Boardwalk REIT announces third quarter financial results, a long-term strategic plan focused on NAV growth, and change to monthly distribution beginning in 2018

PR Newswire

CALGARY, Nov. 14, 2017

- Q3, 2017 FFO per unit of $0.53

- Long-term strategic plan – NAV growth and diversification

1) Portfolio growth of 10,000 to 15,000 apartment units in strategic locations to provide geographic diversification

2) Continue to be long on Alberta

- Near-term focus on the recapture of incentive and vacancy loss from a cyclical bottom

- Long-term focus on brand diversification and suite renewal to expand our resident base and achieve superior organic growth

3) Maintain financial strength and flexibility

- Revised distribution for 2018

- Re-allocate approximately $64 million of distribution towards development, acquisition, strategic partnerships, and renovation program which will accelerate the FFO recovery as well as provide the lowest cost of capital to fund growth

- Revised distribution policy aligns with strategic plan focus of NAV growth

- Operational tailwinds

- Renovation headwinds in the first 9M of 2017 have become tailwinds as they are completed and rented

- Invested $47 million to renovate nearly 2,000 suites

- Renovations to date, are averaging an 8% return on rent, and have created $72 million of NAV

- Sequential month to month increases in occupied rent from Q2

- Incentive and Vacancy Loss total of $51 million or $1.00 of FFO per Trust Unit in the first nine months of 2017, including $8 million for suites not available to rent during renovation

- Occupancy decreased in Q3 as units previously under renovation were introduced; however occupancy has increased in October with increased rentals

- Strong Financial Position

- Current liquidity of $350 million

- Net Asset Value, including cash, of $62.71 per Trust Unit or $170,000 per door

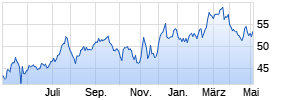

- Current trading value of $40.00 per Trust Unit equates to $141,000 per door

- Reiterates 2017 financial guidance

CALGARY, Nov. 14, 2017 /PRNewswire/ - Boardwalk Real Estate Investment Trust ("BEI.UN" - TSX)

Boardwalk Real Estate Investment Trust ("Boardwalk", the "REIT" or the "Trust") today announced its financial results for the third quarter of 2017, and provided details of its next chapter of growth.

"The last two years of a very difficult Western Canadian economy and the introduction of a significant number of new luxury apartment rentals have taught us many lessons. The importance of brand diversification to increase and improve our product and service offering for our existing and new Resident Members is one of those lessons. Our initial small-scale experimentation of newly designed and renovated suites was met with strong positive reception from our new and existing Resident Members. This success led to a great ambition to deliver even more of our newly designed and exciting product. As we increased the scale of our renovation program in the first half of this year, we learned that, by controlling the following four variables of our renovation program: 1) Efficiency (renovate a scalable amount to minimize transitional vacancy loss and improve costs), 2) Supply (reduce and limit supply of renovated product to maximize demand), 3) Location (pick great locations), and 4) Affordability (continue to maximize the investment of our standard improvements to provide affordability), we can maximize our returns for all of our stakeholders." said Sam Kolias; Chairman and Chief Executive Officer of Boardwalk REIT.

"As renovations for 2017 are completed, and rented, our occupancy is rising and occupied rents are increasing. Going forward, an improving economy and a more moderate and balanced approach to our renovation program will continue to help us drive our financial results higher into our new year. Our stable results in Ontario and Quebec also emphasize the importance of geographic diversification. The importance of allocating capital to maximize our investment in new and existing Communities has also been a significant source of historic growth, and clearly supports our decision to re-allocate a significant portion of our Funds from Operation to re-invest in our future growth."

"These core lessons, combined with all of our previous lessons over our 33-year history, have allowed us to formulate an improved strategy and long-term plan. We have heard directly from many of our diverse stakeholder groups over the last year and have used this invaluable feedback, combined with the above noted lessons to help formulate our improved strategy for re-investment and growth. Our most important lesson remains that our biggest asset is our people. Our Resident Members, our Associates, our Trades, our Financial Partners, and the greater Communities of which we all live and strive to continue to improve."

Boardwalk long-term strategic plan

Boardwalk's strategic plan has three key pillars, and are each a foundation for the Trust's plan to focus on Net Asset Value ("NAV") creation and growth:

- Portfolio expansion in strategic locations, providing NAV growth and diversification

- Re-capture near term vacancy loss and incentives; while positioning brand diversification to expand resident base for long-term superior organic growth

- Maintain a solid financial foundation

Strategic locations: Long on Alberta coupled with portfolio diversification and expansion

The Trust's core markets in Alberta and Saskatchewan have historically outperformed the broader rental market and, despite the cyclical decline we have experienced in these markets over the past 24 months, the Trust believes that these markets will provide cyclically high returns as the rental market continues to re-balance. The Trust will continue to undertake a counter-cyclical approach to its portfolio by utilizing the recent cyclical downturn to high-grade its portfolio through its suite renovation program and potential new developments.

