Commerce Bancshares Extends Use of Alogent Payments Gateway from ProfitStars

PR Newswire

MONETT, Mo., July 23, 2013

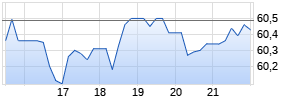

MONETT, Mo., July 23, 2013 /PRNewswire/ -- Jack Henry & Associates, Inc. (NASDAQ:JKHY) is a leading provider of technology solutions and payment processing services primarily for the financial services industry. Its ProfitStars® division announced today that Missouri-based Commerce Bank has extended its use of Alogent® Payments Gateway™.

Alogent Payments Gateway now provides Commerce a single solution for processing both image and paper check transactions across all intra- and inter-bank points of presentment including branch, remote deposit, the back office, ATM, and lockbox. It simplifies the transformation of paper-based transactions to image-enabled processes. The bank previously was using platforms built specifically for managing paper checks. With today's image-centric environment, it needed to replace dated systems with one that accommodated simplified and consistent processing across all items coming into its back office. Selecting Alogent Payments Gateway enabled Commerce to replace five disparate vendors' systems with just one, comprehensive system.

Greg Nickle, executive vice president and operations manager at Commerce, explained, "We have simplified vendor management to a single partner for front-end capture at the branch through to backend posting. In addition to adding new efficiencies, Alogent Payments Gateway allowed us to move our higher-cost processing infrastructure to one with much lower operating expenses – we expect annualized savings of about a half million dollars."

Alogent Payments Gateway collects and retains items captured throughout the day and supports balancing, reject and code line repair, as well as the creation of cash letters. Commerce once needed up to 14 minutes to create a 20,000 item cash letter; the same one can now be generated in a fraction of the time and be automatically forwarded to the Federal Reserve or other clearing exchange for final resolution. Alogent Payments Gateway enables complete image-based processing functions like image assurance, validation and archiving, reporting and extract functionality, and routes transactions to appropriate endpoints for final processing, clearing, and settlement.

According to David Foss, president of ProfitStars, "A significant source of financial institution operating costs is related to maintaining legacy software systems. As unit costs for check processing increase in the face of declining paper processing volumes, the time is right for many financial institutions to move forward with legacy check processing transformation. Banks like Commerce that manage large volumes can gain great benefits from a single solution that streamlines processing across all points of presentment. Alogent Payments Gateway provides a way to achieve optimal performance and seamlessly scale up, down, or out in response to changing conditions and future market opportunities."

Commerce originally installed Alogent Payments Gateway to support its Alogent Back Counter™ branch capture solution in 2010 and had already achieved annualized cost savings in the million-dollar range.

About Commerce Bank

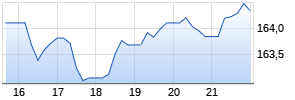

Commerce Bank, is a subsidiary of Commerce Bancshares, Inc. (NASDAQ: CBSH), a $22.2 billion regional bank holding company, as of March 31, 2013. For more than 145 years, Commerce Bank has been meeting the financial services needs of individuals and businesses. Commerce Bank provides a diversified line of financial services, including business and personal banking, wealth management, financial planning, and investments through its affiliated companies. Commerce Bank operates in more than 360 retail locations in the Central United States and has a nationwide presence in the commercial payments industry. Commerce Bancshares also has operating subsidiaries involved in mortgage banking, leasing, credit-related insurance, private equity, and real estate activities. For additional information, please visit www.commercebank.com.

About ProfitStars

As a diverse, global division of Jack Henry & Associates, ProfitStars combines JHA's solid technology background with the latest breakthroughs in five performance-boosting solution groups – financial performance, imaging and payments processing, information security and risk management, retail delivery, and online and mobile. Explore the power of ProfitStars-enhanced performance at www.profitstars.com.

About Jack Henry & Associates, Inc.

Jack Henry & Associates, Inc.® (NASDAQ: JKHY) is a leading provider of computer systems and electronic payment solutions primarily for financial services organizations. Its technology solutions serve more than 11,600 customers nationwide, and are marketed and supported through three primary brands. Jack Henry Banking® supports banks ranging from community to mid-tier institutions with information processing solutions. Symitar® is the leading provider of information processing solutions for credit unions of all sizes. ProfitStars® provides best-of-breed solutions that enhance the performance of domestic and international financial institutions of all asset sizes and charters using any core processing system, as well as diverse corporate entities. Additional information is available at www.jackhenry.com.

Statements made in this news release that are not historical facts are forward-looking information. Actual results may differ materially from those projected in any forward-looking information. Specifically, there are a number of important factors that could cause actual results to differ materially from those anticipated by any forward-looking information. Additional information on these and other factors, which could affect the Company's financial results, are included in its Securities and Exchange Commission (SEC) filings on Form 10-K, and potential investors should review these statements. Finally, there may be other factors not mentioned above or included in the Company's SEC filings that may cause actual results to differ materially from any forward-looking information.

SOURCE Jack Henry & Associates, Inc.

Mehr Nachrichten zur Commerce Banc Aktie kostenlos abonnieren

(Mit der Bestellung akzeptierst du die Datenschutzhinweise)

Hinweis: ARIVA.DE veröffentlicht in dieser Rubrik Analysen, Kolumnen und Nachrichten aus verschiedenen Quellen. Die ARIVA.DE AG ist nicht verantwortlich für Inhalte, die erkennbar von Dritten in den „News“-Bereich dieser Webseite eingestellt worden sind, und macht sich diese nicht zu Eigen. Diese Inhalte sind insbesondere durch eine entsprechende „von“-Kennzeichnung unterhalb der Artikelüberschrift und/oder durch den Link „Um den vollständigen Artikel zu lesen, klicken Sie bitte hier.“ erkennbar; verantwortlich für diese Inhalte ist allein der genannte Dritte.