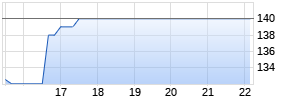

Farmer Mac Reports 2015 Results and Announces Dividend Increase

PR Newswire

WASHINGTON, March 10, 2016

WASHINGTON, March 10, 2016 /PRNewswire/ -- The Federal Agricultural Mortgage Corporation (Farmer Mac; NYSE: AGM and AGM.A) today announced its results for the fiscal quarter and year ended December 31, 2015, which included $1.3 billion in net new business volume growth in 2015 that brought total outstanding business volume to a record $15.9 billion as of December 31, 2015. Farmer Mac's 2015 core earnings, a non-GAAP measure, were $47.0 million ($4.15 per diluted common share), compared to $53.0 million ($4.67 per diluted common share) in 2014. For fourth quarter 2015, core earnings were $13.1 million ($1.17 per diluted common share), compared to $13.2 million ($1.17 per diluted common share) for third quarter 2015, and $9.5 million ($0.84 per diluted common share) for fourth quarter 2014.

Farmer Mac's board of directors also approved an increase in the quarterly dividend on all classes of Farmer Mac's common stock to $0.26 per share for first quarter 2016 and announced a new common stock dividend policy. This quarter's dividend amount represents a 63 percent increase over the $0.16 per share amount paid in each quarter during 2015.

"Farmer Mac completed another successful year in 2015 and positioned itself for continued success over the long-term," said President and Chief Executive Officer Tim Buzby. "Our expanding customer base and product offerings have helped us grow by an average of approximately $1 billion per year in outstanding business volume over the last four years. Our financial results continue to be strong, and our credit quality remains very favorable. While certain segments of agriculture are facing their challenges, Farmer Mac is executing well on the opportunities within its markets and we believe the outlook for us is positive for 2016. We also made some important decisions recently, including the change to our dividend policy and the adoption of a $25 million share repurchase program in September 2015. With our capital restructuring initiative behind us, we have reevaluated our common stock dividend policy and decided to provide a greater payout of core earnings to our common stockholders – one that is more aligned with other publicly-traded financial companies. Given our existing strong capital base, we expect to maintain a growing and sustainable common dividend and to target a payout ratio of core earnings to common stockholders that is anticipated to grow to approximately 30% over time. Even with this higher target payout ratio, Farmer Mac still expects to retain sufficient earnings each year to fund its growth and to build equity capital over the long term."

Earnings

Farmer Mac's net income attributable to common stockholders for 2015 was $47.4 million ($4.19 per diluted common share), compared to $38.3 million ($3.37 per diluted common share) for 2014. The increase in 2015 from 2014 was primarily attributable to the effects of unrealized fair value changes on financial derivatives and hedged assets, which was a $7.1 million after-tax gain in 2015, compared to a $6.5 million after-tax loss in 2014.

Core earnings for 2015 were $47.0 million ($4.15 per diluted common share), compared to $53.0 million ($4.67 per diluted common share) in 2014. The decrease in core earnings in 2015 compared to 2014 was primarily attributable to the absence of the $11.4 million net economic benefit of the cash management and liquidity initiative, which was completed in 2014, and the loss of $5.6 million after-tax in preferred dividend income resulting from the fourth quarter 2014 redemption of Farmer Mac's investment in $78.5 million of high-yielding preferred stock previously held in Farmer Mac's investment portfolio. Also contributing to the decrease was a $2.6 million after-tax increase in operating expenses primarily due to higher compensation costs resulting from the consolidation of Farmer Mac's appraisal subsidiary, Contour Valuation Services, LLC, and higher legal fees, consulting fees, and information services expenses related to corporate strategic initiatives. The year-over-year decrease in core earnings was partially offset by a $7.7 million after-tax increase in net effective spread (excluding the effect of the fourth quarter 2014 redemption of high-yielding preferred stock), which was driven by growth in outstanding business volume, and a $7.6 million after-tax decrease in preferred dividend expense resulting from the redemption of all outstanding shares of Farmer Mac II Preferred Stock in first quarter 2015.

Core earnings in fourth quarter 2015 were $13.1 million ($1.17 per diluted common share), compared to $13.2 million ($1.17 per diluted common share) in third quarter 2015, and $9.5 million ($0.84 per diluted common share) in fourth quarter 2014. The increase in core earnings for fourth quarter 2015 compared to fourth quarter 2014 was attributable to a $1.0 million after-tax increase in net effective spread and a $3.5 million after-tax decrease in preferred dividend expense resulting from the redemption of all outstanding shares of Farmer Mac II Preferred Stock in first quarter 2015.

