C&F Financial Corporation Announces Third Quarter Net Income

PR Newswire

WEST POINT, Va., Oct. 24, 2013

WEST POINT, Va., Oct. 24, 2013 /PRNewswire/ -- C&F Financial Corporation (NASDAQ: CFFI), the one-bank holding company for C&F Bank (the Bank), today reported net income of $3.4 million, or $0.97 per common share assuming dilution, for the third quarter of 2013, compared with $4.5 million, or $1.36 per common share assuming dilution, for the third quarter of 2012. Net income for the first nine months of 2013 was $11.6 million, compared to $12.5 million for the first nine months of 2012. Net income available to common shareholders for the first nine months of 2013 was $11.6 million, or $3.37 per common share assuming dilution, compared to $12.2 million, or $3.69 per common share assuming dilution, for the first nine months of 2012.

For the third quarter of 2013, the corporation's return on average common equity (ROE) and return on average assets (ROA), on an annualized basis, were 12.58 percent and 1.37 percent, respectively, compared to 18.48 percent and 1.88 percent, respectively, for the third quarter of 2012. For the first nine months of 2013, on an annualized basis, the corporation's ROE was 14.52 percent and its ROA was 1.56 percent, compared to a 17.74 percent ROE and a 1.75 percent ROA for the first nine months of 2012. The decline in ROE and ROA during the three and nine months ended September 30, 2013, compared to the same periods of 2012, resulted from capital and asset growth, coupled with lower earnings, during the comparative periods.

"We are very pleased to report earnings of $3.4 million for the third quarter of 2013," said Larry Dillon, president and chief executive officer of C&F Financial Corporation. "The retail banking segment reported an $86,000 increase in net income for the third quarter of 2013 compared to the same period in 2012. Growth in income at the Bank was primarily a result of asset quality improvements, which contributed to a $450,000 decline in the provision for loan losses from the third quarter of 2012 to the third quarter of 2013, which was offset to a significant degree by higher compensation costs associated with our investment in the Bank's commercial lending initiatives in Richmond."

"The consumer finance and mortgage banking segments reported decreases in net income of $778,000 and $434,000, respectively, for the third quarter of 2013 compared to the third quarter of 2012," continued Dillon. "The results of the consumer finance segment were affected by (1) an increasing volume of loan defaults and a correspondingly higher number of repossessed vehicles and (2) lower recovery rates on repossessed vehicles sold, both of which contributed to the $1.3 million increase in the consumer finance segment's provision for loan losses during the third quarter of 2013 compared to the third quarter of 2012. The results of the mortgage banking segment were negatively affected by the continued volatility in mortgage interest rates, which caused a 16 percent decline in the volume of loan originations, including a 48 percent decline in refinancings, during the third quarter of 2013 compared to the third quarter of 2012."

"We are very pleased that the corporation's acquisition of Central Virginia Bankshares, Inc., or CVB, was completed on October 1, 2013. This transaction is a significant milestone for the corporation and a major step in our strategic expansion in the growing Richmond area. We believe the addition of the CVB branch network, which has a very strong deposit base, along with C&F's recently announced plans to grow its commercial lending presence in the Richmond market, will significantly improve opportunities for future growth and increased shareholder value," concluded Dillon.

Retail Banking Segment. C&F Bank reported net income of $791,000 for the third quarter of 2013, compared to net income of $705,000 for the third quarter of 2012. For the first nine months of 2013, C&F Bank reported net income of $2.0 million compared to net income of $1.6 million for the first nine months of 2012.

