Fuwei Films Announces Its Unaudited Financial Results for the First Quarter of 2016

PR Newswire

BEIJING, May 19, 2016

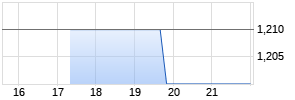

BEIJING, May 19, 2016 /PRNewswire/ -- Fuwei Films (Holdings) Co., Ltd. (Nasdaq: FFHL) ("Fuwei Films" or the "Company"), a manufacturer and distributor of high-quality BOPET plastic films in China, today announced its unaudited financial results for the first quarter of 2016 ended March 31, 2016.

Highlights

Net sales during the first quarter ended March 31, 2016 were RMB62.1 million or US$9.6 million, compared to RMB52.8 million during the same period in 2015, representing an increase of RMB9.3 million or 17.6%.

Net loss attributable to the Company during the first quarter ended March 31, 2016 was RMB12.1 million or US$1.9 million compared to a net loss attributable to the Company of RMB15.0 million during the same period in 2015, representing a decrease of RMB2.9 million.

Basic and diluted net loss per share was RMB0.92 or US$0.14 and RMB1.15 for the three-month period ended March 31, 2016 and 2015, respectively.

Gross profit was RMB5.6 million or US$0.9 million for the first quarter ended March 31, 2016, representing a gross margin of 9.0%, as compared to a gross loss margin of 14.8% for the same period in 2015. Correspondingly, the gross margin rate increased by 23.8 percentage points compared to the same period in 2015.

Mr. Zengyong Wang, Chairman and CEO of Fuwei Films, commented, "The first quarter financial results reflected encouraging results in revenues due to sales in specialty films which contributed to an increase in volumes that also led to improved margins despite weakened market conditions due to significant competition which caused oversupply and excess capacity in the marketplace. We believe that our focus on continued innovation and R&D will enable the Company to expand end-user applications and our high-end specialty films while increasing the product portfolio, which we believe will help us to attract new clients and expand relationships with existing customers. We are encouraged by positive trends in sales volume and gross margins that we expect to enable us to weather different industry and economic conditions in the periods ahead."

First Quarter 2016 Results

Net sales during the first quarter ended March 31, 2016 were RMB62.1 million or US$9.6 million, compared to RMB52.8 million, during the same period in 2015, representing an increase of RMB9.3 million or 17.6%, mainly due to the increased sales volume.

In the first quarter of 2016, sales of specialty films were RMB21.8 million or US$3.4 million or 35.0% of our total revenues as compared to RMB15.0 million or 28.5% in the same period of 2015. The increase was largely attributable to the increase in sales volume for dry films and coated films.

Overseas sales were RMB12.5 million or US$1.9 million, or 20.1% of total revenues, compared with RMB13.1 million or 24.8% of total revenues in the first quarter of 2015, representing a decrease of RMB0.6 million or 4.6%. The decrease in overseas sales was mainly due to the reduction of sales price.

The following is a breakdown of PRC domestic and overseas sales (amounts in thousands except percentages):

| | | Three-Month Period | % of Total | Three-Month Period | % of Total | |

| | | RMB | US$ | RMB | ||

| Sales in China | | 49,632 | 7,697 | 79.9% | 39,696 | 75.2% |

| Sales in other countries | | 12,515 | 1,941 | 20.1% | 13,080 | 24.8% |

| | | | | | | |

| | | 62,147 | 9,638 | 100.0% | 52,776 | 100.0% |

Our gross profit was RMB5.6 million or US$0.9 million for the first quarter ended March 31, 2016, representing a gross margin of 9.0%, as compared to a gross loss margin of 14.8% for the same period in 2015. Correspondingly, gross margin rate increased by 23.8 percentage points compared to the same period in 2015. Our average product sales prices decreased by 2.0% compared to the same period in 2015 while the average cost of goods sold decreased by 22.3% compared to the same period last year, which contributed to the increase in our gross margin compared with the same period in 2015.

Operating expenses for the first quarter ended March 31, 2016 were RMB15.0 million or US$2.3 million, which was RMB6.2 million, or 70.5% higher than the same period in 2015. This increase was mainly due to the accounting treatment that allocated certain amount of fixed overhead from cost of goods sold to general and administrative expense due to the fact that our third production line has not been able to continue its production since April 2015, in addition to the increased allowance for doubtful accounts receivable.

Net loss attributable to the Company during the first quarter ended March 31, 2016 was RMB12.1 million or US$1.9 million compared to net loss attributable to the Company of RMB15.0 million during the same period in 2015, representing a decrease of RMB2.9 million.

Basic and diluted net loss per share was RMB0.92 or US$0.14 and RMB1.15 for the three-month period ended March 31, 2016 and 2015, respectively.

Total shareholders' equity was RMB307.6 million or US$47.7 million as of March 31, 2016, compared with RMB319.7 million as of December 31, 2015.

As of March 31, 2016, the Company had 13,062,500 basic and diluted ordinary shares outstanding.

Conference Call Information

The Company will host a teleconference on Friday, May 20, 2016, at 9:00 a.m. EDT / 9:00 p.m. Beijing time to discuss the financial results. To participate in the call, please dial +1-877-407-9205 in North America, or +1-201-689-8054 internationally, approximately 10 minutes prior to the scheduled start time.