The Trust, however, acknowledges that no individual market is immune to cyclicality and, as part of its long-term goal, intends to couple its Alberta and Saskatchewan portfolio with the acquisition and development of assets in high-growth markets outside of Alberta and Saskatchewan to allow the Trust to provide its brand of housing into new markets, which will result in Net Operating Income ("NOI") growth and capital appreciation for its stakeholders.

Boardwalk's strategic goal is to have a portfolio that is approximately 50% in the high growth markets of Alberta and Saskatchewan ("ABSK") and 50% in other high growth and undersupplied markets including, but not limited to, the Greater Toronto Area, Vancouver, Ottawa, Montreal, Quebec City, Winnipeg, and Halifax.

To accomplish this, the Trust intends to strategically partner, acquire and/or develop 10,000 to 15,000 apartment units in these high growth, undersupplied markets, while also divesting some of its non-core assets in ABSK. The Trust's portfolio growth will primarily focus on value creation in major Canadian markets.

Brand diversification:

The spectrum of rental housing in Canada has expanded over the last few years with rental demand seen across the price spectrum from affordability to high-end luxury. As a result, the ability to offer a more diverse product offering will allow Boardwalk to attract a larger demographic to the Boardwalk brand.

Boardwalk Living – Affordable Value

Boardwalk Living features classic suites for our Resident's who appreciate flexibility, reliability, and value that comes with a quality home.

Boardwalk Communities – Enhanced Value

Boardwalk Communities feature modernized suites and choice amenities for those who value flexibility with all the comforts that come with the perfect place to call home.

Boardwalk Lifestyle – Affordable Luxury

Boardwalk Lifestyle features luxury living with modern amenities, designer suites, and a contemporary style for those who value life experiences and prefer the freedom to enjoy them.

The majority of the Trust's portfolio will remain in its Living category, as affordability remains the largest demographic in the rental market in Canada. Boardwalk's offering in this category will feature high value for an affordable price.

Boardwalk Communities reaches a demographic that the Trust believes may be underserved by the broader market, and will feature an enhanced level of value for an increasing number of renter's who are seeking greater features and amenities without sacrificing flexibility.

Boardwalk Lifestyle provides luxurious living, rich in features, location and amenities at an affordable price. The Trust believes that this segment of the market remains the smallest amongst the pricing spectrum, however does present increased margins for the Trust.

Brand diversification will provide the Trust with a product and service offering that caters to the needs of a broader range of Residents, while also allowing the Trust the ability to high-grade its portfolio organically.

Mr. Kolias concluded: "We are excited with our strategic vision, and what will be the next chapter of growth for Boardwalk. We believe that the Trust's core ABSK portfolio will be well-positioned to outperform in their respective markets through various cycles of growth, and can be balanced with diversification in other geographic locations through the Trust's growth in other major Canadian Cities. The growth we are envisioning is similar to the growth we have experienced over the last 33 years. Our proven track-record of delivering NAV creation through Boardwalk's brand of quality and service has provided organic growth and further enhanced value creation with our accretive acquisitions and developments. We look forward to providing progress reports each quarter as we execute on these goals as we continue to provide the best quality homes for our Residents."

Q3 regular monthly distribution and revised distribution policy

Boardwalk's Board of Trustees reviews the Trust's allocation of capital, including its monthly regular distributions, on a quarterly basis. Despite the improving fundamentals in the Trust's core markets of Alberta and Saskatchewan, the Trust's Management and Board of Trustees are confident that the Trust's capital allocation opportunities, which include the current suite renovation/re-positioning program along with its growth opportunities consistent with Boardwalk's long-term strategic plan to focus on NAV growth and creation, provides an opportunity for the Trust to utilize its cashflow, to maximize value for all Unitholders. The use of cashflow towards these initiatives will accelerate the Trust's FFO recovery in the near term, while providing an additional source of capital to fund its ambitious and exciting growth.

Beginning in 2018, the Trust's distribution policy is consistent with the Trust's long-term focus of NAV growth and will comprise of an annual distribution, paid monthly, at least equal to the taxable portion of the Trust's income.