Factors that contributed to the improved financial results for the three and nine months ended September 30, 2013, when compared to the same periods during 2012, were (1) the effects of the continued low interest rate environment on the cost of deposits and on the renewal rates on borrowings from the Federal Home Loan Bank, (2) a shift in deposit mix to lower rate non-term deposit accounts, (3) the effects of improved credit quality on the loan loss provision and expenses associated with loan work-outs, (4) lower expenses related to the holding costs of foreclosed properties and (5) increased activity-based interchange and overdraft fee income. Partially offsetting these positive factors were (1) the decline in the retail banking segment's average loans to nonaffiliates resulting from continued weak loan demand in the current economic environment and intense competition for loans in our markets, (2) higher personnel costs associated with increased staff levels throughout our branch network and the addition of new personnel dedicated to growing the Bank's commercial and small business loan portfolio, (3) higher occupancy expenses associated with depreciation and maintenance of technology related to expanding the banking services we offer to customers and improving operational efficiency and security and (4) higher data processing expenses related to check card processing and mobile banking products and services.

The Bank's nonperforming assets were $8.0 million at September 30, 2013, compared to $17.7 million at December 31, 2012. Nonperforming assets at September 30, 2013 included $4.2 million in nonaccrual loans, compared to $11.5 million at December 31, 2012, and $3.8 million in foreclosed properties, compared to $6.2 million at December 31, 2012. Troubled debt restructurings (TDRs) were $5.3 million at September 30, 2013, of which $2.6 million were included in nonaccrual loans, as compared to $16.5 million of TDRs at December 31, 2012, of which $9.8 million were included in nonaccrual loans. The decreases in nonaccrual loans and TDRs were primarily a result of (1) the sale of $10.9 million of TDRs during the first quarter of 2013 related to one commercial relationship, $5.2 million of which was on nonaccrual status at December 31, 2012 and (2) the pay-off of $2.0 million of nonaccrual TDRs related to one commercial relationship. The sale of notes referred to above resulted in a $2.1 million charge-off which was previously included in the allowance for loan losses and contributed to the decline in the Bank's allowance for loan losses as a percentage of total loans to 2.88 percent at September 30, 2013 from 3.38 percent at December 31, 2012. Management believes it has provided adequate loan loss reserves for the retail banking segment's loans. Foreclosed properties at September 30, 2013 consist of both residential and non-residential properties. These properties are evaluated regularly and have been written down to their estimated fair values less selling costs.

Mortgage Banking Segment. C&F Mortgage Corporation reported net income of $302,000 for the third quarter of 2013, compared to $736,000 for the third quarter of 2012. For the first nine months of 2013, C&F Mortgage Corporation reported net income of $1.8 million compared to $1.6 million for the first nine months of 2012.

During the second quarter of 2013, the mortgage banking segment began selling a portion of loans originated for sale on a mandatory delivery basis, while continuing to sell the majority of its loans on a best efforts delivery basis. In accordance with Accounting Standards Codification Topic 820-Fair Value Measurement and Disclosures, we have elected to use fair value accounting for loans held for sale and interest rate lock commitments, as well as for forward loan sales commitments and hedging instruments that are used to reduce the effect of changes in interest rates on loans that are to be sold in the secondary market. Under fair value accounting, gains on loans to be sold in the secondary market are recognized as loan applications progress through the origination pipeline, as opposed to recognizing gains when the loans are sold, as was done in the past. The decline in pre-tax income for the third quarter of 2013 compared to the third quarter of 2012 included losses attributable to fair value adjustments of $473,000; whereas, the increase in pre-tax income for the first nine months of 2013 compared to the same period of 2012 included gains of $823,000 attributable to fair value adjustments.

Net income at the mortgage banking segment for the three and nine months ended September 30, 2013, compared to the same periods in 2012, benefited from lower provisions for indemnification losses. Net income at the mortgage banking segment was negatively affected by (1) fluctuations in mortgage interest rates during the third quarter of 2013 that caused lower loan application volume and correspondingly lower loan production for the three and nine months ended September 30, 2013, (2) lower net interest income resulting from lower loan production and (3) higher non-production based personnel costs associated with expansion into Virginia Beach, Virginia and with regulatory compliance. If volatility in mortgage interest rates continues, there may be a continuation of lower loan demand, particularly for refinancings, which could negatively affect earnings of the mortgage banking segment for the remainder of 2013 and possibly beyond.

