Camden National Corporation Reports A 13% Increase In Third Quarter 2016 Net Income And Diluted Earnings Per Share

PR Newswire

CAMDEN, Maine, Oct. 25, 2016

CAMDEN, Maine, Oct. 25, 2016 /PRNewswire/ -- Camden National Corporation (NASDAQ: CAC; "Camden National" or the "Company"), a $3.9 billion bank holding company headquartered in Camden, Maine, reported net income for the third quarter of 2016 of $10.9 million and diluted earnings per share ("EPS")1 of $0.70 per share, representing an increase over the second quarter of 2016 of 13%. For the third quarter of 2016, the Company's return on average assets was 1.11%, return on average tangible equity2 was 15.61%, and efficiency ratio2 was 56.29%.

"We had another strong quarter leading to year-to-date net income of $29.2 million and driving year-to-date diluted EPS growth of 10% over the same period last year," said Gregory A. Dufour, chief executive officer and president of Camden National. "Our strong performance reflects the growth from our acquisition of SBM Financial, Inc. in October 2015 and within our traditional markets, as well as our continued focus on operating efficiencies."

For the nine months ended September 30, 2016, the Company's return on average assets was 1.02%, return on average tangible equity was 14.59%, and efficiency ratio was 57.92%.

Dufour added, "This past quarter we announced two major strategic initiatives — we completed a three-for-two split of the Company's common stock effective September 30, 2016 and announced the proposed merger of Camden National's wholly-owned subsidiary, Acadia Trust, N.A., into Camden National Bank creating Camden National Wealth Management. This will align all of our brands, including our brokerage group, Camden Financial Consultants, to provide a comprehensive offering of banking, wealth management and brokerage products and services."

Subject to regulatory approval, the Company expects to complete the proposed merger of Acadia Trust, N.A. into Camden National Bank in the fourth quarter of 2016.

THIRD QUARTER 2016 FINANCIAL HIGHLIGHTS (compared to the second quarter of 2016, unless otherwise stated)

- Net income reached $10.9 million, representing a $1.3 million, or 13%, increase over last quarter.

- Diluted EPS reached $0.70 per share, representing an $0.08 per share, or 13%, increase over last quarter.

- The return on average assets was 1.11% compared to 1.01% last quarter.

- The return on average tangible equity was 15.61% compared to 14.50% last quarter.

- Tangible book value per share2 increased 3% to $18.87 since last quarter.

- Tangible common equity ratio2 of 7.66% at September 30, 2016 exceeds the pre-acquisition level from a year ago.

FINANCIAL CONDITION

Total assets at September 30, 2016 were $3.9 billion compared to $3.7 billion at December 31, 2015, representing an increase of $194.6 million, or 7% annualized. Our asset growth for the nine months ended September 30, 2016 was driven by strong loan growth, including loans held for sale, of $115.5 million, and a $50.3 million increase in our investment portfolio.

| 1 | All share and per share data has been adjusted for all periods presented to reflect the three-for-two stock split on September 30, 2016. Refer to the "Stock split and Dividend" section of the earnings release for further information. |

| 2 | This is a non-GAAP measure. Please refer to "Reconciliation of non-GAAP to GAAP Financial Measures" for further details. |

Loan growth (excluding loans held for sale) of $101.8 million for the nine months ended September 30, 2016, or 5% annualized, was driven by our commercial loan portfolio, which increased $141.5 million since year-end. The growth within our commercial loan portfolio was centered in commercial real estate, which increased $126.4 million since year-end. Our retail loan portfolio decreased $39.7 million since year-end with a decline in our residential and consumer loan portfolio of 3% and 4%, respectively, since year-end. For the nine months ended September 30, 2016, the Company originated $291.6 million of residential mortgages and sold approximately 70% of this production.

Total deposits at September 30, 2016 were $2.9 billion, representing an increase of $162.8 million since year-end. Core deposits (demand, interest checking, savings and money market) at September 30, 2016 totaled $2.2 billion, representing an increase of $159.7 million, or 11% annualized, since year-end. Total borrowings at September 30, 2016 were $559.3 million, representing $13.1 million decrease since year-end.

The Company and its wholly-owned subsidiary Camden National Bank, continue to maintain risk-based capital ratios in excess of the regulatory levels required for an institution to be considered "well capitalized." At September 30, 2016, the Company's total risk-based capital ratio, Tier I risk-based capital ratio, common equity Tier I risk-based capital ratio, and Tier I leverage capital ratio were 13.60%, 12.16%, 10.86%, and 8.48%, respectively.

