Dana Incorporated Announces Fourth-Quarter, Full-Year 2016 Financial Results

PR Newswire

MAUMEE, Ohio, Feb. 9, 2017

MAUMEE, Ohio, Feb. 9, 2017 /PRNewswire/ --

Full-Year Highlights

- Sales of $5.8 billion

- Net income attributable to Dana of $640 million and diluted EPS of $4.36, inclusive of $478 tax benefit from net release of income tax valuation allowance

- Adjusted EBITDA of $660 million, providing a margin of 11.3 percent, with all four business units improving year-over-year margin performance

- Diluted adjusted EPS of $1.94, 12% improvement over 2015

- Operating cash flow of $384 million; free cash flow of $62 million, including $322 million of capital investment to support new business growth

- Repurchased $81 million of common stock in 2016, totaling nearly $1.5 billion since program inception

- Completed three strategic acquisitions: Magnum Gaskets® in January 2016, SIFCO S.A. in December 2016, and the power-transmission and fluid power businesses of Brevini Group, S.p.A. in February 2017

- Strong sales backlog of $750 million, providing top-line growth in excess of market over the next three years

Dana Incorporated (NYSE: DAN) today announced financial results for the fourth-quarter and full-year for 2016.

"Dana had an excellent 2016 as the team executed our plan very effectively. We successfully launched multiple customer vehicle programs and improved our profitability through cost performance, despite having to overcome significant weakness in certain key end markets," said James Kamsickas, Dana president and chief executive officer. "Our core business continues to expand while we have efficiently grown inorganically by acquiring businesses that align with our enterprise strategy."

Fourth-Quarter 2016 Financial Results

Sales for the fourth quarter of 2016 totaled $1.45 billion, compared with $1.38 billion in same period of 2015, representing a 5 percent increase. The increase was largely attributable to higher light-vehicle end-market demand in North America, Europe, and Asia, as well as new business gains. The benefits from the stronger light-vehicle market were partially offset by weaker demand in the commercial-vehicle and off-highway markets.

Net income attributable to Dana for the fourth quarter of 2016 was $485 million, compared with a loss of $82 million in the fourth quarter of 2015. The company's fourth quarter 2016 results included a $490 million tax benefit compared with a tax expense of $92 million in the same period of 2015. Net income in 2016 includes a tax benefit for the release of valuation allowance against U.S. deferred tax assets of $501 million, offset in part by a $23 million net addition to valuation allowances provided in other countries. These benefits to net income were reduced by a pre-tax charge of $80 million ($52 million after-tax) from the divestiture of subsidiaries. The fourth quarter of 2015 included nonrecurring tax and equity investment impairment charges of $118 million.

Reported diluted earnings per share were $3.34 in the fourth quarter of 2016, compared with a loss per share of $0.54 in 2015.

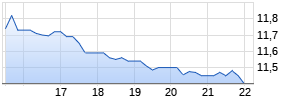

Adjusted EBITDA for the fourth quarter of 2016 was $166 million, a $37 million increase over the same period last year. This provided an 11.5 percent margin, which was a 210 basis point improvement over the fourth quarter of 2015. Profit in 2016 benefited from higher sales volume and pricing recoveries, transactional foreign currency impacts, and improved cost performance, mainly in the Commercial Vehicle segment.

Excluding the effects of certain nonrecurring items such as the above-mentioned income tax valuation allowance adjustments, loss on divestitures, and impairment charges, diluted adjusted earnings per share in the fourth quarter of 2016 were $0.59, compared with $0.34 in the same period last year. This was driven primarily by a year-over-year fourth-quarter 2016 earnings improvement, as well as a lower share count.

Operating cash flow in the fourth quarter of 2016 was $202 million, compared with $140 million in the same period of 2015. Inclusive of capital spending of $124 million in the fourth quarter of 2016, free cash flow was $78 million, a $6 million improvement over the fourth quarter of 2015.

Full-Year 2016 Financial Results

Sales for 2016 were $5.83 billion, $234 million lower compared with 2015, primarily due to unfavorable currency translation that lowered sales by $173 million. Strong market demand, pricing, and new business wins in the company's Light Vehicle Driveline and Power Technologies business units provided a combined organic increase in sales of $322 million. These gains were more than offset by currency headwinds and lower demand in commercial-vehicle and global off-highway markets.

