Cabot Oil & Gas Corporation Announces First-Quarter 2018 Results

PR Newswire

HOUSTON, April 27, 2018

HOUSTON, April 27, 2018 /PRNewswire/ -- Cabot Oil & Gas Corporation (NYSE: COG) ("Cabot" or the "Company") today reported financial and operating results for the first-quarter of 2018.

First-Quarter 2018 Highlights

- Daily equivalent production of 1,884 million cubic feet equivalent (Mmcfe) per day, exceeding the high-end of the Company's guidance range

- Net income of $117.2 million (or $0.26 per share); adjusted net income (non-GAAP) of $128.5 million (or $0.28 per share)

- Net cash provided by operating activities of $272.8 million; discretionary cash flow (non-GAAP) of $280.3 million

- Free cash flow (non-GAAP) of $88.6 million, marking the eighth consecutive quarter of positive free cash flow

- Returned $234.8 million of capital to shareholders through dividends and share repurchases

- Improved operating expenses per unit by 21 percent relative to the prior-year comparable quarter

- Completed the previously announced divestiture of the Company's Eagle Ford Shale assets

See the supplemental tables at the end of this press release for a reconciliation of non-GAAP measures including adjusted net income (loss), EBITDAX, discretionary cash flow, free cash flow, and net debt to adjusted capitalization ratio.

"Our free cash flow generation and return of capital to shareholders during the quarter highlights Cabot's commitment to executing on our differentiated corporate strategy," stated Dan O. Dinges, Chairman, President and Chief Executive Officer. "With the majority of construction work already completed on our new infrastructure projects that are slated to be placed in-service beginning in the second quarter, we are excited about delivering on our combination of top-tier growth, returns and free cash flow over the coming years."

First-Quarter 2018 Financial Results

First-quarter 2018 equivalent production was 169.6 billion cubic feet equivalent (Bcfe), consisting of 164.6 billion cubic feet (Bcf) of natural gas, 754.0 thousand barrels (Mbbls) of crude oil and condensate, and 75.1 Mbbls of natural gas liquids (NGLs). Production for all three product categories exceeded the high-end of the Company's guidance for the quarter.

First-quarter 2018 net income was $117.2 million, or $0.26 per share, compared to net income of $105.7 million, or $0.23 per share, in the prior-year period. First-quarter 2018 adjusted net income (non-GAAP) was $128.5 million, or $0.28 per share, compared to adjusted net income of $89.1 million, or $0.19 per share, in the prior-year period. First-quarter 2018 EBITDAX (non-GAAP) was $278.6 million, compared to $306.3 million in the prior-year period.

First-quarter 2018 net cash provided by operating activities was $272.8 million, compared to $269.4 million in the prior-year period. First-quarter 2018 discretionary cash flow (non-GAAP) was $280.3 million, compared to $273.0 million in the prior-year period. First-quarter 2018 free cash flow (non-GAAP) was $88.6 million, compared to $56.9 million in the prior-year period.

First-quarter 2018 natural gas price realizations, including the impact of derivatives, were $2.44 per thousand cubic feet (Mcf), a decrease of eight percent compared to the prior-year period. Excluding the impact of derivatives, first-quarter 2018 natural gas price realizations were $2.50 per Mcf, representing a $0.50 discount to NYMEX settlement prices compared to a $0.67 discount in the prior-year comparable quarter. First-quarter 2018 oil price realizations, including the impact of derivatives, were $63.61 per barrel (Bbl), an increase of 36 percent compared to the prior-year period. NGL price realizations were $23.75 per Bbl, an increase of 15 percent compared to the prior-year period. First-quarter 2018 operating expenses (including financing) decreased to $1.58 per thousand cubic feet equivalent (Mcfe), a 21 percent improvement compared to the prior-year period.

Cabot incurred a total of $167.3 million of capital expenditures in the first-quarter of 2018 including $158.2 million of drilling and facilities capital; $7.4 million of leasehold acquisition capital; and $1.7 million of other capital. Additionally, the Company contributed $35.4 million to its equity pipeline investments in the first-quarter of 2018. See the supplemental table at the end of this press release reconciling the capital expenditures during the first-quarter of 2018.

