BioScrip Reports Second Quarter 2015 Financial Results

PR Newswire

ELMSFORD, N.Y., Aug. 10, 2015

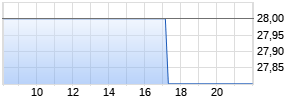

ELMSFORD, N.Y., Aug. 10, 2015 /PRNewswire/ -- BioScrip®, Inc. (NASDAQ: BIOS) (the "Company") today announced 2015 second quarter financial results. Second quarter revenue from continuing operations was $262.4 million and the net loss from continuing operations was $243.2 million, or $3.60 loss per diluted share, which includes a $238.0 million pre-tax goodwill impairment charge resulting from a decline in the Company's common stock price and related market capitalization, as well as an $8.6 million incremental pre-tax bad debt charge predominately attributable to aged accounts receivable balances over 365 days old.

Company Highlights During and Subsequent to the Second Quarter:

- Total revenue increased by $15.2 million, or 6.2%, compared to the prior year period. Revenue from the Infusion Services segment increased to $247.0 million, reflecting 7.1% growth year-over-year, driven by revenue growth in our core infusion business;

- Gross profit from continuing operations was $66.0 million, or 25.1% of revenue, compared to $65.4 million, or 26.4% of revenue, in the prior year period;

- Consolidated Adjusted EBITDA was a loss of $2.5 million, a $13.5 million decrease compared to Adjusted EBITDA of $11.0 million in the prior year period. The decrease was primarily due to a lower gross margin revenue mix shift as well as the increase of contractual and bad debt expense; and

- In a separate press release, the Company also announced today that it is implementing a financial improvement plan to reduce its cost structure and enhance its financial flexibility to drive shareholder value as a pure play infusion services provider.

Results of Operations

Second Quarter 2015 versus Second Quarter 2014

Revenue from continuing operations for the second quarter of 2015 totaled $262.4 million, compared to $247.1 million for the same period a year ago, an increase of $15.2 million or 6.2%. Infusion Services segment revenue was $247.0 million in the second quarter of 2015 as compared to $230.5 million for the same period in 2014. The 7.1% increase was driven primarily by continued strong organic growth particularly in chronic, nutrition and other therapies.

Consolidated gross profit for the second quarter of 2015 was $66.0 million, or 25.1% of revenue, compared to $65.4 million, or 26.4% of revenue, for the second quarter of 2014. The increase in gross profit dollars was due to revenue growth in the Infusion Services segment partially offset by lower PBM Services gross profit. The decrease in gross margin percentage was primarily the result of an Infusion Services segment mix shift from core therapies to more chronic and other therapies.

During the second quarter of 2015, consolidated Adjusted EBITDA from continuing operations declined by $13.5 million to a loss of $2.5 million. Infusion Services segment Adjusted EBITDA was $4.1 million in the second quarter of 2015, compared to Adjusted EBITDA of $16.2 million in the prior year quarter. The decreases in both consolidated Adjusted EBITDA and Infusion Services segment Adjusted EBITDA were principally due to lower gross margin revenue mix shift combined with the $8.6 million incremental pre-tax bad debt charge, which was predominately attributable to aged accounts receivable balances over 365 days old.

PBM Services segment revenue was $15.4 million for the second quarter of 2015, compared to $16.6 million for the prior year period. PBM Services segment Adjusted EBITDA was $1.7 million for the second quarter of 2015, compared to $1.8 million in the prior year quarter.

Interest expense in the second quarter of 2015 was unchanged from the prior year period at $9.1 million.

Income tax benefit for continuing operations in the second quarter of 2015 was $19.9 million compared to income tax expense of $3.1 million in the prior year period.

Net loss from continuing operations for the second quarter of 2015 was $243.2 million, or a $3.60 loss per diluted share, compared to a net loss of $18.6 million, or $0.27 loss per diluted share in the prior year period, largely due to the $238.0 million pre-tax goodwill impairment charge and the $8.6 million incremental pre-tax bad debt charge.

