First Community Corporation Announces Annual and Fourth Quarter Results and Increased Cash Dividend

PR Newswire

LEXINGTON, S.C., Jan. 20, 2016

LEXINGTON, S.C., Jan. 20, 2016 /PRNewswire/ --

Highlights

- Net income of $ 6.1 million in 2015, a 19.6% increase over 2014 earnings

- Diluted EPS of $0.91 per common share in 2015, compared to $0.78 in 2014, an increase of 16.7%

- Increase in cash dividend to $0.08 per common share, the 56th consecutive quarter of cash dividends paid to common shareholders

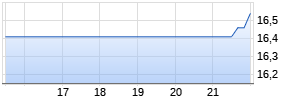

- Total shareholder return of 35% in 2015, as compared to the NASDAQ Bank Index growth of 6.6%

- Total revenue growth of $2.276 million, a 7.1% increase to $34.2 million in total revenue in 2015

- Strong loan growth of $45.3 million in 2015, an increase of 10.2%

- Pure deposit growth (including customer cash management accounts) of $62.2 million during the year, an 11.9% increase.

- Key credit quality metrics were excellent with net charge-offs of 0.14% during the year and non-performing assets of 0.85% at year end.

- Regulatory capital ratios of 10.19% (Tier 1 Leverage) and 16.21% (Total Capital) along with Tangible Common Equity / Tangible Assets (TCE/TA) ratio of 8.47%

Today, First Community Corporation (Nasdaq: FCCO), the holding company for First Community Bank, reported net income available to common shareholders for the fourth quarter and year end of 2015. For the year ended December 31, 2015 net income available to common shareholders was $6.1 million compared to $5.1 million during year ended December 31, 2014. Diluted earnings per share for 2015 were $0.91 an increase over $0.78 in 2014. Net income available to common shareholders for the fourth quarter of 2015 was $1.60 million, compared to $1.51 million in the fourth quarter of 2014. Diluted earnings per common share were $0.24 for the fourth quarter of 2015 as compared to $0.22 for the fourth quarter of 2014. First Community President and CEO Michael Crapps commented, "We are pleased with our company's financial results during 2015 led by strong organic growth in both loans and pure deposits. This is built on top of the transformational year of 2014, which included both acquisitions and a denovo banking office."

Cash Dividend and Capital

The Board of Directors has approved an increase in the cash dividend for the fourth quarter of 2015 to $0.08. This dividend is payable on February 12, 2016 to shareholders of record of the company's common stock as of February 1, 2016. Mr. Crapps commented, "The entire board is pleased that our company's strong financial performance enables us to increase the cash dividend. We are also proud that dividend payments have continued uninterrupted for 56 consecutive quarters."

Each of the regulatory capital ratios (Leverage, Tier I Risk Based and Total Risk Based) exceeds the well capitalized minimum levels currently required by regulatory statute. At December 31, 2015, the company's regulatory capital ratios (Leverage, Tier I Risk Based and Total Risk Based) were 10.19%, 15.40%, and 16.21%, respectively. This compares to the same ratios as of December 31, 2014 of 10.02%, 16.12%, and 16.94%, respectively. Additionally, the regulatory capital ratios for the company's wholly owned subsidiary, First Community Bank, were 9.73%, 14.72%, and 15.54% respectively as of December 31, 2015. Further, the company's ratio of tangible common equity to tangible assets indicates a high quality of capital with a ratio of 8.47% as of December 31, 2015. The common equity tier one ratio for the company and the bank was 12.87% and 14.72%, respectively, at December 31, 2015.

Asset Quality

The company's asset quality remains strong and showed continued improvement on a linked quarter and year-over-year comparison. The non-performing assets ratio declined to 0.85% of total assets at December 31, 2015, as compared to the ratio of 0.88% at the end of the third quarter of 2015 and 1.18% at December 31, 2014. The nominal level of non-performing assets decreased to $7.297 million at year end 2015 from $7.519 million at the end of the third quarter of 2015 and $9.528 million at the end of 2014. Trouble debt restructurings, that are still accruing interest, declined slightly during the quarter to $1.632 million from $1.654 million at the end of the third quarter of 2015 and $2.200 million at year end 2014.

