Cheniere Energy, Inc. Reports Fourth Quarter and Full Year 2016 Results

PR Newswire

HOUSTON, Feb. 28, 2017

HOUSTON, Feb. 28, 2017 /PRNewswire/ -- Cheniere Energy, Inc. ("Cheniere") (NYSE MKT: LNG) reported net income1 of $109.7 million, or $0.48 per share (basic and diluted), for the three months ended December 31, 2016, compared to a net loss1 of $291.1 million, or $1.28 per share (basic and diluted), for the comparable 2015 period. Net Loss, As Adjusted2 was $78.1 million, or $0.34 per share (basic and diluted), for the three months ended December 31, 2016, compared to a Net Loss, As Adjusted of $154.8 million, or $0.68 per share (basic and diluted), for the comparable 2015 period.

For the twelve months ended December 31, 2016, Cheniere reported a net loss of $610.0 million, or $2.67 per share (basic and diluted), compared to a net loss of $975.1 million, or $4.30 per share (basic and diluted), for the comparable 2015 period. For the twelve months ended December 31, 2016, Net Loss, As Adjusted was $447.2 million, or $1.95 per share (basic and diluted), compared to a Net Loss, As Adjusted of $653.3 million, or $2.88 per share (basic and diluted), for the comparable 2015 period.

For the three and twelve months ended December 31, 2016, Net Loss, As Adjusted excludes the impact of changes in the fair value of our interest rate, commodity and foreign currency exchange ("FX") derivatives, loss on early extinguishment of debt, restructuring expense, amortization of the beneficial conversion feature related to certain Class B units of Cheniere Energy Partners, L.P. ("Cheniere Partners") (NYSE MKT: CQP) and impairment expense. Loss on early extinguishment of debt was associated with the write-off of debt issuance costs by Sabine Pass Liquefaction, LLC ("SPL") and Cheniere Corpus Christi Holdings, LLC ("CCH") in connection with the refinancing of a portion of their credit facilities, by Sabine Pass LNG, L.P. ("SPLNG") as a result of the redemption of its senior notes, and by Cheniere Creole Trail Pipeline, L.P. as a result of the prepayment of its outstanding term loan. For the three and twelve months ended December 31, 2015, Net Loss, As Adjusted excludes the impact of changes in the fair value of interest rate, commodity and FX derivatives, loss on early extinguishment of debt related to the write-off of debt issuance costs by SPL primarily in connection with the refinancing of a portion of its credit facilities, the write-off of debt issuance costs by CCH primarily in connection with the termination of a portion of its credit facility and note commitments, restructuring expense, amortization of the beneficial conversion feature and impairment expense.

"The fourth quarter of 2016 was another milestone quarter for Cheniere, as today we report financial results driven by nearly a full quarter of LNG production from the first two Trains at Sabine Pass," said Jack Fusco, Cheniere's President and CEO. "Transition and execution will remain central themes for Cheniere in 2017, as we expect Trains 3 and 4 at Sabine Pass to begin commercial operations, with Train 3 having produced its first commissioning cargo in January. The financial and operational results we are reporting today reflect our employees' steadfast dedication to execution on our goals."

Fourth Quarter 2016 Highlights

- In November 2016, the date of first commercial delivery was reached under the 20-year LNG Sale and Purchase Agreement ("SPA") with BG Gulf Coast LNG, LLC relating to the first train of the Sabine Pass Liquefaction Project (defined below).

- In November 2016, SPLNG redeemed all of its outstanding $420 million in aggregate principal amount of 6.50% Senior Secured Notes due 2020 (the "2020 Notes") and repaid all of its outstanding $1,665.5 million in aggregate principal amount of 7.50% Senior Secured Notes due 2016 (the "2016 Notes"). Subsequent to the redemption of the 2020 Notes and the repayment of the 2016 Notes, the Cheniere Partners complex has no long-term debt maturity until 2020.

- In December 2016, CCH issued an aggregate principal amount of $1.5 billion of 5.875% Senior Secured Notes due 2025. Net proceeds from the offering were used to prepay a portion of the outstanding borrowings under CCH's credit facility.