ARIVA.DE Börsen-Geflüster

Kurse

|

|

See "Non-GAAP Earnings Measures" below for more information about core earnings and for a reconciliation of Farmer Mac's net income attributable to common stockholders to core earnings.

Business Volume Highlights

Farmer Mac added $3.2 billion of new business volume during 2015. Specifically, Farmer Mac:

- purchased $748.4 million of newly originated Farm & Ranch loans;

- purchased $743.2 million of AgVantage securities;

- added $522.3 million of Rural Utilities loans under LTSPCs;

- added $427.8 million of Farm & Ranch loans under LTSPCs;

- purchased $363.6 million of USDA Securities;

- added a $300.0 million revolving floating rate AgVantage facility;

- purchased $108.3 million of Rural Utilities loans; and

- purchased $13.3 million of Farmer Mac Guaranteed USDA Securities.

During fourth quarter 2015, Farmer Mac added $564.1 million of new business volume, with Farm & Ranch loan purchases and Farm & Ranch loans under LTSPCs driving the volume growth. Specifically, Farmer Mac:

- purchased $245.3 million of newly originated Farm & Ranch loans;

- added $185.9 million of Farm & Ranch loans under LTSPCs;

- purchased $72.4 million of USDA Securities;

- purchased $46.1 million of Rural Utilities loans; and

- purchased $14.4 million of AgVantage securities.

After $1.9 billion of maturities and principal paydowns on existing business during 2015, which included $715.8 million in scheduled maturities of AgVantage securities, Farmer Mac's outstanding business volume increased by $1.3 billion from December 31, 2014 to $15.9 billion as of December 31, 2015. The increase in Farmer Mac's outstanding business volume was driven by the addition of $522.3 million of Rural Utilities loans under LTSPCs, as well as broad-based portfolio growth across most of Farmer Mac's other products, including AgVantage securities, Farm & Ranch loans, and USDA Securities. The large LTSPC transaction completed in 2015 was the first time Farmer Mac has provided LTSPCs under its Rural Utilities line of business. Of the new business volume in AgVantage securities for 2015, a $300.0 million revolving floating rate AgVantage facility with the National Rural Utilities Cooperative Finance Corporation ("CFC") was added as an off-balance sheet commitment because CFC had not drawn on the facility as of December 31, 2015. If CFC draws on this facility, the amounts drawn will be presented as on-balance sheet AgVantage securities, and Farmer Mac will earn interest income on the drawn balance.

Net Effective Spread

Farmer Mac's net effective spread was $119.4 million (87 basis points) for 2015, compared to $113.7 million (91 basis points) for 2014. The contraction in net effective spread in percentage terms in 2015 compared to 2014 was primarily attributable to the loss of $6.5 million in preferred dividend income (5 basis points) from the fourth quarter 2014 redemption of the high-yielding preferred stock previously held in Farmer Mac's investment portfolio and a higher average balance in low-yielding cash and cash equivalents intended to increase Farmer Mac's liquidity position, partially offset by a shift towards products earning higher spreads. The year-over-year increase in dollars was primarily attributable to growth in outstanding business volume.

Net effective spread was $29.9 million (85 basis points) in fourth quarter 2015, compared to $30.4 million (88 basis points) in third quarter 2015, and $28.4 million (91 basis points) in fourth quarter 2014. The decrease in net effective spread in fourth quarter 2015 compared to third quarter 2015 was primarily attributable to a decline in cash interest received on non-accrual Farm & Ranch loans. The decrease in net effective spread in percentage terms in fourth quarter 2015 compared to fourth quarter 2014 was primarily attributable to a higher average balance in Farmer Mac's low-yielding cash and cash equivalents intended to increase Farmer Mac's liquidity position. The increase in dollar terms in fourth quarter 2015 compared to fourth quarter 2014 was primarily attributable to growth in outstanding business volume.