Net loan charge-offs for the quarter were $9 thousand and $642 thousand for the year of 2015. The ratio of classified loans plus OREO now stands at 14.68% of total bank regulatory risk-based capital as of December 31, 2015.

| Balance Sheet | |||||||||

| (Numbers in millions) | |||||||||

| | Quarter ending | | Quarter ending | | Quarter ending | | 12 Month | | 12 Month |

| | 12/31/15 | | 12/31/14 | | 9/30/15 | | $ Variance | | % Variance |

| Assets | | | | | | | | | |

| Investments | $283.8 | | $282.8 | | $273.7 | | $ 1.0 | | .4% |

| Loans | 489.2 | | 443.8 | | 483.9 | | 45.4 | | 10.2% |

| | | | | | | | | | |

| Liabilities | | | | | | | | | |

| Total Pure Deposits | $563.1 | | $504.5 | | $549.9 | | $ 58.6 | | 11.6% |

| Certificates of Deposit | 153.0 | | 165.1 | | 154.5 | | (12.1) | | (7.3%) |

| Total Deposits | $716.1 | | $669.6 | | $704.4 | | $46.5 | | 6.9% |

| | | | | | | | | | |

| Customer Cash Management | 21.0 | | 17.4 | | 19.9 | | 3.6 | | 20.7% |

| FHLB Advances | 24.8 | | 28.8 | | 27.5 | | (4.0) | | (13.9%) |

| | | | | | | | | | |

| Total Funding | $761.9 | | $715.8 | | 751.8 | | 46.1 | | 6.4% |

| Cost of Funds* | 0.44% | | 0.47% | | 0.45% | | | | (3 bps) |

| (*including demand deposits) | | | | | | | | | |

| Cost of Deposits | 0.25% | | 0.26% | | 0.26% | | | | (1 bp) |

| | | | | | | | | | |

Mr. Crapps commented, "Deposit and loan growth during 2015 were both strong and we are encouraged as that momentum continues into 2016. During 2015, our company saw the benefit of a number of previously discussed initiatives focused on increasing loan growth, resulting in loan production of $116 million and net loan growth of $45.3 million. This will continue to be an area of intense focus for our company. With our current level of liquidity and continued success in pure deposit growth, we have the funding available to support significant additional loan growth."

Revenue

Net Interest Income/Net Interest Margin

Net interest income increased on a linked quarter basis to $6.348 million for the fourth quarter up from $6.253 million in the third quarter of 2015 and year-over-year increased to $25.253 million at December 31, 2015 from $23.731 million at December 31, 2014. The net interest margin, on a taxable equivalent basis, decreased slightly to 3.29% for the fourth quarter of 2015 from 3.32% in the third quarter of the year.

Non-Interest Income

Non-interest income, adjusted for securities gains and loss on the early extinguishment of debt, increased year-over-year to $8.810 million in 2015 from $8.382 million in 2014, although it decreased on a linked quarter basis. During the quarter, the company repaid $2.75 million in Federal Home Loan Bank (FHLB) advances and experienced a $226 thousand loss on this early extinguishment of debt. This prepayment of the FHLB advances will enable the bank to save the expense of these borrowings in future periods. This loss was offset by a gain on the sale of securities of $84 thousand and as well as a gain of $130 thousand on the redemption of $500 thousand in Trust Preferred securities at a discount.

Revenues in the mortgage line of business increased year-over-year to $3.432 million in 2015 from $3.186 million in 2014, but declined as anticipated on a linked quarter basis from $964 thousand in the third quarter to $753 thousand in the fourth quarter of 2015. Mortgage production year-over-year increased $20.6 million or 22.6%, but declined on a linked quarter basis which was expected due to seasonal fluctuations and the impact of the historic floods which occurred in a major portion of the company's market area early in the fourth quarter. Revenue in the investment advisory line of business was up slightly year-over-year, $1.287 million in 2015 and $1.268 million in 2014, and was flat on a linked quarter basis, $294 thousand in the fourth quarter of 2015 compared to $290 thousand in the third quarter.