Liquidity and Capital Resources

For the six months ended June 30, 2015, BioScrip used $42.1 million in net cash from continuing operating activities, as compared to $26.7 million of net cashed used in continuing operating activities in the prior year period. As of June 30, 2015, the Company had $1.2 million in cash and $418.9 million of outstanding debt. As of August 10, 2015, the Company has approximately $54.4 million of liquidity, which is comprised of $22.6 million of cash and $31.8 million of undrawn capacity available on its revolving credit facility.

Events Subsequent to the End of the Second Quarter

In a separate press release issued today, BioScrip announced steps to enhance shareholder value as a pure play infusion services provider:

- Implementing $35 - $40 million in total cost savings over the next 12 months to enhance financial flexibility;

- Announcing sale of non-core PBM business;

- Retaining Jefferies to explore strategic alternatives; and

- Naming Chris Luthin as Chief Operating Officer; Scott Davido as Chief Implementation Officer and announces additional executive appointments.

Conference Call and Presentation

BioScrip will host a conference call and live webcast today, August 10, 2015 at 8:30 a.m. Eastern Time, to discuss its second quarter 2015 financial results and its separately announced plan to enhance shareholder value as a pure play infusion services provider. Interested parties may participate by dialing 800-732-8470 (US), or 212-231-2902 (International) or accessing a link on the Company's website at www.bioscrip.com. The Company is also providing supplemental slides that will be posted prior to the conference call and will be accessible through the "Investor Relations" section of the BioScrip website at www.bioscrip.com.

A replay of the conference call will be available for two weeks after the call's completion by dialing 800-633-8284 (US) or 402-977-9140 (International) and entering conference call ID number 21773453. An audio webcast and archive will also be available for 30 days under the "Investor Relations" section of the Company's website.

About BioScrip, Inc.

BioScrip, Inc. is a leading national provider of infusion and home care management solutions. BioScrip partners with physicians, hospital systems, skilled nursing facilities, healthcare payors, and pharmaceutical manufacturers to provide patients access to post-acute care services. BioScrip operates with a commitment to bring customer-focused pharmacy and related healthcare infusion therapy services into the home or alternate-site setting. By collaborating with the full spectrum of healthcare professionals and the patient, BioScrip provides cost-effective care that is driven by clinical excellence, customer service, and values that promote positive outcomes and an enhanced quality of life for those it serves.

Forward-Looking Statements – Safe Harbor

This press release includes statements that may constitute "forward-looking statements," including projections of certain measures of the Company's results of operations, projections of future levels of certain charges and expenses, and other statements regarding the Company's financial improvement plan and strategy. These statements are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. You can identify these statements by the fact that they do not relate strictly to historical or current facts. In some cases, forward-looking statements can be identified by words such as "may," "should," "could," "anticipate," "estimate," "expect," "project," "outlook," "aim," "intend," "plan," "believe," "predict," "potential," "continue" or comparable terms. Because such statements inherently involve risks and uncertainties, actual future results may differ materially from those expressed or implied by such forward-looking statements. Investors are cautioned that any such forward-looking statements are not guarantees of future performance and involve risks and uncertainties, and that actual results may differ materially from those in the forward-looking statements as a result of various factors. Important factors that could cause or contribute to such differences include but are not limited to risks associated with: the Company's ability to implement its financial improvement plan to reduce operating costs and focus its business on its Infusion Services segment; reductions in federal, state and commercial reimbursement for the Company's products and services; increased government regulation related to the health care and insurance industries; as well as the risks described in the Company's periodic filings with the Securities and Exchange Commission. The Company does not undertake any duty to update these forward-looking statements after the date hereof, even though the Company's situation may change in the future. All of the forward-looking statements herein are qualified by these cautionary statements.

