Fannie Mae Issues $17.9 Billion of Multifamily MBS in the Third Quarter of 2016

PR Newswire

WASHINGTON, Oct. 20, 2016

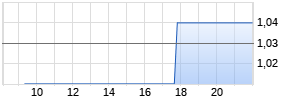

WASHINGTON, Oct. 20, 2016 /PRNewswire/ -- Fannie Mae (OTC Bulletin Board: FNMA) announced today that the company issued $17.9 billion1 of multifamily MBS in the third quarter of 2016, primarily through its Delegated Underwriting and Servicing (DUS®) program. Fannie Mae also resecuritized $2.1 billion of DUS MBS through its Guaranteed Multifamily Structures (Fannie Mae GeMS™) program.

"Hats off to the Fannie Mae Multifamily Lenders for a fantastic third quarter," said Josh Seiff, Vice President of Multifamily Capital Markets and Trading, Fannie Mae. "When I look at our third quarter production, the numbers that are most impressive are 2.1 times actual DSCR (debt service coverage ratio) and 69 percent LTV (loan-to-value) ratio. Maintaining that level of credit quality while issuing nearly $18 billion in MBS to end investors is outstanding. It is a reflection of the strong credit culture created by a long standing risk-sharing partnership between Fannie Mae and the DUS lender community."

The company's DUS MBS securities provide market participants with highly predictable cash flows and call protection in defined maturities ranging from five to 30 years. Fannie Mae's GeMS program consists of structured multifamily securities created from collateral specifically selected by Fannie Mae Capital Markets. Features of Fannie Mae GeMS include consistent monthly issuance, block size transactions, collateral diversity, and pricing close to par.

Highlights of Fannie Mae's multifamily activity in the third quarter of 2016 include the following:

| 1) | MULTIFAMILY MBS BACKED BY NEW MULTIFAMILY ACQUISITIONS |

| | |

| 2) | FANNIE MAE GeMS ISSUANCE/STRUCTURED SECURITIES |

| | |

| 3) | FANNIE MAE SALES |

For additional information about Fannie Mae's multifamily MBS products and issuance please refer to the Multifamily MBS webpage and the MBSenger® Publication "Over Twenty-Five Years of Multifamily Mortgage Financing Through Fannie Mae's DUS Program" on fanniemae.com.

Fannie Mae GeMS Issuance in the Third Quarter of 2016

FNA 2016-M9, Priced on September 8, 2016

| Class | Original Face | Weighted | Coupon | Coupon Type | Spread | Offered |

| FA | $579,564,135 | 6.44 | 1.108 | Floater/AFC | L+59 | 100.00 |

| FX | $579,564,135 | 0.81 | 0.495 | WAC IO | Not Offered | Not Offered |

| A1 | $60,591,000 | 5.77 | 2.003 | Fixed | S+56 | 101.00 |

| A2 | $444,364,282 | 9.62 | 2.292 | Fixed | S+73 | 101.00 |

| AB1 | $8,263,000 | 5.77 | 1.800 | Fixed | Not Available | Not Available |

| AB2 | $60,595,000 | 9.62 | 2.217 | Fixed | Not Offered | Not Offered |

| X2 | $573,813,282 | 8.72 | 0.450 | WAC IO | Not Offered | Not Offered |

| Total | $1,153,377,417 | | | | | |

Lead Manager: Morgan Stanley

Co-Managers: Citigroup, KGS-Alpha Capital Markets, and Multi-Bank Securities

FNA 2016-M7, Priced on July 12, 2016

| Class | Original Face | Weighted | Coupon | Coupon Type | Spread | Offered |

| FA | $190,212,689 | 6.17 | 1.118 | Floater/AFC | L+67 | 99.93 |

| FX | $190,212,689 | 0.56 | 0.772 | WAC IO | Not Offered | Not Offered Werbung Mehr Nachrichten zur Fannie Mae Federal National Mortgage Association GSE Aktie kostenlos abonnieren

E-Mail-Adresse

Bitte überprüfe deine die E-Mail-Adresse.

Benachrichtigungen von ARIVA.DE (Mit der Bestellung akzeptierst du die Datenschutzhinweise) -1  Vielen Dank, dass du dich für unseren Newsletter angemeldet hast. Du erhältst in Kürze eine E-Mail mit einem Aktivierungslink. Hinweis: ARIVA.DE veröffentlicht in dieser Rubrik Analysen, Kolumnen und Nachrichten aus verschiedenen Quellen. Die ARIVA.DE AG ist nicht verantwortlich für Inhalte, die erkennbar von Dritten in den „News“-Bereich dieser Webseite eingestellt worden sind, und macht sich diese nicht zu Eigen. Diese Inhalte sind insbesondere durch eine entsprechende „von“-Kennzeichnung unterhalb der Artikelüberschrift und/oder durch den Link „Um den vollständigen Artikel zu lesen, klicken Sie bitte hier.“ erkennbar; verantwortlich für diese Inhalte ist allein der genannte Dritte. Andere Nutzer interessierten sich auch für folgende News |