Non-Interest Expense

Non-interest expenses increased slightly on a linked quarter basis to $6.122 million in the fourth quarter from $6.067 million in the third quarter of 2015. Occupancy expenses related to flood damage, including an insurance deductible and other small losses not covered by insurance, and marketing expenses associated with an expanded media campaign to support commercial loan growth represented the majority of the expense increase.

First Community Corporation stock trades on the NASDAQ Capital Market under the symbol "FCCO" and is the holding company for First Community Bank, a local community bank based in the midlands of South Carolina. First Community Bank operates fifteen banking offices located in Lexington, Richland, Newberry, Kershaw, and Aiken counties in South Carolina and Augusta, Georgia, in addition to First Community Financial Consultants, a financial planning/investment advisory division.

FORWARD-LOOKING STATEMENTS

Certain statements in this news release contain "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995, such as statements relating to future plans, goals, projections and expectations, and are thus prospective. Such forward-looking statements are subject to risks, uncertainties, and other factors which could cause actual results to differ materially from future results expressed or implied by such forward-looking statements. Such risks, uncertainties and other factors, include, among others, the following: (1) competitive pressures among depository and other financial institutions may increase significantly and have an effect on pricing, spending, third-party relationships and revenues; (2) the strength of the United States economy in general and the strength of the local economies in which we conduct operations may be different than expected resulting in, among other things, a deterioration in the credit quality or a reduced demand for credit, including the resultant effect on the company's loan portfolio and allowance for loan losses; (3) the rate of delinquencies and amounts of charge-offs, the level of allowance for loan loss, the rates of loan growth, or adverse changes in asset quality in our loan portfolio, which may result in increased credit risk-related losses and expenses; (4) changes in the U.S. legal and regulatory framework; (5) adverse conditions in the stock market, the public debt markets and other capital markets (including changes in interest rate conditions) could have a negative impact on the company; (6) technology and cybersecurity risks, including potential business disruptions, reputational risks, and financial losses, associated with potential attacks on or failures by our computer systems and computer systems of our vendors and other third parties; (7) we may be unable to comply, or may need to devote more resources than currently expected in order to comply, with the requirements that will be set forth in our final BSA-related Consent Order with the FDIC, and (8) risks, uncertainties and other factors disclosed in our most recent Annual Report on Form 10-K filed with the SEC, or in any of our Quarterly Reports on Form 10-Q or Current Reports on Form 8-K filed with the SEC since the end of the fiscal year covered by our most recently filed Annual Report on Form 10-K, which are available at the SEC's Internet site (http://www.sec.gov).

Although we believe that the assumptions underlying the forward-looking statements are reasonable, any of the assumptions could prove to be inaccurate. We can give no assurance that the results contemplated in the forward-looking statements will be realized. The inclusion of this forward-looking information should not be construed as a representation by our company or any person that the future events, plans, or expectations contemplated by our company will be achieved. We undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise.

| FIRST COMMUNITY CORPORATION | | | | | ||

| | | | | | | |

| BALANCE SHEET DATA; Werbung Mehr Nachrichten zur First Community Aktie kostenlos abonnieren

E-Mail-Adresse

Bitte überprüfe deine die E-Mail-Adresse.

Benachrichtigungen von ARIVA.DE (Mit der Bestellung akzeptierst du die Datenschutzhinweise) -1  Vielen Dank, dass du dich für unseren Newsletter angemeldet hast. Du erhältst in Kürze eine E-Mail mit einem Aktivierungslink. Hinweis: ARIVA.DE veröffentlicht in dieser Rubrik Analysen, Kolumnen und Nachrichten aus verschiedenen Quellen. Die ARIVA.DE AG ist nicht verantwortlich für Inhalte, die erkennbar von Dritten in den „News“-Bereich dieser Webseite eingestellt worden sind, und macht sich diese nicht zu Eigen. Diese Inhalte sind insbesondere durch eine entsprechende „von“-Kennzeichnung unterhalb der Artikelüberschrift und/oder durch den Link „Um den vollständigen Artikel zu lesen, klicken Sie bitte hier.“ erkennbar; verantwortlich für diese Inhalte ist allein der genannte Dritte. Andere Nutzer interessierten sich auch für folgende News | ||||||