Consumer Finance Segment. C&F Finance Company reported net income of $2.4 million for the third quarter of 2013, compared with $3.2 million for the third quarter of 2012. For the first nine months of 2013, C&F Finance Company reported net income of $8.8 million, compared to $9.8 million for the first nine months of 2012.

Factors contributing to the consumer finance segment's net income for the three and nine months ended September 30, 2013 were loan growth of 7 percent and 10 percent, respectively, and low funding costs on its variable-rate borrowings. Offsetting these benefits were (1) increases in the segment's provision for loan losses resulting from higher loan charge-offs due to the continued uncertain economic environment, lower resale values on repossessed vehicles and credit easing by competitors, (2) a decline in average loan yields as a result of aggressive loan pricing strategies used by competitors attempting to grow market share in automobile financing and (3) higher personnel expenses resulting from an increase in the number of personnel to support loan growth and expansion into new markets.

The allowance for loan losses as a percentage of loans at September 30, 2013 was 8.01 percent, as compared with 7.96 percent at December 31, 2012. Management believes that the current allowance for loan losses is adequate to absorb probable losses in the consumer finance loan portfolio. However, if the current economic environment and credit easing by new entrants into the automobile financing sector continues to contribute to an increase in the segment's defaults, the consumer finance segment could continue to experience an elevated level of charge-offs for the remainder of 2013 and possibly beyond, which may result in higher provisions for loan losses.

Other Segments. Other segments reported an aggregate net loss of $167,000 for the third quarter of 2013, compared to a net loss of $126,000 for the third quarter of 2012. For the first nine months of 2013, other segments reported an aggregate net loss of $1.1 million, compared to a net loss of $471,000 for the first nine months of 2012. Other segments includes the corporation's holding company, which recognized $220,000 and $868,000 in transactions costs, net of taxes, ($286,000 and $1.1 million before taxes, respectively) during the third quarter and first nine months of 2013, respectively, associated with the corporation's acquisition of CVB. Additional information on the acquisition of CVB is provided below.

Capital and Dividends. The corporation's capital and liquidity positions remain strong. The corporation paid a quarterly cash dividend of 29 cents per common share during the third quarter of 2013. The Board of Directors of the corporation continues to review the dividend payout ratio, which was 28.71 percent of net income during the third quarter of 2013, in light of changes in economic conditions, capital levels, expected future levels of earnings and the changes to the regulatory capital framework that were approved on July 9, 2013 by the federal banking agencies.

Acquisition of Central Virginia Bankshares, Inc. C&F Financial Corporation completed its acquisition of Central Virginia Bankshares, Inc. effective October 1, 2013. CVB shareholders received $0.32 for each share of CVB common stock they owned, or approximately $853,000 in the aggregate. In addition, the corporation purchased from the U.S. Treasury for $3.35 million all of CVB's preferred stock and warrants issued to the U.S. Treasury, including accrued and unpaid dividends on the preferred stock, under the Capital Purchase Program. CVB's stock symbol, "CVBK," was retired effective October 1, 2013.

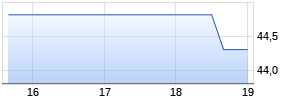

About C&F Financial Corporation. C&F Financial Corporation's common stock is listed for trading on The Nasdaq Stock Market under the symbol CFFI. The common stock closed at a price of $55.80 per share on October 23, 2013. At September 30, 2013, the book value of the corporation was $32.84 per common share. The corporation's market makers include Davenport & Company LLC, McKinnon & Company, Inc. and BB&T Scott & Stringfellow, Inc.

As of the date of this press release, C&F Financial Corporation is the parent of C&F Bank and of CVB, which is the parent of Central Virginia Bank. C&F Bank operates 18 retail bank branches located throughout the Hampton to Richmond corridor in Virginia. Central Virginia Bank operates seven retail bank branches located in the counties of Powhatan, Cumberland, Chesterfield and Henrico.