Credit Quality

Credit quality remains favorable across Farmer Mac's four lines of business. In the Farm & Ranch portfolio, 90-day delinquencies were $32.1 million (0.56 percent of the Farm & Ranch portfolio) as of December 31, 2015, compared to $36.7 million (0.67 percent) as of September 30, 2015, and $18.9 million (0.35 percent) as of December 31, 2014. The increase in the 90-day delinquencies in 2015 compared to 2014 was related to the delinquency of two Agricultural Storage and Processing loans that financed one canola facility. Although these two loans were outstanding and delinquent as of December 31, 2015, Farmer Mac collected funds in the amount of $9.8 million to pay them off in January 2016. Farmer Mac charged off the $3.7 million specific allowance related to these two loans in fourth quarter 2015. Farmer Mac expects that over time its 90-day delinquency rate will eventually revert closer to Farmer Mac's historical averages due to macroeconomic and other potential factors, but Farmer Mac has not yet seen an impact on its portfolio or a rise in delinquencies related to these factors. Farmer Mac's average 90-day delinquency rate for the Farm & Ranch line of business over the last fifteen years is approximately one percent.

For Farmer Mac's other lines of business, there are currently no delinquent AgVantage securities or Rural Utilities loans held or underlying LTSPCs, and USDA Securities are backed by the full faith and credit of the United States. As a result, across all of Farmer Mac's lines of business, 90-day delinquencies represented 0.20 percent of total business volume as of December 31, 2015, compared to 0.23 percent as of September 30, 2015, and 0.13 percent as of December 31, 2014.

The western part of the United States, and in particular California, continues to experience drought conditions, with the water level in many California reservoirs at or near historically low levels. The persistence of extreme drought conditions in the western states could have an adverse effect on Farmer Mac's delinquency rates or loss experience in the future; however, Farmer Mac has not observed any material effect on its portfolio from the drought through 2015. Farmer Mac continues to remain informed about the drought and its effects on the agricultural industries located in the western states and on Farmer Mac's Farm & Ranch portfolio through regular discussions with its loan servicers that service loans in drought-stricken areas, as well as customers and other lenders in the industry.

Lines of Business

Farmer Mac's operations consist of four lines of business – Farm & Ranch, USDA Guarantees, Rural Utilities, and Institutional Credit. Net effective spread by business segment for fourth quarter 2015 was $9.4 million (172 basis points) for Farm & Ranch, $4.5 million (96 basis points) for USDA Guarantees, $2.8 million (114 basis points) for Rural Utilities, and $10.9 million (80 basis points) for Institutional Credit.

Liquidity and Capital

Farmer Mac's core capital totaled $564.5 million as of December 31, 2015, exceeding the statutory minimum capital requirement by $102.4 million, or 22 percent, compared to $766.3 million as of December 31, 2014, which was $345.0 million, or 82 percent, above the statutory minimum capital requirement. The decrease in core capital primarily resulted from the redemption of $250.0 million of Farmer Mac II LLC Preferred Stock on March 30, 2015. Farmer Mac issued an aggregate of $150.0 million of non-cumulative preferred stock during the first half of 2014 and used the proceeds of these preferred stock offerings and cash on hand to cause Farmer Mac II LLC to redeem all of the outstanding shares of Farmer Mac II LLC Preferred Stock. The preferred stock issued in 2014 qualifies as Tier 1 capital for Farmer Mac whereas the Farmer Mac II LLC Preferred Stock that was redeemed did not qualify as Tier 1 capital.

As of December 31, 2015, Farmer Mac's total stockholders' equity was $553.5 million, compared to $545.8 million as of December 31, 2014. The increase in total stockholders' equity was primarily attributable to an increase in retained earnings, offset in part by a decrease in accumulated other comprehensive income due to decreases in fair value of available-for-sale securities. The decrease in the fair value of available-for-sale securities was driven primarily by higher market interest rates and wider credit spreads on certain investment securities as of December 31, 2015 compared to December 31, 2014.

On September 8, 2015, Farmer Mac's board of directors approved a share repurchase program, which authorized Farmer Mac to repurchase up to $25 million of its outstanding Class C non-voting common stock through September 2017. As of December 31, 2015, Farmer Mac had repurchased approximately 362,000 shares at a cost of approximately $10.5 million.

As prescribed by FCA regulations, Farmer Mac is required to maintain a minimum of 90 days of liquidity. In accordance with the methodology prescribed by those regulations, Farmer Mac maintained an average of 171 days of liquidity during 2015 and had 166 days of liquidity as of December 31, 2015.