Marcellus Shale Operational Highlights

During the first-quarter of 2018, the Company averaged 1,822 million cubic feet (Mmcf) per day of net Marcellus production, an increase of three percent sequentially compared to the fourth-quarter of 2017 despite the Company not placing any wells on production during the quarter. During the second-quarter of 2018, the Company plans to place 20.0 net wells on production, of which 16.0 net wells have already been turned to sales. Cabot expects to place an additional 60.0 net wells on production during the second half of the year to allow for the anticipated increase in production volumes associated with the in-service of new infrastructure projects beginning in June.

Cabot is currently operating three rigs and two completion crews in the Marcellus Shale.

Financial Position and Liquidity

As of March 31, 2018, Cabot had total debt of $1.5 billion and cash on hand of $964.9 million. The Company's net debt to adjusted capitalization ratio and net debt to trailing twelve months EBITDAX ratio were 18.8 percent and 0.5x, respectively, compared to 29.2 percent and 1.0x as of December 31, 2017.

Effective April 18, 2018, Cabot's borrowing base was unanimously reaffirmed by its 20 lenders at $3.2 billion. Total commitments under the Company's credit facility remain unchanged at $1.8 billion, with approximately $1.7 billion currently available to Cabot. The Company currently has no debt outstanding under the credit facility, resulting in approximately $2.6 billion of liquidity. Cabot's next annual borrowing base redetermination is scheduled for April 2019.

Share Repurchase Program Update

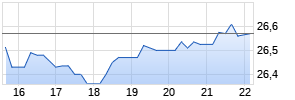

During the first-quarter of 2018, Cabot repurchased 8.3 million shares at a weighted-average share price of $24.85. Subsequent to the end of the first-quarter, the Company repurchased an additional 1.6 million shares at a weighted-average share price of $23.40 under a Rule 10b5-1 plan, resulting in year-to-date repurchases of approximately 10.0 million shares at a weighted-average share price of $24.61. The Company has 20.1 million shares remaining under its current share repurchase program authorization. "Since we reactivated our share repurchase program in the second-quarter of 2017, Cabot has allocated approximately $370 million of capital to repurchasing approximately 15.0 million shares, further reinforcing the Company's commitment to increasing our return of capital to shareholders," commented Dinges.

Second-Quarter and Full-Year 2018 Guidance Update

Cabot has provided second-quarter 2018 net production guidance of 1,850 to 1,900 Mmcfe per day. The Company has also reaffirmed its total 2018 daily production growth guidance of 10 to 15 percent (18 to 23 percent on a divestiture-adjusted basis) and its full-year capital budget of $950 million.

As a result of the divestiture of Cabot's Eagle Ford Shale assets in the first-quarter, the Company has updated its operating expense guidance for the remaining nine months of 2018 to the following:

| • Direct operations: | | | $0.08 - $0.10 per Mcfe |

| • Transportation and gathering: | | | $0.66 - $0.68 per Mcfe |

| • Taxes other than income: | | | $0.02 - $0.03 per Mcfe |

| • Depreciation, depletion and amortization: | | | $0.48 - $0.53 per Mcfe |

| • Interest expense: | | | $0.09 - $0.11 per Mcfe |

| • Cash general and administrative (ex. stock-based compensation): | | | $40 - $42 million |

| • Exploration: | | | $30 - $32 million |

"Our 2018 plan remains on track to deliver double-digit corporate returns, double-digit growth in production per debt-adjusted share, and over $180 million of positive free cash flow at current prices," noted Dinges. "Additionally, we remain confident in our three-year plan that can generate between $1.6 and $2.5 billion of after-tax cumulative free cash flow based on a range of NYMEX prices of $2.75 to $3.25 per Mmbtu."

Conference Call Webcast

A conference call is scheduled for Friday, April 27, 2018, at 9:30 a.m. Eastern Time to discuss first quarter 2018 financial and operating results. To access the live audio webcast, please visit the Investor Relations section of the Company's website. A replay of the call will also be available on the Company's website.