C&F Bank also offers full investment services through its subsidiary C&F Investment Services, Inc. C&F Mortgage Corporation provides mortgage, title and appraisal services through 18 offices located in Virginia, Maryland, North Carolina, Delaware and New Jersey. C&F Finance Company provides automobile loans in Virginia, Tennessee, Maryland, North Carolina, Georgia, Ohio, Kentucky, Indiana, New Hampshire, Alabama, Missouri, Illinois, Texas, Florida and West Virginia through its offices in Richmond and Hampton, Virginia, in Nashville, Tennessee and in Hunt Valley, Maryland.

Additional information regarding the corporation's products and services, as well as access to its filings with the Securities and Exchange Commission, are available on the corporation's web site at http://www.cffc.com.

Use of Certain Non-GAAP Financial Measures. The accounting and reporting policies of the corporation conform to generally accepted accounting principles ("GAAP") in the United States and prevailing practices in the banking industry. However, certain non-GAAP measures are used by management to supplement the evaluation of the corporation's performance. These include the following fully-taxable equivalent ("FTE") measures: interest income on loans-FTE, interest income on securities-FTE, total interest income-FTE and net interest income-FTE, and the adjusted annualized net charge-off ratio for the combined Retail Banking and Mortgage Banking segments.

Management believes that FTE measures provide users of the corporation's financial information a presentation of the performance of interest earning assets on a basis that is comparable within the banking industry. Management reviews interest income of the corporation on an FTE basis. In this non-GAAP presentation, interest income is adjusted to reflect tax-exempt interest income on an equivalent before-tax basis. This measure ensures the comparability of net interest income arising from both taxable and tax-exempt sources.

Management believes that the presentation of the adjusted annualized net charge-off ratio for the combined Retail Banking and Mortgage Banking segments that excludes the effect of a significant nonrecurring charge-off recognized in a single accounting period permits a comparison of asset quality related to ongoing business operations, and it is on this basis that management internally assesses the corporation's performance and establishes goals for the future.

These non-GAAP financial measures should not be considered an alternative to GAAP-basis financial statements, and other bank holding companies may define or calculate these or similar measures differently. A reconciliation of the non-GAAP financial measures used by the corporation to evaluate and measure the corporation's performance to the most directly comparable GAAP financial measures is presented below.

Forward-Looking Statements.Statements in this press release which express "belief," "intention," "expectation," "potential" and similar expressions, identify forward-looking statements. These forward-looking statements are based on the beliefs of the corporation's management, as well as assumptions made by, and information currently available to, the corporation's management. These statements are inherently uncertain, and there can be no assurance that the underlying assumptions will prove to be accurate. Actual results could differ materially from those anticipated by such statements. Forward-looking statements in this release include, without limitation, statements regarding expected future financial performance, strategic business initiatives, asset quality and future actions to manage asset quality, adequacy of reserves for loan losses and capital levels. Factors that could have a material adverse effect on the operations and future prospects of the corporation include, but are not limited to, changes in: (1) interest rates, such as the current volatility in yields on U.S. Treasury bonds and increases or volatility in mortgage rates, (2) general business conditions, as well as conditions within the financial markets, (3) general economic conditions, including unemployment levels, (4) the legislative/regulatory climate, including the Dodd-Frank Wall Street Reform and Consumer Protection Act and regulations promulgated thereunder, (5) monetary and fiscal policies of the U.S. Government, including policies of the Treasury and the Federal Reserve Board, (6) the ability to achieve the operations and results expected after the CVB acquisition, including by achieving anticipated cost savings, continued relationships with major customers and deposit retention, (7) the value of securities held in the corporation's investment portfolios, (8) the quality or composition of the loan portfolios and the value of the collateral securing those loans, (9) the inventory level and pricing of used automobiles, including sales prices of repossessed vehicles, (10) the level of net charge-offs on loans and the adequacy of our allowance for loan losses, (11) the level of indemnification losses related to mortgage loans sold, (12) demand for loan products, (13) deposit flows, (14) the strength of the corporation's counterparties, (15) competition from both banks and non-banks, (16) demand for financial services in the corporation's market area, (17) technology, (18) reliance on third parties for key services, (19) the commercial and residential real estate markets, (20) demand in the secondary residential mortgage loan markets, (21) the corporation's expansion and technology initiatives, and (22) accounting principles, policies and guidelines and elections by the corporation thereunder, such as the election of fair value accounting for loans held for sale. These risks and uncertainties should be considered in evaluating the forward-looking statements contained herein, and readers are cautioned not to place undue reliance on any forward-looking statements, which speak only as of the date of this release.