FINANCIAL OPERATING RESULTS

THIRD QUARTER 2016 COMPARED TO SECOND QUARTER 2016:

Net income for the third quarter of 2016 was $10.9 million, representing an increase of $1.3 million, or 13%, over the prior quarter, which was driven by a $1.6 million decrease in provision for loan losses. Diluted EPS for the third quarter of 2016 was $0.70 per share compared to $0.62 per share last quarter.

Core operating earnings2 for the third quarter of 2016 was $10.9 million, representing an increase over last quarter of $1.2 million, or 12%. Core diluted EPS1 for the third quarter of 2016 increased $0.07 per share to $0.70 per share over last quarter.

Total revenue3 increased $317,000, or 1%, in the third quarter of 2016 to $39.4 million over last quarter. The increase was due to a $449,000 increase in non-interest income, but was partially offset by a $132,000 decrease in net interest income.

- Non-interest income of $11.0 million increased 4% due to:

- An increase in mortgage banking income of $701,000 primarily due to an increase in mortgage gains of $763,000 as a result of higher loan sale volume in the third quarter of 2016 of $15.1 million; and

- Legal settlement proceeds of $638,000 related to a previously charged-off acquired loan, which increased third quarter diluted EPS $0.03 per share.

- Partially offset by:

- A decrease in fee income generated from commercial back-to-back loans swaps of $747,000. Total fees generated in the third quarter of 2016 were $443,000 on $46.5 million of back-to-back loan swap agreements; and

- A decrease in bank-owned life insurance ("BOLI") income of $307,000 driven by death benefits of $394,000 received on an insured last quarter, which increased second quarter 2016 diluted EPS $0.03 per share.

| 2 | This is a non-GAAP measure. Please refer to "Reconciliation of non-GAAP to GAAP Financial Measures" for further details. |

| 3 | Revenue is defined as the sum of net interest income and non-interest income. |

- Net interest income on a fully-taxable basis for the third quarter of 2016 was $28.9 million, representing a decrease of $128,000 on a fully-taxable basis compared to last quarter. The decrease was due to:

- Net interest margin decreased 10 basis points to 3.24% in the third quarter of 2016 compared to last quarter. The decrease in our net interest margin was driven by lower fair value mark accretion from purchase accounting and collection of previously charged-off acquired loans of $883,000 compared to last quarter. Excluding the effects of such, our normalized net interest margin1 for the third quarter of 2016 was 3.10% compared to 3.09% last quarter.

- Our loan yield for the third quarter of 2016, excluding the effects of fair value mark accretion from purchase accounting and collection of previously charged-off acquired loans, was 4.01%, representing a decrease of three basis points compared to last quarter.

- Our investments yield for the third quarter of 2016 was 2.44%, which included prepayment income contributing three basis points to our third quarter 2016 yield, compared to 2.41% last quarter.

- Our cost of funds for the third quarter of 2016 was 0.49%, representing a decrease of two basis points compared to last quarter.

- Partially offset by average interest-earning assets growth of $66.2 million, or 2%, for the third quarter of 2016 compared to last quarter driven by higher average loan balances of $56.3 million.

- Net interest margin decreased 10 basis points to 3.24% in the third quarter of 2016 compared to last quarter. The decrease in our net interest margin was driven by lower fair value mark accretion from purchase accounting and collection of previously charged-off acquired loans of $883,000 compared to last quarter. Excluding the effects of such, our normalized net interest margin1 for the third quarter of 2016 was 3.10% compared to 3.09% last quarter.

Non-interest expense for the third quarter of 2016 totaled $22.1 million, representing a decrease of $181,000, or 1%, compared to last quarter. Our efficiency ratio for the third quarter of 2016 was 56.29% compared to 56.53% last quarter. The decrease in non-interest expense was driven by:

- Lower consulting and professional fees of $240,000 as last quarter included the issuance of Company equity awards to its Board of Directors;

- Lower merger and acquisition costs of $132,000 as non-recurring costs associated with the SBM acquisition in October 2015 wind-down; and

- Lower net occupancy costs of $105,000 and regulatory assessment of $107,000 driven by the change in the Federal Deposit Insurance Corporation's ("FDIC") assessment calculation effective for the third quarter of 2016.