Cabot Oil & Gas Corporation, headquartered in Houston, Texas, is a leading independent natural gas producer with its entire resource base located in the continental United States. For additional information, visit the Company's website at www.cabotog.com.

This press release includes forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. The statements regarding future financial and operating performance and results, strategic pursuits and goals, market prices, future hedging and risk management activities, and other statements that are not historical facts contained in this report are forward-looking statements. The words "expect", "project", "estimate", "believe", "anticipate", "intend", "budget", "plan", "forecast", "outlook", "predict", "may", "should", "could", "will" and similar expressions are also intended to identify forward-looking statements. Such statements involve risks and uncertainties, including, but not limited to, market factors, market prices (including geographic basis differentials) of natural gas and crude oil, results of future drilling and marketing activity, future production and costs, legislative and regulatory initiatives, electronic, cyber or physical security breaches and other factors detailed herein and in our other Securities and Exchange Commission (SEC) filings. See "Risk Factors" in Item 1A of the Form 10-K and subsequent public filings for additional information about these risks and uncertainties. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual outcomes may vary materially from those indicated. Any forward-looking statement speaks only as of the date on which such statement is made, and the Company does not undertake any obligation to correct or update any forward-looking statement, whether as the result of new information, future events or otherwise, except as required by applicable law.

FOR MORE INFORMATION CONTACT

Matt Kerin (281) 589-4642

| OPERATING DATA | |||||||

| | |||||||

| | Three Months Ended | ||||||

| | 2018 | | 2017 | ||||

| PRODUCTION VOLUMES | | | | ||||

| Natural gas (Bcf) | 164.6 | | | 163.8 | | ||

| Crude oil and condensate (Mbbl) | 754.0 | | | 921.0 | | ||

| Natural gas liquids (NGLs) (Mbbl) | 75.1 | | | 123.5 | | ||

| Equivalent production (Bcfe) | 169.6 | | | 170.1 | | ||

| | | | | ||||

| AVERAGE SALES PRICE | | | | ||||

| Natural gas, including hedges ($/Mcf) | $ | 2.44 | | | $ | 2.64 | |

| Natural gas, excluding hedges ($/Mcf) | $ | 2.50 | | | $ | 2.65 | |

| Crude oil and condensate, including hedges ($/Bbl) | $ | 63.61 | | | $ | 46.73 | |

| Crude oil and condensate, excluding hedges ($/Bbl) | $ | 64.61 | | | $ | 46.68 | |

| NGL ($/Bbl) | $ | 23.75 | | | $ | 20.71 | |

| | | | | ||||

| AVERAGE UNIT COSTS ($/Mcfe) | | | | ||||

| Direct operations | $ | 0.12 | | | $ | 0.14 | |

| Transportation and gathering | 0.66 | | | 0.73 | | ||

| Taxes other than income | 0.04 | | | 0.05 | | ||

| Exploration | 0.02 Werbung Mehr Nachrichten zur Coterra Energy Inc. Aktie kostenlos abonnieren

E-Mail-Adresse

Bitte überprüfe deine die E-Mail-Adresse.

Benachrichtigungen von ARIVA.DE (Mit der Bestellung akzeptierst du die Datenschutzhinweise) -1  Vielen Dank, dass du dich für unseren Newsletter angemeldet hast. Du erhältst in Kürze eine E-Mail mit einem Aktivierungslink. Hinweis: ARIVA.DE veröffentlicht in dieser Rubrik Analysen, Kolumnen und Nachrichten aus verschiedenen Quellen. Die ARIVA.DE AG ist nicht verantwortlich für Inhalte, die erkennbar von Dritten in den „News“-Bereich dieser Webseite eingestellt worden sind, und macht sich diese nicht zu Eigen. Diese Inhalte sind insbesondere durch eine entsprechende „von“-Kennzeichnung unterhalb der Artikelüberschrift und/oder durch den Link „Um den vollständigen Artikel zu lesen, klicken Sie bitte hier.“ erkennbar; verantwortlich für diese Inhalte ist allein der genannte Dritte. Andere Nutzer interessierten sich auch für folgende News | ||||||