| C&F Financial Corporation | |||||||||

| Selected Financial Information | |||||||||

| (in thousands, except for share and per share data) | |||||||||

| | | | | | | | | | |

| | | | | | | | | | |

| Financial Condition | 9/30/13 | | 12/31/12 | | 9/30/12 | ||||

| | | | | | (unaudited) | | | | (unaudited) |

| Interest-bearing deposits with other banks and | | | | | | ||||

| | federal funds sold | $ 36,531 | | $ 17,541 | | $ 7,649 | |||

| Investment securities - available for sale, at fair value | 147,161 | | 152,817 | | 140,608 | ||||

| Loans held for sale* | 55,911 | | 72,727 | | 78,072 | ||||

| Loans, net: | | | | | | ||||

| | Retail Banking segment | 381,827 | | 382,283 | | 394,715 | |||

| | Mortgage Banking segment | 2,405 | | 1,947 | | 2,014 | |||

| | Consumer Finance segment | 265,044 | | 256,053 | | 249,507 | |||

| Federal Home Loan Bank stock | 3,525 | | 3,744 | | 3,744 | ||||

| Total assets | 983,631 | | 977,018 | | 961,819 | ||||

| Deposits | 685,232 | | 686,184 | | 664,212 | ||||

| Repurchase agreements and federal funds purchased | 18,653 | | 14,139 | | 22,371 | ||||

| Borrowings | 148,607 | | 148,607 | | 148,607 | ||||

| Shareholders' equity | 109,379 | | 102,197 | | 98,477 | ||||

| | | | | | | | | | |

| * | Reported at fair value at 9/30/13 and at cost at 12/31/12 and 9/30/12 | ||||||||

| | | | | | | | | | |

| | | | For The | For The | |||||

| | | | Quarter Ended | Nine Months Ended | |||||

| Results of Operations | | 9/30/13 | | 9/30/12 | | 9/30/13 | | 9/30/12 | |

| | | | (unaudited) | (unaudited) Werbung Mehr Nachrichten zur C&F Financial Corp Aktie kostenlos abonnieren

E-Mail-Adresse

Bitte überprüfe deine die E-Mail-Adresse.

Benachrichtigungen von ARIVA.DE (Mit der Bestellung akzeptierst du die Datenschutzhinweise) -1  Vielen Dank, dass du dich für unseren Newsletter angemeldet hast. Du erhältst in Kürze eine E-Mail mit einem Aktivierungslink. Hinweis: ARIVA.DE veröffentlicht in dieser Rubrik Analysen, Kolumnen und Nachrichten aus verschiedenen Quellen. Die ARIVA.DE AG ist nicht verantwortlich für Inhalte, die erkennbar von Dritten in den „News“-Bereich dieser Webseite eingestellt worden sind, und macht sich diese nicht zu Eigen. Diese Inhalte sind insbesondere durch eine entsprechende „von“-Kennzeichnung unterhalb der Artikelüberschrift und/oder durch den Link „Um den vollständigen Artikel zu lesen, klicken Sie bitte hier.“ erkennbar; verantwortlich für diese Inhalte ist allein der genannte Dritte. Andere Nutzer interessierten sich auch für folgende News | |||||