- Partially offset by higher other real estate owned and collection costs of $381,000 driven by an increase in sub-servicer costs of $333,000.

NINE MONTHS ENDED SEPTEMBER 30, 2016 COMPARED TO NINE MONTHS ENDED SEPTEMBER 30, 2015:

Net income for the nine months ended September 30, 2016 was $29.2 million compared to $19.3 million for the same period in 2015, representing an increase of $9.9 million, or 51%. Diluted EPS for the nine months ended September 30, 2016 was $1.88 per share compared to $1.71 per share for the same period in 2015, representing an increase of $0.17 per share, or 10%.

Our return on average assets and average tangible equity for the nine months ended September 30, 2016 was 1.02% and 14.59%, respectively, compared to 0.91% and 12.92% for the nine months ended September 30, 2015. Our efficiency ratio for the nine months ended September 30, 2016 was 57.92% compared to 59.80% for the same period a year ago.

Core operating earnings for the nine months ended September 30, 2016 was $29.7 million, representing an increase over the same period last year of $9.2 million, or 45%. Core diluted EPS for the nine months ended September 30, 2016 and 2015 was $1.91 and $1.83 per share, respectively. Our core return on average tangible equity2 for the nine months ended September 30, 2016 was 14.86% compared to 13.75% for the same period last year.

ASSET QUALITY

The provision for credit losses was $1.3 million for the third quarter of 2016, representing a decrease of $1.6 million over last quarter. In the second quarter of 2016, the Company recorded a $2.3 million provision for a commercial real estate loan and a commercial loan. In the third quarter of 2016, we charged-off $1.4 million related to the aforementioned commercial loan, for which a reserve had previously been established, that resulted in a 19 basis point increase in the annualized quarter-to-date net charge-off to average loans ratio compared to last quarter.

Overall, the Company's asset quality within its loan portfolio remains stable with non-performing assets to total assets of 0.67%, loans 30-89 days past due to total loans of 0.17%, and annualized year-to-date net charge-offs to average loans of 0.15%.

STOCK SPLIT AND DIVIDEND

On August 30, 2016, the Company's Board of Directors approved a three-for-two stock split to be effected in the form of a stock dividend on the Company's common stock. The three-for-two stock split was payable September 30, 2016, to the Company's common shareholders of record on September 15, 2016. As a result of the three-for-two stock split, the Company's historical and current period per share financial information and ratios were adjusted.

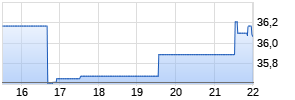

The Board of Directors approved a dividend of $0.20 per share, payable on October 31, 2016, to shareholders of record as of October 17, 2016. The third quarter 2016 dividend was adjusted for the three-for-two stock split. This distribution represents an annualized dividend yield of 2.51%, based on the September 30, 2016 closing price of Camden National's common stock at $31.83 per share, as adjusted for the three-for-two stock split, as reported by NASDAQ.

CONFERENCE CALL

Camden National will host a conference call and webcast at 3:30 p.m. eastern time on October 25, 2016 to discuss our third quarter 2016 financial results and outlook. Participants should dial in to the call 10 - 15 minutes before it begins. Information about the conference call is as follows:

| Live dial-in (domestic): | (888) 349-0139 |

| Live dial-in (international): | (412) 542-4154 |

| Live webcast: |

A link to the live webcast will be will be available on Camden National's website under "Investor Relations" at www.CamdenNational.com prior to the meeting. The transcript of the conference call will also be available on Camden National's website approximately two days after the conference call.

| 2 | This is a non-GAAP measure. Please refer to "Reconciliation of non-GAAP to GAAP Financial Measures" for further details. |

ABOUT CAMDEN NATIONAL CORPORATION

Camden National Corporation is the holding company of Camden National Bank and Acadia Trust, N.A. Headquartered in Camden, Maine, Camden National Corporation has $3.9 billion in assets and is the largest publicly traded bank holding company in Northern New England (NASDAQ: CAC). Camden National Bank is a full-service community bank that employs over 650 people, features a network of 63 banking centers and 85 ATMs in Maine, and offers state-of-the-art online and mobile banking resources as well as investment, insurance and financial planning services through its division, Camden Financial Consultants. With offices in Portland, Bangor, and Ellsworth, Acadia Trust, N.A. provides comprehensive wealth management, investment management and trust services to individual and institutional clients throughout Maine and New England. To learn more, visit www.CamdenNational.com.