This formal policy will allow the Trust to retain a significant portion of cashflow to re-invest in capital growth opportunities.

| | | | | | ||

| Month | Per Unit | Annualized | Record Date | Distribution Date | ||

| Nov-17 | $ | 0.1875 | $ | 2.25 | 30-Nov-17 | 15-Dec-17 |

| Dec-17 | $ | 0.1875 | $ | 2.25 | 29-Dec-17 | 15-Jan-18 |

| Jan-18 | $ | 0.0834 | $ | 1.00 | 31-Jan-18 | 15-Feb-18 |

The Board of Trustees will review the taxable portion of the Trust's income on a quarterly basis, and may announce an increase or a special distribution from time to time to ensure that all taxable income is distributed to Unitholders.

Operational tailwinds

Rob Geremia, President of Boardwalk REIT, commented: "In 2017, the Trust capitalized on cyclically high vacancy in its core portfolio in Alberta and Saskatchewan by using the opportunity to high-grade its portfolio through an investment in suite renovations and re-positioning. The Trust continues to complete and lease these newly renovated homes, and will undertake future renovations at a more moderated pace to balance the cost of transitional vacancy with higher rental rates, which will position the Trust to capitalize on the housing market re-balancing in both Alberta and Saskatchewan."

Boardwalk's Suite Renovation Package offers various levels of suite renovations to new and existing Resident Members. These renovations may include new flooring, baseboards, kitchen cabinets, countertops, appliances, tiling, lighting, and fixtures in exchange for higher rents and lower incentives for our new and existing Residents.

Boardwalk's suite renovation program includes four distinct levels:

The first is Boardwalk's standard turnovers. These turnover suites typically have had a renovation treatment completed in the last 12-36 months and require only minor repairs and replacements to prepare the suite for immediate rental. The average cost of a standard turnover is approximately $2,700.

The second is Boardwalk's partial renovation. Partial renovations may include a combination of new paint, flooring, fixtures, and appliances to provide superior value to its Residents. The average investment of a partial renovation is approximately $16,000.

The third level of renovation is Boardwalk's full renovation. These suites undergo a full-scale renovation, which include new flooring, cabinets, appliances, countertops, sinks, paint, lighting, tiling and fixtures to provide a new level of affordable luxury. The average investment of a full renovation is approximately $29,000.

The fourth level of renovation is Boardwalk's turnkey renovation. Similar to full renovations, these suites undergo a full-scale renovation, however also include re-modelling of a unit to suit the upscale demographic the home is marketed towards. These turnkey renovations will be focused primarily on Boardwalk Lifestyle communities. The average investment of a turnkey renovation is approximately $46,000 not including the cost of upgrading amenity areas.

For all levels, each renovation project is completed with a recently enhanced parts and materials specification, which adds to the quality and longevity of Boardwalk's suites.

The Trust has seen success as a result of its suite renovation program. Newly-renovated units are renting on completion and at rental rates that are significantly higher than the Trust's un-renovated suites. The average net, in place rental rate of a renovated unit in the Trust's portfolio as of September 2017 was approximately $1,203 per unit as compared to $1,041 on a net basis for unrenovated units.

As the Trust began introducing renovated units on completion between June and September, the Trust's occupied rent, or the average rental rate charged on units that were occupied, increased from $1,070 in June of 2017 to $1,091 in September of 2017 on a stabilized property basis.

| | ||

| Stabilized Property Occupied Rent | ||

| Month | Occupied Rent | |

| Jan-17 | $ | 1,104 |

| Feb-17 | $ | 1,093 |

| Mar-17 | $ | 1,090 |

| Apr-17 | $ | 1,083 |

| May-17 | $ | 1,081 |

| Jun-17 | $ | 1,070 |

| Jul-17 | $ | 1,073 |

| Aug-17 | $ | 1,079 Werbung Mehr Nachrichten zur Boardwalk Real Estat Aktie kostenlos abonnieren

E-Mail-Adresse

Bitte überprüfe deine die E-Mail-Adresse.

Benachrichtigungen von ARIVA.DE (Mit der Bestellung akzeptierst du die Datenschutzhinweise) -1  Vielen Dank, dass du dich für unseren Newsletter angemeldet hast. Du erhältst in Kürze eine E-Mail mit einem Aktivierungslink. Hinweis: ARIVA.DE veröffentlicht in dieser Rubrik Analysen, Kolumnen und Nachrichten aus verschiedenen Quellen. Die ARIVA.DE AG ist nicht verantwortlich für Inhalte, die erkennbar von Dritten in den „News“-Bereich dieser Webseite eingestellt worden sind, und macht sich diese nicht zu Eigen. Diese Inhalte sind insbesondere durch eine entsprechende „von“-Kennzeichnung unterhalb der Artikelüberschrift und/oder durch den Link „Um den vollständigen Artikel zu lesen, klicken Sie bitte hier.“ erkennbar; verantwortlich für diese Inhalte ist allein der genannte Dritte. Andere Nutzer interessierten sich auch für folgende News |