Net income attributable to Dana for the full-year 2016 was $640 million, compared with $159 million in 2015. Net income in 2016 benefited from the above-mentioned $478 million fourth-quarter net release of tax valuation allowances offset in part by after-tax charges of $52 million on divestitures and loss on debt extinguishment of $11 million. Net income in 2015 was impacted by net non-recurring charges of $68 million.

Excluding the impact of these non-recurring items in both years, net income attributable to Dana was $225 million in 2016, compared with $227 million in 2015. Adjusted EBITDA for 2016 was $660 million, or 11.3 percent of sales, 50 basis points higher than 2015, as all product groups improved margins in 2016. Foreign currency effects reduced adjusted EBITDA by $20 million, with lower sales volume net of pricing reduced earnings by $19 million. Higher end-market demand, new customer programs, and cost recoveries in the Light Vehicle Driveline and Power Technologies businesses, was offset by weaker volumes in the commercial vehicle and off-highway markets. A combination of strong cost performance and gains associated with the recently divested Dana Companies subsidiary contributed $47 million to adjusted EBITDA, which more than offset the currency and volume headwinds. The benefit to net income from increased adjusted EBITDA was offset by higher restructuring expense.

Diluted earnings per share were $4.36 for 2016, compared with $0.99 in 2015, primarily reflecting a higher level of non-recurring tax benefits in 2016 discussed above. Diluted adjusted earnings per share for 2016 were $1.94, compared with $1.74 in 2015, a 12 percent increase reflecting a lower share count from execution of the company's share repurchase program.

The company reported operating cash flow of $384 million in 2016, down from $406 million in 2015. Investment requirements for new customer programs resulted in higher capital spending of $322 million in 2016, compared with $260 million in 2015. As a result, free cash flow was $62 million in 2016, compared with $146 million in 2015. In addition to increased capital spend, higher interest payments occurred in 2016 due to the accelerated payment of accrued interest related to debt refinancing that was completed in June 2016. As of Dec. 31, 2016, cash balances, including marketable securities, totaled $737 million, and total liquidity was $1.2 billion, including $478 million of availability under the company's undrawn U.S. credit facility.

"We look forward to 2017, which will be another year of important transformation as we launch new programs across the company and convert our new business backlog into production," Mr. Kamsickas said. "Separately, we are off to a great start by completing the Brevini acquisition in less than three months, after reaching a definitive agreement."

2017 Full-Year Financial Targets

Dana has affirmed key financial guidance, which includes the Brevini acquisition, as well as the impact of the U.S. valuation allowance release:1

- Sales of $6.2 to $6.4 billion;

- Adjusted EBITDA of $695 to $725 million;

- Adjusted EBITDA as a percent of sales of 11.2 to 11.4 percent;

- Diluted adjusted EPS of $1.60 to $1.80;

- Cash flow from operations of $410 to $450 million;

- Capital spending of $350 to $370 million; and

- Free cash flow of $50 to $90 million.

1Net income and diluted EPS guidance is not provided, as discussed below in Non-GAAP Financial Information.

Dana Continues to Strengthen its Product Portfolio Through Strategic Acquisitions

In addition to the Magnum Gaskets® and SIFCO acquisitions, Dana announced in the fourth quarter a definitive agreement to purchase the power-transmission and fluid power businesses of Brevini Group, S.p.A. The company completed the acquisition on Feb. 1. Dana purchased an 80 percent share in the Brevini businesses, with an option to purchase the remaining 20 percent by 2020.

Brevini technologies purchased by Dana include a wide range of highly engineered mobile planetary hub drives; planetary gearboxes; hydraulic pumps, motors, and valves; and advanced electronic control systems. Their expertise in cylindrical gearing and planetary hub gears will supplement Dana's long history and market leadership in spiral bevel and hypoid gear technologies.

These key initiatives are reflective of the company's enterprise strategy, which includes leveraging core expertise, strengthening customer centricity, expanding global markets, commercializing new technologies, and accelerating hybridization and electrification.