- In December 2016, CCH entered into a $350 million Working Capital Facility Agreement that will be used primarily for certain working capital requirements related to developing and placing into operation the CCL Project (defined below).

- In December 2016, Moody's Investors Service upgraded SPL's senior secured rating to Ba1 from Ba2. Subsequent to the end of the quarter, in January 2017 Fitch Ratings assigned a BBB- (Investment Grade) rating to senior secured debt issued by SPL.

- In December 2016, Cheniere terminated negotiations with the conflicts committee of the board of directors of Cheniere Energy Partners LP Holdings, LLC ("Cheniere Partners Holdings") (NYSE MKT: CQH) regarding Cheniere's previously announced non-binding proposal to acquire all of the publicly held shares of Cheniere Partners Holdings not already owned by Cheniere in a stock-for-stock merger transaction. Subsequent to the termination of negotiations, Cheniere acquired 5,785,161 shares of Cheniere Partners Holdings through individually negotiated transactions with shareholders of Cheniere Partners Holdings.

Fourth Quarter and Full Year 2016 Results

Our financial results are reported on a consolidated basis. Our ownership interest in Cheniere Partners as of December 31, 2016 consisted of 100% ownership of the general partner of Cheniere Partners and 82.6% ownership interest in Cheniere Partners Holdings which owns a 55.9% limited partner interest in Cheniere Partners.

ARIVA.DE Börsen-Geflüster

Weiter aufwärts?

| Kurzfristig positionieren in Cheniere Energy | ||

|

MB820V

| Ask: 1,18 | Hebel: 19,66 |

| mit starkem Hebel |

Zum Produkt

| |

|

MD4DUU

| Ask: 3,21 | Hebel: 4,54 |

| mit moderatem Hebel |

Zum Produkt

| |

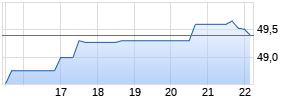

Kurse

|

|

|

Adjusted EBITDA2 for the three and twelve months ended December 31, 2016 was $134.2 million and $153.6 million, respectively, compared to losses of $90.6 million and $228.6 million, respectively, for the comparable 2015 periods. During the three months ended December 31, 2016, a total of 24 LNG cargoes were loaded and exported from the Sabine Pass Liquefaction Project, none of which were commissioning cargoes.

Total operating costs and expenses increased $139.7 million and $592.3 million during the three and twelve months ended December 31, 2016 compared to the three and twelve months ended December 31, 2015, respectively, generally as a result of the commencement of operations of Train 1 and Train 2 of the Sabine Pass Liquefaction Project in May and September 2016, respectively. Depreciation and amortization expense increased during the three and twelve months ended December 31, 2016 from the comparable 2015 periods as we began depreciation of our assets related to Train 1 and Train 2 of the Sabine Pass Liquefaction Project upon reaching substantial completion. Selling, general and administrative expense during the three and twelve months ended December 31, 2016 decreased from the comparable 2015 periods, primarily due to the timing of share-based compensation recognition and the recognition of certain employee-related costs within restructuring expense during the three and twelve months ended December 31, 2016 historically reported in selling, general and administrative expense, a reduction in certain professional services fees, and reallocation of costs from selling, general and administrative activities to operating and maintenance activities following commencement of operations at the Sabine Pass Liquefaction Project.

As a result of restructuring efforts initiated in 2015, during the three and twelve months ended December 31, 2016 we recorded $12.2 million and $61.4 million, respectively, of restructuring charges and other costs associated with restructuring and operational efficiency initiatives compared to $60.8 million for each of the three and twelve months ended December 31, 2015 for which the majority of these charges required, or will require, cash expenditure. Included in these amounts are $3.9 million and $46.9 million for share-based compensation for the three and twelve months ended December 31, 2016, respectively, and $57.9 million for each of the three and twelve months ended December 31, 2015. Charges related to restructuring efforts were recorded within restructuring expense on our Consolidated Statements of Operations and substantially all related to severance and other employee-related costs.

Included in selling, general and administrative expense were share-based compensation expenses of $7.0 million and $38.2 million for the three and twelve months ended December 31, 2016, respectively, compared to $17.2 million and $102.4 million for the comparable 2015 periods, respectively.