Dividends

On March 2, 2016, Farmer Mac's board of directors declared a quarterly dividend of $0.26 per share for each of Farmer Mac's three classes of common stock – Class A voting common stock (NYSE: AGM.A), Class B voting common stock (not listed on any exchange), and Class C non-voting common stock (NYSE: AGM). This quarterly dividend will be payable on March 31, 2016 to holders of record of common stock as of March 21, 2016. This represents the fifth consecutive year that Farmer Mac has increased its dividend from the prior year. Farmer Mac seeks to provide a competitive return on its common stockholders' investment through the payment of cash dividends while retaining sufficient capital to support future growth in its business and to meet regulatory requirements and metrics established by Farmer Mac's board of directors.

Farmer Mac's board of directors also declared a dividend on each of Farmer Mac's three classes of preferred stock. The quarterly dividend of $0.3672 per share of 5.875% Non-Cumulative Preferred Stock, Series A (NYSE: AGM.PR.A), $0.4297 per share of 6.875% Non-Cumulative Preferred Stock, Series B (NYSE: AGM.PR.B), and $0.375 per share of 6.000% Fixed-to-Floating Rate Non-Cumulative Preferred Stock, Series C (NYSE: AGM.PR.C), is for the period from but not including January 17, 2016 to and including April 17, 2016. The preferred stock dividends will be payable on April 17, 2016 to holders of record as of April 4, 2016.

Non-GAAP Earnings Measure

Farmer Mac uses core earnings to measure corporate economic performance and develop financial plans because, in management's view, core earnings is a useful alternative measure in understanding Farmer Mac's economic performance, transaction economics, and business trends. Core earnings principally differs from net income attributable to common stockholders by excluding the effects of fair value fluctuations, which are not expected to have a cumulative net impact on financial condition or results of operations reported in accordance with GAAP if the related financial instruments are held to maturity, as is generally expected. Core earnings also differs from net income attributable to common stockholders by excluding specified infrequent or unusual transactions that Farmer Mac believes are not indicative of future operating results and that may not reflect the trends and economic financial performance of Farmer Mac's core business.

This non-GAAP financial measure may not be comparable to similarly labeled non-GAAP financial measures disclosed by other companies. Farmer Mac's disclosure of this non-GAAP measure is intended to be supplemental in nature, and is not meant to be considered in isolation from, as a substitute for, or as more important than, the related financial information prepared in accordance with GAAP.

A reconciliation of Farmer Mac's net income attributable to common stockholders to core earnings is presented in the following table along with a breakdown of the composition of core earnings:

Reconciliation of Net Income Attributable to Common Stockholders to Core Earnings For the Three Months Ended December 31, 2015 September 30, 2015 December 31, 2014 (in thousands, except per share amounts) Net income attributable to common stockholders $ 15,032 $ 8,359 $ 5,647 Less the after-tax effects of: Unrealized gains/(losses) on financial derivatives and hedging activities 1,784 (4,489) (3,717) Unrealized gains/(losses) on trading assets(1) 452 (5) 679 Amortization of premiums/discounts and deferred gains on assets consolidated (171) (76) (811) Net effects of settlements on agency forward contracts (106) (253) 30 Sub-total 1,959 (4,823) (3,879) Core earnings $ 13,073 $ 13,182 $ 9,526 Composition of Core Earnings: Revenues: Net effective spread(2) $ 29,949 $ 30,387 $ 28,442 Guarantee and commitment fees(3) 4,730 4,328 4,097 Other(4) (284) (93) (1,285) Total revenues 34,395 34,622 31,254 Credit related (income)/expense (GAAP): Release of losses Hinweis:

ARIVA.DE veröffentlicht in dieser Rubrik Analysen, Kolumnen und Nachrichten aus verschiedenen Quellen.

Die ARIVA.DE AG ist nicht verantwortlich für Inhalte, die erkennbar von Dritten in den „News“-Bereich

dieser Webseite eingestellt worden sind, und macht sich diese nicht zu Eigen. Diese Inhalte sind insbesondere durch

eine entsprechende „von“-Kennzeichnung unterhalb der Artikelüberschrift und/oder durch den Link

„Um den vollständigen Artikel zu lesen, klicken Sie bitte hier.“ erkennbar; verantwortlich für

diese Inhalte ist allein der genannte Dritte.

at fair value

Mehr Nachrichten zur Federal Agricultural Aktie kostenlos abonnieren

(Mit der Bestellung akzeptierst du die

Datenschutzhinweise)