BetterInvesting 100 Index Grows 3.9% in November, Up 15.6% Over Five Years Through November

PR Newswire

MADISON HEIGHTS, Mich., Dec. 15, 2017

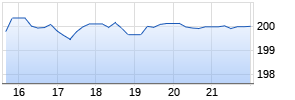

MADISON HEIGHTS, Mich., Dec. 15, 2017 /PRNewswire/ -- At the end of November, the BetterInvesting 100 Index (BIXX), reflecting the portfolios of Main Street investors, increased 15.6 percent annually for the previous five years, versus annual growth of 16.0 percent for the Standard & Poor's 500 Equal-Weight Index (based on a total return for both indexes in which dividends are reinvested).

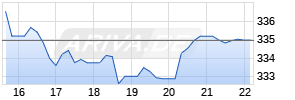

The index increased 3.9 percent from the end of October. BIXX's total return index ended November at 441.68, compared with 425.13 at the end of October. Without dividends reinvested, the index was 333.67 at the end of November, an annual increase of 13.7 percent for the past five years.

The BetterInvesting 100 Index comprises the most popular holdings of investment clubs, employing annual data from the myICLUB.com online club accounting program. Solactive calculates the index, which began on April 9, 2007, at a base value of 150. BIXX is equal-weighted, meaning that each component constitutes the same percentage in the index.

BIXX reflects actual portfolio decisions by individual investors in investment clubs, while other indexes are weighted heavily toward decisions by large institutional investors. BetterInvesting's individual members and investment clubs tend to have a longer-term focus than do institutions, with clubs' average holding period for stocks at 3.1 years in 2016, according to myICLUB.com data.

Holding quality stocks selling at reasonable prices for the long term allows clubs and individual investors to benefit from the return these stocks often earn when the market recognizes their excellence. Long-term investing also reduces the costs of trading, which effectively increases return.

In November, the most common stocks acquired by investment clubs that subscribe to club-accounting portal myICLUB, in terms of number of clubs buying, were:

- Apple (AAPL)

- Amazon.com (AMZN)

- General Electric (GE)

- Facebook (FB)

- AT&T (T)

- Tesla (TSLA)

- Home Depot (HD)

- CVS Health (CVS)

- Microsoft (MSFT)

- Nvidia (NVDA)

BIXX includes companies of all sizes, from small and medium-size firms to the world's largest companies. To see the top 100 companies held by BetterInvesting members, go to the BetterInvesting website at www.betterinvesting.org.

ARIVA.DE Börsen-Geflüster

Weiter aufwärts?

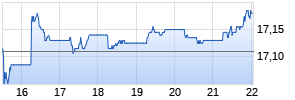

| Kurzfristig positionieren in Amazon | ||

|

HS4ZPN

| Ask: 0,90 | Hebel: 20,94 |

| mit starkem Hebel |

Zum Produkt

| |

|

HS2XX3

| Ask: 3,26 | Hebel: 4,50 |

| mit moderatem Hebel |

Zum Produkt

| |

Kurse

|

|

|

|

|

|

|

|

|

|

To track the performance of BIXX, go to the Solactive site:

www.solactive.com/s=betterinvesting+100.

About BetterInvesting

BetterInvesting is a national nonprofit organization that has been empowering individual investors since 1951. Founded in Detroit, the association (formerly known as National Association of Investors Corporation) was borne of the conviction that anyone can become a successful long-term investor by following commonsense investing practices. BetterInvesting has helped more than 5 million people become better, more informed investors by providing webinars, in-person events, easy-to-use online tools for analyzing stocks and mutual funds, a monthly magazine and a community of volunteers and like-minded investors. For more information about BetterInvesting, visit its website at www.betterinvesting.org or call toll free (877) 275-6242.

About ICLUBcentral

ICLUBcentral Inc. develops powerful, commonsense tools for investment clubs and independent investors, including software products such as Toolkit 6, the StockCentral.com and EquityResearchService.com stock research sites, the myICLUB.com club accounting service, MyStockProspector stock screen program and the SmallCap Informer and market-beating Investor Advisory Service newsletters. ICLUBcentral, a wholly owned for-profit subsidiary of nonprofit investment education association BetterInvesting, has remained true to BetterInvesting's fundamental investing principles while serving millions of individual investors striving for financial freedom. For more information, visit www.iclub.com.

![]() View original content:http://www.prnewswire.com/news-releases/betterinvesting-100-index-grows-39-in-november-up-156-over-five-years-through-november-300572175.html

View original content:http://www.prnewswire.com/news-releases/betterinvesting-100-index-grows-39-in-november-up-156-over-five-years-through-november-300572175.html

SOURCE BetterInvesting

Mehr Nachrichten zur Amazon Aktie kostenlos abonnieren

(Mit der Bestellung akzeptierst du die Datenschutzhinweise)

Hinweis: ARIVA.DE veröffentlicht in dieser Rubrik Analysen, Kolumnen und Nachrichten aus verschiedenen Quellen. Die ARIVA.DE AG ist nicht verantwortlich für Inhalte, die erkennbar von Dritten in den „News“-Bereich dieser Webseite eingestellt worden sind, und macht sich diese nicht zu Eigen. Diese Inhalte sind insbesondere durch eine entsprechende „von“-Kennzeichnung unterhalb der Artikelüberschrift und/oder durch den Link „Um den vollständigen Artikel zu lesen, klicken Sie bitte hier.“ erkennbar; verantwortlich für diese Inhalte ist allein der genannte Dritte.