CME Group Reached Record Average Daily Volume of 20.9 Million Contracts per Day in November 2016, up 52 Percent from November 2015

PR Newswire

CHICAGO, Dec. 2, 2016

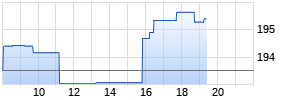

CHICAGO, Dec. 2, 2016 /PRNewswire/ -- CME Group, the world's leading and most diverse derivatives marketplace, today announced that November 2016 average daily volume (ADV) reached a record 20.9 million contracts per day, up 52 percent from November 2015. CME Group November 2016 options volume averaged 4.3 million contracts per day, up 63 percent versus November 2015, with electronic options averaging a record 2.4 million contracts per day, up 74 percent over the same period last year. CME Group year-to-date 2016 ADV through November averaged 15.7 million contracts per day, up 12 percent from the same period a year ago. Open interest at the end of November was 113 million contracts, up 11 percent from November 2015, and daily open interest reached a record of 117 million contracts on November 23, 2016.

Interest rate volume averaged a record 11.8 million contracts per day in November 2016, up 73 percent from November 2015. Highlights include:

- Achieved record Treasury futures and options ADV of 5.9 million contracts, up 55 percent, including monthly ADV records across 10-Year, 5-Year, 2-Year and Ultra 10-Year Treasury Notes and Ultra Treasury Bonds

- Grew Eurodollar futures ADV 102 percent to more than 4 million contracts, and Eurodollar options ADV 73 percent to 1.8 million contracts

- Grew Fed Fund futures ADV 143 percent to 161,000 contracts per day

- Reached record levels in overall interest rate open interest of more than 69 million contracts during the month, with month-end open interest of 67 million contracts, up 22 percent from 56 million contracts at the same time last year

Metals volume averaged a record 718,000 contracts per day in November 2016, up 71 percent from November 2015. Highlights include:

- Grew Gold futures and options ADV 74 percent to a record 408,000 contracts

- Increased Silver futures and options ADV 62 percent to 112,000 contracts

- Achieved monthly futures and options ADV record for Copper of 168,000 contracts per day, up 82 percent

- Achieved daily volume record of 897,219 Gold futures on November 9 and a record 332,467 Copper futures contracts on November 11

Energy volume averaged a record 2.8 million contracts per day in November 2016, up 41 percent from November 2015. Highlights include:

- Grew WTI Crude Oil futures and options ADV 63 percent to a record 1.6 million contracts, and achieved a single-day trading volume record of 2.5 million contracts on November 30

- Achieved record energy options ADV of 405,000 contracts, up 42 percent

- Finished November with record level of physically delivered WTI Crude Oil futures (CL) open interest of more than 2.1 million contracts, up 27 percent

- Increased electronic Natural Gas futures ADV 44 percent to 481,000 contracts

- Reached record volume in Ethanol

Foreign exchange volume averaged 987,000 contracts per day in November 2016, up 39 percent from November 2015. Highlights include:

- Grew British Pound futures and options ADV 61 percent to 135,000 contracts

- Achieved monthly volume records across E-micro FX futures and options, European Option futures and options, Indian Rupee futures and options and Mexican Peso options

Equity index volume averaged 3.2 million contracts per day in November 2016, up 34 percent from November 2015. Highlights include:

- Grew Equity Index options ADV 60 percent to 803,000 contracts

- Achieved ADV of 55,000 contracts for S&P 500 and E-mini S&P 500 Wednesday Weekly options launched September 26, 2016

Agricultural volume averaged 1.4 million contracts per day in November 2016, down 1 percent from November 2015. Highlights include:

- Achieved 16 percent growth in Soybean futures and options and 11 percent growth in Soybean Oil futures and options

- Grew Hard Red Winter Wheat futures and options ADV 14 percent

Footnote: To see CME Group daily over-the-counter (OTC) notional cleared volumes and open interest, monthly OTC notional cleared volumes and monthly total trade count, go to http://www.cmegroup.com/education/cme-volume-oi-records.html

| MONTHLY AVERAGE DAILY VOLUME (ADV) | |||||

| | | | | ||

| Total Exchange ADV (in thousands) | |||||

| | |||||

| | Nov 2016 | Nov 2015 | | ||

| Trading Days | 21 | 20 | | ||

| | | | | ||

| PRODUCT LINE | Nov 2016 | Nov 2015 | Percent Change | ||

| Interest Rates | 11,848 | 6,866 | 73% | ||

| Equity Indexes | 3,179 | 2,367 | 34% | ||

| Foreign Exchange (FX) | 987 | 713 | 39% | ||

| Energy | 2,772 | 1,971 | 41% | ||

| Agricultural Commodities | 1,363 | 1,376 | -1% | ||

| Metals | 718 | 419 | 71% | ||

| Total | 20,867 | 13,712 | 52% | ||

| | | | | | |

VENUE | Nov 2016 | Nov 2015 | P Percent Change | ||

| Open outcry | 1,441 | 1,041 | 38% | ||

| CME Globex | 18,378 | 11,980 | 53% | ||

| Privately negotiated | 1,048 | 692 | 51% | ||

| ROLLING THREE-MONTH AVERAGES | ||||

| Average Daily Volume (In thousands) | ||||

| | ||||

| | 3-Month Period Ending | |||

| PRODUCT LINE | Nov-16 | Oct-16 | Sep-16 | Aug-16 |

| Interest Rates | 8,025 | 6,445 | 6,791 | 7,062 |

| Equity Indexes | 3,180 | 2,882 | 2,876 | 2,816 |

| Foreign Exchange (FX) | 909 | 786 | 772 | 791 |

| Energy | 2,541 | 2,358 | 2,294 | 2,239 |

| Agricultural Commodities | 1,173 | 1,110 | 1,156 Werbung Mehr Nachrichten zur CME Group Aktie kostenlos abonnieren

E-Mail-Adresse

Bitte überprüfe deine die E-Mail-Adresse.

Benachrichtigungen von ARIVA.DE (Mit der Bestellung akzeptierst du die Datenschutzhinweise) -1  Vielen Dank, dass du dich für unseren Newsletter angemeldet hast. Du erhältst in Kürze eine E-Mail mit einem Aktivierungslink. Hinweis: ARIVA.DE veröffentlicht in dieser Rubrik Analysen, Kolumnen und Nachrichten aus verschiedenen Quellen. Die ARIVA.DE AG ist nicht verantwortlich für Inhalte, die erkennbar von Dritten in den „News“-Bereich dieser Webseite eingestellt worden sind, und macht sich diese nicht zu Eigen. Diese Inhalte sind insbesondere durch eine entsprechende „von“-Kennzeichnung unterhalb der Artikelüberschrift und/oder durch den Link „Um den vollständigen Artikel zu lesen, klicken Sie bitte hier.“ erkennbar; verantwortlich für diese Inhalte ist allein der genannte Dritte. Andere Nutzer interessierten sich auch für folgende News | |