Reconciliation to Non-GAAP Financial Measures

In addition to reporting all financial information required in accordance with generally accepted accounting principles (GAAP), the Company is also reporting Adjusted EBITDA (including segment Adjusted EBITDA) and Adjusted EPS, which are non-GAAP financial measures. Adjusted EBITDA and Adjusted EPS are not measurements of financial performance under GAAP and should not be used in isolation or as a substitute or alternative to net income, operating income or any other performance measure derived in accordance with GAAP, or as a substitute or alternative to cash flow from operating activities or a measure of our liquidity. In addition, the Company's definitions of Adjusted EBITDA and Adjusted EPS may not be comparable to similarly titled non-GAAP financial measures reported by other companies. Adjusted EBITDA, as defined by the Company, represents net income before net interest expense, loss on sale of assets, income tax expense, depreciation and amortization, impairment of goodwill, stock-based compensation expense, acquisition and integration expenses, restructuring-related expenses and investments in start-up operations. As part of restructuring, the Company may incur significant charges such as the write down of certain long−lived assets, temporary redundant expenses, retraining expenses, potential cash bonus payments and potential accelerated payments or terminated costs for certain of its contractual obligations. Adjusted EPS, as defined by the Company, represents earnings per basic and diluted share, excluding stock-based compensation expense, acquisition and integration expenses, impairment of goodwill, loss on sale of assets, restructuring-related expenses and investments in start-up operations as well as the impact of acquisition-related intangible amortization. Management believes that these non-GAAP financial measures provide useful supplemental information regarding the performance of our business operations and facilitates comparisons to our historical operating results. For a full reconciliation of Adjusted EBITDA and Adjusted EPS to the most comparable GAAP financial measures, please see the attachments to this earnings release.

| Schedule 1 | |||

| BIOSCRIP, INC. AND SUBSIDIARIES | |||

| | |||

| CONSOLIDATED BALANCE SHEETS | |||

| (in thousands, except for share amounts) | |||

| | |||

| | June 30, | | December 31, |

| | (unaudited) | | |

| ASSETS | | | |

| Current assets | | | |

| Cash and cash equivalents | $ 1,172 | | $ 740 |

| Receivables, less allowance for doubtful accounts of $72,332 and $66,500 as of June 30, 2015 and December 31, 2014, respectively | 131,471 | | 140,810 |

| Inventory | 42,364 | | 37,215 |

| Prepaid expenses and other current assets | 10,396 | | 9,450 |

| Total current assets | 185,403 | | 188,215 |

| Property and equipment, net | 34,906 | | 38,171 |

| Goodwill | 335,323 | | 573,323 |

| Intangible assets, net | 7,290 | | 10,269 |

| Deferred financing costs | 13,035 | | 13,463 |

| Other non-current assets | 1,192 | | 1,272 |

| Total assets | $ 577,149 | | $ 824,713 |

| LIABILITIES AND STOCKHOLDERS' EQUITY | | | |

| Current liabilities | | | |

| Current portion of long-term debt | $ 238 | | $ 5,395 |

| Accounts payable | 77,085 | | 90,032 |

| Claims payable | 4,816 | | 8,162 |

| Amounts due to plan sponsors | 4,254 | | 5,779 |

| Accrued interest | 6,705 | | 6,853 |

| Accrued expenses and other current liabilities | 40,923 | | 46,092 |

| Total current liabilities | 134,021 | | 162,313 |

| Long-term debt, net of current portion | 418,619 | | 418,408 |

| Deferred taxes | 2,924 | | 19,058 |

| Other non-current liabilities Werbung Mehr Nachrichten zur Option Care Health Aktie kostenlos abonnieren

E-Mail-Adresse

Bitte überprüfe deine die E-Mail-Adresse.

Benachrichtigungen von ARIVA.DE (Mit der Bestellung akzeptierst du die Datenschutzhinweise) -1  Vielen Dank, dass du dich für unseren Newsletter angemeldet hast. Du erhältst in Kürze eine E-Mail mit einem Aktivierungslink. Hinweis: ARIVA.DE veröffentlicht in dieser Rubrik Analysen, Kolumnen und Nachrichten aus verschiedenen Quellen. Die ARIVA.DE AG ist nicht verantwortlich für Inhalte, die erkennbar von Dritten in den „News“-Bereich dieser Webseite eingestellt worden sind, und macht sich diese nicht zu Eigen. Diese Inhalte sind insbesondere durch eine entsprechende „von“-Kennzeichnung unterhalb der Artikelüberschrift und/oder durch den Link „Um den vollständigen Artikel zu lesen, klicken Sie bitte hier.“ erkennbar; verantwortlich für diese Inhalte ist allein der genannte Dritte. Andere Nutzer interessierten sich auch für folgende News | |||