Dana to Host Conference Call at 9 a.m. Today

Dana will discuss its full-year and fourth-quarter results in a conference call at 9 a.m. EST today. Participants may listen to the conference call via audio streaming online or by telephone. Slide viewing is available via Dana's investor website: www.dana.com/investors. U.S. and Canadian locations should dial 1-888-311-4590 and international locations should call 1-706-758-0054. Please enter conference I.D. 54463266 and ask for the "Dana Incorporated's Financial Webcast and Conference Call." Phone registration will be available starting at 8:30 a.m.

An audio recording of the webcast will be available after 5 p.m. today by dialing 1-855-859-2056 (U.S. or Canada) or 1-404-537-3406 (international) and entering conference I.D. 54463266. A webcast replay will be available after 5 p.m. today, and may be accessed via Dana's investor website.

Non-GAAP Financial Information

This release refers to adjusted EBITDA, a non-GAAP financial measure which we have defined as net income before interest, taxes, depreciation, amortization, equity grant expense, restructuring expense and other adjustments not related to our core operations (gain/loss on debt extinguishment, pension settlements, divestitures, impairment, etc.). Adjusted EBITDA is a measure of our ability to maintain and continue to invest in our operations and provide shareholder returns. We use adjusted EBITDA in assessing the effectiveness of our business strategies, evaluating and pricing potential acquisitions and as a factor in making incentive compensation decisions. In addition to its use by management, we also believe adjusted EBITDA is a measure widely used by securities analysts, investors and others to evaluate financial performance of our company relative to other Tier 1 automotive suppliers. Adjusted EBITDA should not be considered a substitute for income before income taxes, net income or other results reported in accordance with GAAP. Adjusted EBITDA may not be comparable to similarly titled measures reported by other companies.

Diluted adjusted EPS is a non-GAAP financial measure, which we have defined as adjusted net income divided by adjusted diluted shares. We define adjusted net income as net income (loss) attributable to the parent company, excluding any nonrecurring income tax items, restructuring and impairment expense, amortization expense, and other adjustments not related to our core operations (as used in adjusted EBITDA), net of any associated income tax effects. We define adjusted diluted shares as diluted shares as determined in accordance with GAAP based on adjusted net income. This measure is considered useful for purposes of providing investors, analysts, and other interested parties with an indicator of ongoing financial performance that provides enhanced comparability to EPS reported by other companies. Diluted adjusted EPS is neither intended to represent nor be an alternative measure to diluted EPS reported under GAAP.

Free cash flow is a non-GAAP financial measure, which we have defined as cash provided by (used in) operating activities, less purchases of property, plant, and equipment. We believe this measure is useful to investors in evaluating the operational cash flow of the company inclusive of the spending required to maintain the operations. Free cash flow is neither intended to represent nor be an alternative to the measure of net cash provided by (used in) operating activities reported under GAAP. Free cash flow may not be comparable to similarly titled measures reported by other companies.

The accompanying financial information provides reconciliations of adjusted EBITDA, diluted adjusted EPS and free cash flow to the most directly comparable financial measures calculated and presented in accordance with GAAP. We have not provided a reconciliation of our adjusted EBITDA and diluted adjusted EPS outlook to the most comparable GAAP measures of net income and diluted EPS. Providing net income and diluted EPS guidance is potentially misleading and not practical given the difficulty of projecting event driven transactional and other non-core operating items that are included in net income and diluted EPS, including restructuring actions, asset impairments and income tax valuation adjustments. The accompanying reconciliations of these non-GAAP measures with the most comparable GAAP measures for the historical periods presented are indicative of the reconciliations that will be prepared upon completion of the periods covered by the non-GAAP guidance.

Please reference the "Non-GAAP financial information" accompanying our quarterly earnings conference call presentations on our website at www.dana.com/investors for our GAAP results and the reconciliations of these measures, where used, to the comparable GAAP measures.

Forward-Looking Statements

Certain statements and projections contained in this news release are, by their nature, forward-looking within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements are based on our current expectations, estimates and projections about our industry and business, management's beliefs, and certain assumptions made by us, all of which are subject to change. Forward-looking statements can often be identified by words such as "anticipates," "expects," "intends," "plans," "predicts," "believes," "seeks," "estimates," "may," "will," "should," "would," "could," "potential," "continue," "ongoing," similar expressions, and variations or negatives of these words. These forward-looking statements are not guarantees of future results and are subject to risks, uncertainties and assumptions that could cause our actual results to differ materially and adversely from those expressed in any forward-looking statement.

