FICO Announces Earnings for Third Quarter Fiscal 2017

PR Newswire

SAN JOSE, Calif., July 31, 2017

SAN JOSE, Calif., July 31, 2017 /PRNewswire/ -- FICO (NYSE:FICO), a leading predictive analytics and decision management software company, today announced results for its third fiscal quarter ended June 30, 2017.

Third Quarter Fiscal 2017 GAAP Results

Net income for the quarter totaled $25.2 million, or $0.78 per share, versus $35.0 million, or $1.08 per share, reported in the prior year period. The current quarter earnings include a reduction to income tax expense of $2.7 million, or $0.08 per share, associated with the adoption of FASB Accounting Standards Update No. 2016-09 ("ASU 2016-09"). The current quarter also includes a pre-tax restructuring charge of $4.5 million, or $0.09 per share after tax.

Net cash provided by operating activities for the quarter was $72.0 million versus $85.4 million in the prior year period.

Third Quarter Fiscal 2017 Non-GAAP Results

Non-GAAP Net Income for the quarter was $37.4 million vs. $46.8 million in the prior year period. Non-GAAP EPS for the quarter was $1.16 vs. $1.45 in the prior year period. Free cash flow for the quarter was $66.8 million vs. $80.0 million in the prior year period. Free cash flow for both periods reflects the impact of ASU 2016-09. These non-GAAP financial measures are described in the financial table captioned "Non-GAAP Results" and are reconciled to the corresponding GAAP measures in the financial tables at the end of this release.

Third Quarter Fiscal 2017 GAAP Revenue

The company reported revenues of $231.0 million for the quarter as compared to $238.8 million reported in the prior year period.

"We had a very strong quarter in our Scores business, where our efforts to expand our revenue sources continue to pay off," said Will Lansing, chief executive officer. "We also had a strong bookings quarter, posting more than $90 million for the third consecutive quarter, and continuing to build a backlog of recurring revenue."

ARIVA.DE Börsen-Geflüster

Weiter aufwärts?

| Kurzfristig positionieren in Fair Isaac | ||

|

ME4TYX

| Ask: 0,32 | Hebel: 5,85 |

| mit moderatem Hebel |

Zum Produkt

| |

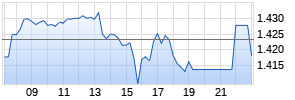

Kurse

|

Revenues for the third quarter of fiscal 2017 across each of the company's three operating segments were as follows:

- Applications revenues, which include the company's preconfigured decision management applications and associated professional services, were $133.8 million in the third quarter, compared with $141.6 million in the prior year quarter, a decrease of 5%. This was primarily due to decreased license sales in Fraud Management Solutions.

- Scores revenues, which include the company's business-to-business (B2B) scoring solutions and associated professional services, and business-to-consumer (B2C) service, were $69.5 million in the third quarter, compared to $61.1 million in the prior year quarter, an increase of 14%. B2B revenue increased 13% and B2C revenue increased 16% from the prior year quarter.

- Decision Management Software revenues, which include FICO® Blaze Advisor®, FICO® Xpress Optimization and related professional services, were $27.7 million in the third quarter compared to $36.1 million in the prior year quarter, a decrease of 23%, due primarily to decreased license revenues of Blaze Advisor.

Outlook

The company is updating its previously provided guidance for fiscal 2017 as a result of the impact of ASU 2016-09 on the current quarter to approximately:

| | Previous | Quarter 3, | New Fiscal |

| Revenue | $925 million | - | $925 million |

| GAAP Net Income | $130 million | $3 million | $133 million |

| GAAP Earnings Per Share | $4.03 | $0.08 | $4.11 |

| Non-GAAP Net Income | $158 million | - | $158 million |

| Non-GAAP Earnings Per Share | $4.92 | - | $4.92 |

The non-GAAP financial measures are described in the financial table captioned "Reconciliation of Non-GAAP Guidance."

Company to Host Conference Call

The company will host a webcast today at 5:00 p.m. Eastern Time (2:00 p.m. Pacific Time) to report its third quarter fiscal 2017 results and provide various strategic and operational updates. The call can be accessed at FICO's Web site at www.FICO.com/investors. A replay of the webcast will be available through July 31, 2018.

The webcast will also be distributed through the Thomson StreetEvents Network to both institutional and individual investors. The webcast can be accessed via Thomson's password-protected event management site, StreetEvents (www.streetevents.com).