A replay of the call can also be accessed via telephone by calling +1-877-660-6853 in North America, or +1-201-612-7415 internationally, and entering the following Conference ID: 13637379. The replay will be available until June 20, 2016, at 11:59 p.m. EDT.

About Fuwei Films

Fuwei Films conducts its business through its wholly owned subsidiary, Fuwei Films (Shandong) Co., Ltd. ("Fuwei Shandong"). Fuwei Shandong develops, manufactures and distributes high-quality plastic films using the biaxial oriented stretch technique, otherwise known as BOPET film (biaxially oriented polyethylene terephthalate). Fuwei's BOPET film is widely used to package food, medicine, cosmetics, tobacco, and alcohol, as well as in the imaging, electronics, and magnetic products industries.

Safe Harbor

This press release contains information that constitutes forward-looking statements made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995 and are subject to risks. Risk factors that could contribute to such differences include those matters more fully disclosed in the Company's reports filed with the U.S. Securities and Exchange Commission which, among other things, include; significant competition in the BOPET film industry, especially the significant oversupply of BOPET films resulting from the rapid growth of the Chinese BOPET industry capacity, changes in the international market and trade barriers, especially the adverse impact of the antidumping investigation and imposition of an anti-dumping duty on imports of the BOPET films originating from the People's Republic of China ("China") conducted by certain main importing countries; fluctuations of RMB exchange rate, the reduce in demand for the Company's products or the loss of main customers which may result in the decrease of sales, and negatively influencing the Company's financial performance, uncertainty as to the future profitability, uncertainty as to the Company's ability to successfully operate its third BOPET production line, uncertainty as to the Company's ability to continuously develop new BOPET film products to be produced by the third production line and keep up with changes in BOPET film technology, risks associated with possible defects and errors in its products including complaints and claims from clients, uncertainty as to its ability to protect and enforce its intellectual property rights, uncertainty as to its ability to attract and retain qualified executives and personnel, and uncertainty in acquiring raw materials on time and on acceptable terms, particularly in light of the volatility in the prices of petroleum products in recent years, instability of power and energy supply, and the uncertainty regarding the future operation of the Company in connection with the changes in the labor law in China, the measures taken by the Chinese government to save energy and reduce emissions, and the complaints from nearby residents and local government about the noise caused by our production as well as the uncertainty of the impact of major shareholder transfer that have substantial influence over the Company and the Company's business operation including possible overlap of our BOPET products, customers and market orientation with an BOPET film manufacturer, which is controlled by the same individual who has control over the shares of our major shareholder. The forward-looking information provided herein represents the Company's estimates as of the date of the press release, and subsequent events and developments may cause the Company's estimates to change. The Company specifically disclaims any obligation to update the forward-looking information in the future. Therefore, this forward-looking information should not be relied upon as representing the Company's estimates of its future financial performance as of any date subsequent to the date of this press release. Actual results of our operations may differ materially from information contained in the forward-looking statements as a result of the risk factors.

For more information, please contact:

In China:

Ms. Xiaoli Yu

Investor Relations Officer

Phone: +86-133-615-59266

Email: fuweiIR@fuweifilms.com

In the U.S.:

Vivian Chen

Investor Relations

Grayling

Phone: +1-646-284-9427

Email: vivian.chen@grayling.com

Financial Tables to Follow

|

FUWEI FILMS (HOLDINGS) CO., LTD. AND SUBSIDIARIES CONDENSED CONSOLIDATED BALANCE SHEETS AS OF MARCH 31, 2016 AND DECEMBER 31, 2015 (amounts in thousands except share and per share value) (Unaudited)

| |||||

| | | March 31, | | December 31, | |

| | RMB | US$ | | RMB | |

| ASSETS | |||||

| Current assets | | | | | |

| Cash and cash equivalents | | 9,429 | 1,462 | | 14,355 |

| Restricted cash | | 46,628 | 7,231 | | 43,215 |

| Accounts and bills receivable, net | | 21,948 | 3,404 | | 10,046 |

| Inventories | | 24,389 | 3,782 | | 29,574 |

| Advance to suppliers | | 5,598 | 868 | | 5,640 |

| Prepayments and other receivables | | 10,696 | 1,659 | | 20,334 |

| Deferred tax assets - current | | 1,812 | 281 | | 1,438 |

| Total current assets Werbung Mehr Nachrichten zur Baijiayun Group Ltd Aktie kostenlos abonnieren

E-Mail-Adresse

Bitte überprüfe deine die E-Mail-Adresse.

Benachrichtigungen von ARIVA.DE (Mit der Bestellung akzeptierst du die Datenschutzhinweise) -1  Vielen Dank, dass du dich für unseren Newsletter angemeldet hast. Du erhältst in Kürze eine E-Mail mit einem Aktivierungslink. Hinweis: ARIVA.DE veröffentlicht in dieser Rubrik Analysen, Kolumnen und Nachrichten aus verschiedenen Quellen. Die ARIVA.DE AG ist nicht verantwortlich für Inhalte, die erkennbar von Dritten in den „News“-Bereich dieser Webseite eingestellt worden sind, und macht sich diese nicht zu Eigen. Diese Inhalte sind insbesondere durch eine entsprechende „von“-Kennzeichnung unterhalb der Artikelüberschrift und/oder durch den Link „Um den vollständigen Artikel zu lesen, klicken Sie bitte hier.“ erkennbar; verantwortlich für diese Inhalte ist allein der genannte Dritte. Andere Nutzer interessierten sich auch für folgende News | |||||