Dana's Annual Report on Form 10-K, subsequent Quarterly Reports on Form 10-Q, recent Current Reports on Form 8-K, and other Securities and Exchange Commission filings discuss important risk factors that could affect our business, results of operations and financial condition. The forward-looking statements in this news release speak only as of this date. Dana does not undertake any obligation to revise or update publicly any forward-looking statement for any reason.

About Dana Incorporated

Dana is a world leader in highly engineered solutions for improving the efficiency, performance, and sustainability of powered vehicles and machinery. Dana supports the passenger vehicle, commercial truck, off-highway, and industrial markets as well as industrial and stationary equipment applications. Founded in 1904, Dana employs approximately 27,000 people in 34 countries on six continents who are committed to delivering long-term value to customers. The company reported sales of more than $5.8 billion in 2016. Forbes Magazine has again selected Dana as one of America's 100 Most Trustworthy Companies. Based in Maumee, Ohio, the company's headquarters operations were selected as a "Top Workplace" by The (Toledo) Blade in 2017. For more information, please visit dana.com.

| DANA INCORPORATED | ||||||

| Consolidated Statement of Operations (Unaudited) | ||||||

| For the Three Months Ended December 31, 2016 and 2015 | ||||||

| | | | | | | |

| | | | | Three Months Ended | ||

| (In millions except per share amounts) | | | December 31, | |||

| | | | | 2016 | | 2015 |

| Net sales | | | | $ 1,447 | | $ 1,375 |

| Costs and expenses | | | | | | |

| Cost of sales | | | 1,243 | | 1,203 | |

| Selling, general and administrative expenses | | | 103 | | 92 | |

| Amortization of intangibles | | | 2 | | 1 | |

| Restructuring charges, net | | | 13 | | 2 | |

| Loss on sale of subsidiaries | | | (80) | | | |

| Other income (expense), net | | | 9 | | (6) | |

| Income before interest and income taxes | | | 15 | | 71 | |

| Interest income | | | 5 | | 2 | |

| Interest expense | | | 29 | | 27 | |

| Income (loss) from continuing operations before income taxes | | (9) | | 46 | ||

| Income tax expense (benefit) | | | (490) | | 92 | |

| Equity in earnings (losses) of affiliates | | | 8 | | (37) | |

| Income (loss) from continuing operations | | | 489 | | (83) | |

| Income from discontinued operations | | | | | 4 | |

| Net income (loss) | | | 489 | | (79) | |

| Less: Noncontrolling interests net income | | | 4 | | 3 | |

| Net income (loss) attributable to the parent company | | $ 485 | | $ (82) | ||

| | | | | | | |

| Net income (loss) per share attributable to the parent company | | | | | ||

| | | | | | | |

| Basic: | | | | | | |

| Income (loss) from continuing operations Werbung Mehr Nachrichten zur Dana Inc Aktie kostenlos abonnieren

E-Mail-Adresse

Bitte überprüfe deine die E-Mail-Adresse.

Benachrichtigungen von ARIVA.DE (Mit der Bestellung akzeptierst du die Datenschutzhinweise) -1  Vielen Dank, dass du dich für unseren Newsletter angemeldet hast. Du erhältst in Kürze eine E-Mail mit einem Aktivierungslink. Hinweis: ARIVA.DE veröffentlicht in dieser Rubrik Analysen, Kolumnen und Nachrichten aus verschiedenen Quellen. Die ARIVA.DE AG ist nicht verantwortlich für Inhalte, die erkennbar von Dritten in den „News“-Bereich dieser Webseite eingestellt worden sind, und macht sich diese nicht zu Eigen. Diese Inhalte sind insbesondere durch eine entsprechende „von“-Kennzeichnung unterhalb der Artikelüberschrift und/oder durch den Link „Um den vollständigen Artikel zu lesen, klicken Sie bitte hier.“ erkennbar; verantwortlich für diese Inhalte ist allein der genannte Dritte. Andere Nutzer interessierten sich auch für folgende News | ||||||