of $92 million and $26 million, respectively.

GEG experienced good luck in its gaming operation during Q1 2016, which increased its Adjusted EBITDA by approximately $100 million.

Balance Sheet and Special Dividends

The Group's balance sheet continues to be one of the strongest in the industry with healthy liquidity and virtually debt free. At 31 March 2016, GEG's cash on hand was $8.8 billion and net cash position was $8.0 billion with debt of $0.8 billion. As previously announced we are scheduled to pay another special dividend of $0.15 per share on 29 April 2016 totaling $640 million, bringing total dividends paid to $7.3 billion since July 2014.

The Group's total gaming revenue on a management basis[1] in Q1 2016 of $12.7 billion increased by 2% quarter-on-quarter and decreased by 5% year-on-year. Total mass table games revenue of $5.0 billion increased by 2% quarter-on-quarter and 17% year-on-year. Total VIP revenue grew 3% quarter-on-quarter to $7.2 billion but dropped 17% year-on-year as we continue to allocate our resources to their highest and best use and transition the business to the mass market and non-gaming.

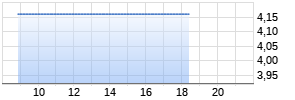

For the Group's Q1 2016 Adjusted EBITDA (HK$'m), please visit: http://photos.prnasia.com/prnh/20160427/8521602708-a

Galaxy Macau™

In Q1 2016, Galaxy Macau™ reported Adjusted EBITDA was $2.0 billion, flat sequentially and up 12% year-on-year. Revenue of $9.8 billion represented an increase of 2% quarter-on-quarter and 6% year-on-year. The vast majority of Galaxy Macau™'s earnings are generated by the mass market and non-gaming offerings.

Galaxy Macau™ experienced good luck in its gaming operations which increased its Adjusted EBITDA by approximately $135 million in Q1 2016.

Adjusted EBITDA margin under HKFRS was 21% (Q1 2015: 20%), or 27% under US GAAP (Q1 2015: 27%) in Q1 2016.

VIP Gaming Performance

Total VIP rolling chip volume for the first quarter was $130.5 billion. This translated into revenue of $5.5 billion, an increase of 5% quarter-on-quarter but down 3% year-on-year.

| VIP Gaming | | | | | |

| HK$'m | Q1 2015 | Q4 2015 | Q1 2016 | QoQ% | YoY% |

| Turnover | 156,645 | 136,630 | 130,536 | -4% | -17% |

| Net Win | 5,623 | 5,177 | 5,458 | 5% | -3% |

| Win % | 3.6% | 3.8% | 4.2% | | |

Mass Gaming Performance

First quarter revenue increased by 14% year-on-year to $3.3 billion, and was up 2% sequentially.

| Mass Gaming | | | | | |||||||

| HK$'m | Q1 2015 | Q4 2015 | Q1 2016 | QoQ% | YoY% | ||||||

| Table Drop | 6,018 | 7,410 | 7,734 | 4% | 29% | ||||||

| Net Win | 2,879 | 3,217 | 3,284 | 2% | 14% | ||||||

| Hold % | 47.8% | 43.4% | 42.5% | | | ||||||

Electronic Gaming Performance

In the first quarter, electronic gaming revenue was up 21% year-on-year but down 19% quarter-on-quarter at $381 million.

| Electronic Gaming | | | | | |||||||

| HK$'m | Q1 2015 | Q4 2015 | Q1 2016 | QoQ% | YoY% | ||||||

| Slots Handle | 7,608 | 12,323 | 11,542 | -6% | 52% | ||||||

| Net Win | 316 | 468 | 381 | -19% | 21% | ||||||

| Hold % | 4.2% | 3.8% Werbung Mehr Nachrichten zur Galaxy Entertainment Aktie kostenlos abonnieren

E-Mail-Adresse

Bitte überprüfe deine die E-Mail-Adresse.

Benachrichtigungen von ARIVA.DE (Mit der Bestellung akzeptierst du die Datenschutzhinweise) -1  Vielen Dank, dass du dich für unseren Newsletter angemeldet hast. Du erhältst in Kürze eine E-Mail mit einem Aktivierungslink. Hinweis: ARIVA.DE veröffentlicht in dieser Rubrik Analysen, Kolumnen und Nachrichten aus verschiedenen Quellen. Die ARIVA.DE AG ist nicht verantwortlich für Inhalte, die erkennbar von Dritten in den „News“-Bereich dieser Webseite eingestellt worden sind, und macht sich diese nicht zu Eigen. Diese Inhalte sind insbesondere durch eine entsprechende „von“-Kennzeichnung unterhalb der Artikelüberschrift und/oder durch den Link „Um den vollständigen Artikel zu lesen, klicken Sie bitte hier.“ erkennbar; verantwortlich für diese Inhalte ist allein der genannte Dritte. Andere Nutzer interessierten sich auch für folgende News | |||||||||