BNY Mellon Reaches Agreement to Sell One Wall Street Building

PR Newswire

NEW YORK, May 21, 2014

NEW YORK, May 21, 2014 /PRNewswire/ -- BNY Mellon, a global leader in investment management and investment services, announced today it has reached an agreement to sell its One Wall Street office building in lower Manhattan for $585 million to a joint venture led by Macklowe Properties. The sale was brokered by CBRE. The sale is expected to be completed in the third quarter of 2014, subject to customary closing conditions.

"We're pleased to have reached this agreement. Once finalized, it will advance our plan to consolidate office space in New York City, lead to a more functional and efficient work environment for our employees, and deliver a solid financial gain to the company," said Gerald L. Hassell, chairman and chief executive officer of BNY Mellon. "We expect to announce our decision for new leased space in the New York region in the next two months."

BNY Mellon has occupied the 50 story, 1.1 million square foot building since 1989, when The Bank of New York acquired the Irving Trust Company. The company's headquarters moved from 48 Wall Street to One Wall Street in 1998. The original lot was purchased by the Irving Trust Company in 1927 for $14.5 million and construction was completed in March 1931. The building, considered one of New York's landmark Art Deco skyscrapers, was designed by architects Voorhees, Gmelin and Walker. Maine granite was used for the base, and the building is sheathed with Indiana limestone.

Macklowe Properties was founded in the mid-1960s by Harry Macklowe. For the past 40 years, the company has been an active and profitable developer, acquirer, redeveloper, owner, and manager of a diverse array of real estate investments. The company has successfully achieved a full level of vertical integration, combining design, planning, construction, management, accounting, and executive-level ownership and operation to provide for absolute responsibility and control over its assets. These investments, which have covered virtually every sector of the property market, have included the development, acquisition, and repositioning of office and apartment buildings, land assemblages, and conversion of industrial and loft properties. In the aggregate, these developments have totaled over 10 million square feet and have taken place in nearly every commercial and residential submarket of Manhattan.

CBRE Group, Inc. (NYSE:CBG), a Fortune 500 and S&P 500 company headquartered in Los Angeles, is the world's largest commercial real estate services and investment firm.

BNY Mellon is a global investments company dedicated to helping its clients manage and service their financial assets throughout the investment lifecycle. Whether providing financial services for institutions, corporations or individual investors, BNY Mellon delivers informed investment management and investment services in 35 countries and more than 100 markets. As of March 31, 2014, BNY Mellon had $27.9 trillion in assets under custody and/or administration, and $1.6 trillion in assets under management. BNY Mellon can act as a single point of contact for clients looking to create, trade, hold, manage, service, distribute or restructure investments. BNY Mellon is the corporate brand of The Bank of New York Mellon Corporation (NYSE: BK). Additional information is available on www.bnymellon.com, or follow us on Twitter @BNYMellon.

The information presented in this news release may contain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements, which may be expressed in a variety of ways, including the use of future or present tense language, relate to, among other things, expectations with respect to the closing of the sale and the decision for new leased space. These statements are based upon current beliefs and expectations and are subject to significant risks and uncertainties (some of which are beyond BNY Mellon's control). Factors that could cause BNY Mellon's results to differ materially can be found in the risk factors set forth in BNY Mellon's Annual Report on Form 10-K for the year ended December 31, 2013 and BNY Mellon's other filings with the Securities and Exchange Commission. All statements in this press release speak only as of the date of this news release, and BNY Mellon undertakes no obligation to update any statement to reflect events or circumstances after the date of this news release or to reflect the occurrence of unanticipated events.

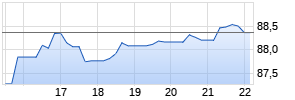

ARIVA.DE Börsen-Geflüster

Weiter aufwärts?

| Kurzfristig positionieren in Bank of New York Mellon | ||

|

ME7K62

| Ask: 0,65 | Hebel: 5,95 |

| mit moderatem Hebel |

Zum Produkt

| |

Kurse

|

|

Mehr Nachrichten zur Bank of New York Mellon Aktie kostenlos abonnieren

(Mit der Bestellung akzeptierst du die Datenschutzhinweise)

Hinweis: ARIVA.DE veröffentlicht in dieser Rubrik Analysen, Kolumnen und Nachrichten aus verschiedenen Quellen. Die ARIVA.DE AG ist nicht verantwortlich für Inhalte, die erkennbar von Dritten in den „News“-Bereich dieser Webseite eingestellt worden sind, und macht sich diese nicht zu Eigen. Diese Inhalte sind insbesondere durch eine entsprechende „von“-Kennzeichnung unterhalb der Artikelüberschrift und/oder durch den Link „Um den vollständigen Artikel zu lesen, klicken Sie bitte hier.“ erkennbar; verantwortlich für diese Inhalte ist allein der genannte Dritte.