About FICO

FICO (NYSE: FICO) powers decisions that help people and businesses around the world prosper. Founded in 1956 and based in Silicon Valley, the company is a pioneer in the use of predictive analytics and data science to improve operational decisions. FICO holds more than 170 US and foreign patents on technologies that increase profitability, customer satisfaction and growth for businesses in financial services, telecommunications, health care, retail and many other industries. Using FICO solutions, businesses in more than 100 countries do everything from protecting 2.6 billion payment cards from fraud, to helping people get credit, to ensuring that millions of airplanes and rental cars are in the right place at the right time.

Learn more at http://www.fico.com

Join the conversation at https://twitter.com/fico & http://www.fico.com/en/blogs/

FICO and Blaze Advisor are registered trademarks of Fair Isaac Corporation in the U.S. and other countries.

Statement Concerning Forward-Looking Information

Except for historical information contained herein, the statements contained in this news release that relate to FICO or its business are forward-looking statements within the meaning of the "safe harbor" provisions of the Private Securities Litigation Reform Act of 1995. These forward-looking statements are subject to risks and uncertainties that may cause actual results to differ materially, including the success of the Company's Decision Management strategy and reengineering initiative, the maintenance of its existing relationships and ability to create new relationships with customers and key alliance partners, its ability to continue to develop new and enhanced products and services, its ability to recruit and retain key technical and managerial personnel, competition, regulatory changes applicable to the use of consumer credit and other data, the failure to realize the anticipated benefits of any acquisitions, continuing material adverse developments in global economic conditions or in the markets we serve, and other risks described from time to time in FICO's SEC reports, including its Annual Report on Form 10-K for the year ended September 30, 2016 and Form 10-Q for the quarter ended June 30, 2017. If any of these risks or uncertainties materializes, FICO's results could differ materially from its expectations. FICO disclaims any intent or obligation to update these forward-looking statements.

| FAIR ISAAC CORPORATION | |||

| CONDENSED CONSOLIDATED BALANCE SHEETS | |||

| (In thousands) | |||

| (Unaudited) | |||

| | | | |

| | | | |

| | | | |

| | June 30, | | September 30, |

| | 2017 | | 2016 |

| ASSETS: | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ 130,667 | | $ 75,926 |

| Accounts receivable, net | 140,265 | | 167,786 |

| Prepaid expenses and other current assets | 51,033 | | 23,926 |

| Total current assets | 321,965 | | 267,638 |

| | | | |

| Marketable securities and investments | 24,746 | | 21,936 |

| Property and equipment, net | 42,143 | | 45,122 |

| Goodwill and intangible assets, net | 823,373 | | 832,034 |

| Other assets | 46,127 | | 53,946 |

| | $ 1,258,354 | | $ 1,220,676 |

| | | | |

| LIABILITIES AND STOCKHOLDERS' EQUITY: | | | |

| Current liabilities: | | | |

| Accounts payable and other accrued liabilities | $ 47,381 | | $ 50,732 |

| Accrued compensation and employee benefits | 62,616 | | 71,216 |

| Deferred revenue | 65,028 | | 47,129 |

| Current maturities on debt | 224,000 | | 77,000 |

| Total current liabilities | 399,025 | | 246,077 |

| | | | |

| Long-term debt | 387,767 | | 493,624 |

| Other liabilities | 38,807 Werbung Mehr Nachrichten zur Fair Isaac Aktie kostenlos abonnieren

E-Mail-Adresse

Bitte überprüfe deine die E-Mail-Adresse.

Benachrichtigungen von ARIVA.DE (Mit der Bestellung akzeptierst du die Datenschutzhinweise) -1  Vielen Dank, dass du dich für unseren Newsletter angemeldet hast. Du erhältst in Kürze eine E-Mail mit einem Aktivierungslink. Hinweis: ARIVA.DE veröffentlicht in dieser Rubrik Analysen, Kolumnen und Nachrichten aus verschiedenen Quellen. Die ARIVA.DE AG ist nicht verantwortlich für Inhalte, die erkennbar von Dritten in den „News“-Bereich dieser Webseite eingestellt worden sind, und macht sich diese nicht zu Eigen. Diese Inhalte sind insbesondere durch eine entsprechende „von“-Kennzeichnung unterhalb der Artikelüberschrift und/oder durch den Link „Um den vollständigen Artikel zu lesen, klicken Sie bitte hier.“ erkennbar; verantwortlich für diese Inhalte ist allein der genannte Dritte. Andere Nutzer interessierten sich auch für folgende News | ||