Comerica Bank's Michigan Index Improves

PR Newswire

DALLAS, Jan. 3, 2018

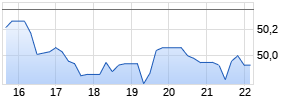

DALLAS, Jan. 3, 2018 /PRNewswire/ -- Comerica Bank's Michigan Economic Activity Index increased by 0.4 percent in October to a level of 117.8. October's reading is 20 points, or 20 percent, above the index cyclical low of 97.9. The index averaged 117.3 points for all of 2016, two points above the index average for 2015. September's index reading was revised to 117.3.

Comerica Bank's Michigan Economic Activity Index increased slightly in October after stalling through last summer. The October gain is the first increase in the Michigan Index since last May. Over the previous 12 months, the Michigan Index was up only 0.8 percent in October, so it is fair to say the Michigan economy was feeling less momentum through most of 2017 than it did in 2016. Positive factors for October were nonfarm payrolls, housing starts, house prices and auto production. Industrial electricity demand, total state trade, hotel occupancy and state sales tax revenues were negatives. We expect auto sales to ease gradually through 2018 as the support from hurricane-related replacements in Texas and Florida fades. A key positive for auto sales in 2018 will be the expected solid performance of the U.S. economy. However, with auto sales currently near the cyclical peak of the mid-2000's, it looks like there is only limited upside potential for sales even in a relatively strong economy. We look for the service sector in Michigan to support modest growth going forward as the push from auto-related manufacturing eases. Tax reform will be an overall positive for the U.S. economy, including Michigan. However, higher interest rates through 2018 are a developing headwind for both the auto sector and real estate.

The Michigan Economic Activity Index consists of nine variables, as follows: nonfarm payroll employment, continuing claims for unemployment insurance, housing starts, house price index, industrial electricity sales, auto assemblies, total trade, hotel occupancy and sales tax revenue. All data are seasonally adjusted. Nominal values have been converted to constant dollar values. Index levels are expressed in terms of three-month moving averages.

Comerica Bank, with more than 200 banking centers in Michigan, is a subsidiary of Comerica Incorporated (NYSE: CMA), a financial services company headquartered in Dallas, Texas, and strategically aligned by three business segments: The Business Bank, The Retail Bank, and Wealth Management. Comerica focuses on relationships, and helping people and businesses be successful. In addition to Michigan and Texas, Comerica Bank locations can be found in Arizona, California, and Florida, with select businesses operating in several other states, as well as in Canada and Mexico.

To subscribe to our publications or for questions, contact us at ComericaEcon@comerica.com. Archives are available at http://www.comerica.com/economics. Follow us on Twitter: @Comerica_Econ.

![]() View original content with multimedia:http://www.prnewswire.com/news-releases/comerica-banks-michigan-index-improves-300577105.html

View original content with multimedia:http://www.prnewswire.com/news-releases/comerica-banks-michigan-index-improves-300577105.html

SOURCE Comerica Bank

Mehr Nachrichten zur Comerica Inc. Aktie kostenlos abonnieren

(Mit der Bestellung akzeptierst du die Datenschutzhinweise)

Hinweis: ARIVA.DE veröffentlicht in dieser Rubrik Analysen, Kolumnen und Nachrichten aus verschiedenen Quellen. Die ARIVA.DE AG ist nicht verantwortlich für Inhalte, die erkennbar von Dritten in den „News“-Bereich dieser Webseite eingestellt worden sind, und macht sich diese nicht zu Eigen. Diese Inhalte sind insbesondere durch eine entsprechende „von“-Kennzeichnung unterhalb der Artikelüberschrift und/oder durch den Link „Um den vollständigen Artikel zu lesen, klicken Sie bitte hier.“ erkennbar; verantwortlich für diese Inhalte ist allein der genannte Dritte.