Liquefaction Projects Update

Sabine Pass Liquefaction Project

Through Cheniere Partners, we are developing up to six Trains at the Sabine Pass LNG terminal adjacent to the existing regasification facilities (the "Sabine Pass Liquefaction Project"). Each train is expected to have a nominal production capacity, which is prior to adjusting for planned maintenance, production reliability, and potential overdesign, of approximately 4.5 million tonnes per annum ("mtpa") of LNG.

The Trains are in various stages of operation, construction, and development.

- Construction on Trains 1 and 2 began in August 2012 and substantial completion was achieved in May 2016 and September 2016, respectively. Substantial completion is achieved upon the completion of construction, commissioning and the satisfaction of certain performance tests.

- Construction on Trains 3 and 4 began in May 2013, and as of December 31, 2016, the overall project completion percentage for Trains 3 and 4 was approximately 95.5%, which is ahead of the contractual schedule. In September 2016, commissioning activities commenced on Train 3. Based on the current construction schedule, Cheniere Partners expects to reach substantial completion for Train 3 in the first quarter of 2017 and Train 4 in the second half of 2017.

- Construction on Train 5 began in June 2015, and as of December 31, 2016, the overall project completion percentage for Train 5 was approximately 52.4%, which is ahead of the contractual schedule. Engineering, procurement, subcontract work and construction were approximately 96.6%, 76.6%, 43.7% and 11.3% complete, respectively. Based on the current construction schedule, Cheniere Partners expects Train 5 to reach substantial completion in the second half of 2019.

- Train 6 is currently under development, with all necessary regulatory approvals in place. Cheniere Partners expects to make a final investment decision and commence construction on Train 6 upon, among other things, entering into an engineering, procurement, and construction contract, entering into acceptable commercial arrangements, and obtaining adequate financing.

| | Sabine Pass Liquefaction Project | ||||||

| Liquefaction Train | Train 1 | Train 2 | Trains 3-4 | Train 5 | |||

| Project Status | Operational | Operational | 96% Overall Completion | 52% Overall Completion | |||

| Expected Substantial Completion | - | - | T3 - 1Q 2017 T4 - 2H 2017 | 2H 2019 | |||

| | | | | | |||

Corpus Christi LNG Terminal

We are developing up to three Trains near Corpus Christi, Texas (the "CCL Project"). Each train is expected to have a nominal production capacity, which is prior to adjusting for planned maintenance, production reliability, and potential overdesign, of approximately 4.5 mtpa of LNG.

The Trains are in various stages of construction and development:

- Construction on Trains 1 and 2 began in May 2015, and as of December 31, 2016, the overall project completion percentage for Trains 1 and 2 was approximately 49.2%, which is ahead of the contractual schedule. Engineering, procurement and construction were approximately 100%, 65.6% and 21.4% complete, respectively. Based on the current construction schedule, we expect Trains 1 and 2 to reach substantial completion in 2019.

- Train 3 is under development, with all necessary regulatory approvals in place. We have entered into an SPA for approximately 0.8 mtpa of LNG volumes that commence with Train 3 and expect to commence construction upon entering into additional SPAs and obtaining adequate financing.

Additionally, we are developing two additional trains adjacent to the CCL Project and have initiated the regulatory approval process with respect to those Trains.

| | Corpus Christi LNG Terminal |

| Liquefaction Train | Trains 1-2 |

| Project Status | 49% Overall Completion |

| Expected Substantial Completion | T1 - 1H 2019 T2 - 2H 2019 |

Investor Conference Call and Webcast

We will host a conference call to discuss our financial and operating results for the fourth quarter and full year on Tuesday, February 28, 2017, at 11 a.m. Eastern time / 10 a.m. Central time. A listen-only webcast of the call and an accompanying slide presentation may be accessed through our website at www.cheniere.com. Following the call, an archived recording will be made available on our website.

1 Reported as Net income (loss) attributable to common stockholders on our Consolidated Statements of Operations.

2 Non-GAAP financial measure. See "Reconciliation of Non-GAAP Measures" for further details.

About Cheniere

Cheniere Energy, Inc., a Houston-based energy company primarily engaged in LNG-related businesses, owns and operates the Sabine Pass LNG terminal in Louisiana. Directly and through its subsidiary, Cheniere Energy Partners, L.P., Cheniere is developing, constructing, and operating liquefaction projects near Corpus Christi, Texas and at the Sabine Pass LNG terminal, respectively. Cheniere is also exploring a limited number of opportunities directly related to its existing LNG business.