FORWARD-LOOKING STATEMENTS

Certain statements contained in this press release that are not statements of historical fact constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, including certain plans, expectations, goals, projections and other statements, which are subject to numerous risks, assumptions and uncertainties. Forward-looking statements can be identified by the fact that they do not relate strictly to historical or current facts. They often include words like "believe," "expect," "anticipate," "estimate," and "intend" or future or conditional verbs such as "will," "would," "should," "could" or "may." Certain factors that could cause actual results to differ materially from expected results include difficulties in achieving cost savings in connection with the recent acquisition of SBM or in achieving such cost savings within the expected time frame, increased competitive pressures, changes in the interest rate environment, changes in general economic conditions, legislative and regulatory changes that adversely affect the business in which Camden National is engaged, changes in the securities markets and other risks and uncertainties disclosed from time to time in in Camden National's Annual Report on Form 10-K for the year ended December 31, 2015, as updated by other filings with the Securities and Exchange Commission ("SEC"). Camden National does not have any obligation to update forward-looking statements.

USE OF NON-GAAP MEASURES

In addition to evaluating the Company's results of operations in accordance with generally accepted accounting principles in the United States ("GAAP"), management supplements this evaluation with certain non-GAAP financial measures, such as the efficiency, tangible common equity, and core return ratios; core operating earnings; core diluted EPS; normalized net interest margin; tangible book value per share; and tax-equivalent net interest income. Management believes these non-GAAP financial measures help investors in understanding the Company's operating performance and trends and allow for better performance comparisons to other banks. In addition, these non-GAAP financial measures remove the impact of unusual items that may obscure trends in the Company's underlying performance. These disclosures should not be viewed as a substitute for GAAP operating results, nor are they necessarily comparable to non-GAAP performance measures that may be presented by other financial institutions. Reconciliation to the comparable GAAP financial measure can be found in this document.

ANNUALIZED DATA

Certain returns, yields and performance ratios are presented on an "annualized" basis. This is done for analytical and decision-making purposes to better discern underlying performance trends when compared to full-year or year-over-year amounts.

| Selected Financial Data (unaudited) | ||||||||||||||||||||

| | | At or For The Three Months Ended | | At or For The | ||||||||||||||||

| (In thousands, except number of shares and per share data) | | September 30, | | June 30, | | September 30, | | September 30, | | September 30, | ||||||||||

| Financial Condition Data | | | | | | | | | | | ||||||||||

| Investments | | $ | 906,286 | | | $ | 921,989 | | | $ | 820,052 | | | $ | 906,286 | | | $ | 820,052 | |

| Loans and loans held for sale | | 2,616,653 | | | 2,608,228 | | | 1,831,033 | | | 2,616,653 | | | 1,831,033 | | |||||

| Allowance for loan losses | | (23,290) | | | (23,717) | | | (21,132) | | | (23,290) | | | (21,132) | | |||||

| Total assets | | 3,903,966 | | | 3,910,386 | | | 2,871,798 | | | 3,903,966 | | | 2,871,798 Werbung Mehr Nachrichten zur Camden National Aktie kostenlos abonnieren

E-Mail-Adresse

Bitte überprüfe deine die E-Mail-Adresse.

Benachrichtigungen von ARIVA.DE (Mit der Bestellung akzeptierst du die Datenschutzhinweise) -1  Vielen Dank, dass du dich für unseren Newsletter angemeldet hast. Du erhältst in Kürze eine E-Mail mit einem Aktivierungslink. Hinweis: ARIVA.DE veröffentlicht in dieser Rubrik Analysen, Kolumnen und Nachrichten aus verschiedenen Quellen. Die ARIVA.DE AG ist nicht verantwortlich für Inhalte, die erkennbar von Dritten in den „News“-Bereich dieser Webseite eingestellt worden sind, und macht sich diese nicht zu Eigen. Diese Inhalte sind insbesondere durch eine entsprechende „von“-Kennzeichnung unterhalb der Artikelüberschrift und/oder durch den Link „Um den vollständigen Artikel zu lesen, klicken Sie bitte hier.“ erkennbar; verantwortlich für diese Inhalte ist allein der genannte Dritte. Andere Nutzer interessierten sich auch für folgende News | ||||||