For additional information, please refer to the Cheniere website at www.cheniere.com and Annual Report on Form 10-K for the fiscal year ended December 31, 2016, filed with the Securities and Exchange Commission.

Forward-Looking Statements

This press release contains certain statements that may include "forward-looking statements" within the meanings of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. All statements, other than statements of historical fact, included herein are "forward-looking statements." Included among "forward-looking statements" are, among other things, (i) statements regarding Cheniere's business strategy, plans and objectives, including the development, construction and operation of liquefaction facilities, (ii) statements regarding expectations regarding regulatory authorizations and approvals, (iii) statements expressing beliefs and expectations regarding the development of Cheniere's LNG terminal and pipeline businesses, including liquefaction facilities, (iv) statements regarding the business operations and prospects of third parties, (v) statements regarding potential financing arrangements and (vi) statements regarding future discussions and entry into contracts. Although Cheniere believes that the expectations reflected in these forward-looking statements are reasonable, they do involve assumptions, risks and uncertainties, and these expectations may prove to be incorrect. Cheniere's actual results could differ materially from those anticipated in these forward-looking statements as a result of a variety of factors, including those discussed in Cheniere's periodic reports that are filed with and available from the Securities and Exchange Commission. You should not place undue reliance on these forward-looking statements, which speak only as of the date of this press release. Other than as required under the securities laws, Cheniere does not assume a duty to update these forward-looking statements.

(Financial Table Follows)

| | |||||||||||||||

| Cheniere Energy, Inc. Consolidated Statements of Operations (in thousands, except per share data) | |||||||||||||||

| | |||||||||||||||

| | (Unaudited) | | | | | ||||||||||

| | Three Months Ended | | Year Ended | ||||||||||||

| | December 31, | | December 31, (1) | ||||||||||||

| | 2016 | | 2015 | | 2016 | | 2015 | ||||||||

| Revenues | | | | | | | | ||||||||

| LNG revenues | $ | 504,140 | | | $ | 1,667 | | | $ | 1,016,133 | | | $ | 66 | |

| Regasification revenues | 67,262 | | | 65,832 | | | 265,405 | | | 265,720 | | ||||

| Other revenues | 184 | | | 933 | | | 1,629 | | | 5,099 | | ||||

| Total revenues | 571,586 | | | 68,432 | | | 1,283,167 | | | 270,885 | | ||||

| | | | | | | | | ||||||||

| Operating costs and expenses | | | | | | | | ||||||||

| Cost (cost recovery) of sales (excluding depreciation and amortization expense shown separately below) | 229,358 | | | 7,044 | | | 581,917 | | | (15,033) | | ||||

| Operating and maintenance expense | 72,731 Werbung Mehr Nachrichten zur Cheniere Energy Aktie kostenlos abonnieren

E-Mail-Adresse

Bitte überprüfe deine die E-Mail-Adresse.

Benachrichtigungen von ARIVA.DE (Mit der Bestellung akzeptierst du die Datenschutzhinweise) -1  Vielen Dank, dass du dich für unseren Newsletter angemeldet hast. Du erhältst in Kürze eine E-Mail mit einem Aktivierungslink. Hinweis: ARIVA.DE veröffentlicht in dieser Rubrik Analysen, Kolumnen und Nachrichten aus verschiedenen Quellen. Die ARIVA.DE AG ist nicht verantwortlich für Inhalte, die erkennbar von Dritten in den „News“-Bereich dieser Webseite eingestellt worden sind, und macht sich diese nicht zu Eigen. Diese Inhalte sind insbesondere durch eine entsprechende „von“-Kennzeichnung unterhalb der Artikelüberschrift und/oder durch den Link „Um den vollständigen Artikel zu lesen, klicken Sie bitte hier.“ erkennbar; verantwortlich für diese Inhalte ist allein der genannte Dritte. Andere Nutzer interessierten sich auch für folgende News | ||||||||||||||