BB&T declares first-quarter dividends

PR Newswire

WINSTON-SALEM, N.C., Jan. 24, 2017

WINSTON-SALEM, N.C., Jan. 24, 2017 /PRNewswire/ -- The board of directors of BB&T Corporation (NYSE: BBT) today declared the following regular quarterly dividends payable March 1, 2017, to shareholders of record at the close of business Feb. 10, 2017:

- A dividend of $0.30 per common share

- A dividend of $365.625 per share (equivalent to $0.365625 per depositary share or 1/1,000th interest per share) on BB&T's Series D Non-Cumulative Perpetual Preferred Stock (NYSE: BBT PrD)

- A dividend of $351.5625 per share (equivalent to $0.3515625 per depositary share or 1/1,000th interest per share) on BB&T's Series E Non-Cumulative Perpetual Preferred Stock (NYSE: BBT PrE)

- A dividend of $325.000 per share (equivalent to $0.325000 per depositary share or 1/1,000th interest per share) on BB&T's Series F Non-Cumulative Perpetual Preferred Stock (NYSE: BBT PrF)

- A dividend of $325.000 per share (equivalent to $0.325000 per depositary share or 1/1,000th interest per share) on BB&T's Series G Non-Cumulative Perpetual Preferred Stock (NYSE: BBT PrG)

- A dividend of $351.5625 per share (equivalent to $0.3515625 per depositary share or 1/1,000th interest per share) on BB&T's Series H Non-Cumulative Perpetual Preferred Stock (NYSE: BBT PrH)

BB&T has approximately 809 million shares of common stock as of Dec. 31, 2016; 23 million depositary shares related to its Series D Non-Cumulative Perpetual Preferred Stock; 46 million depositary shares related to its Series E Non-Cumulative Perpetual Preferred Stock; 18 million depositary shares related to its Series F Non-Cumulative Perpetual Preferred Stock; 20 million depositary shares related to its Series G Non-Cumulative Perpetual Preferred Stock; and 19 million depositary shares related to its Series H Non-Cumulative Perpetual Preferred Stock.

BB&T has paid a cash dividend to shareholders of its common stock every year since 1903.

About BB&T

BB&T is one of the largest financial services holding companies in the U.S. with $219.3 billion in assets and market capitalization of $38.1 billion as of Dec. 31, 2016. Based in Winston-Salem, N.C., the company operates 2,196 financial centers in 15 states and Washington, D.C., and offers a full range of consumer and commercial banking, securities brokerage, asset management, mortgage and insurance products and services. A Fortune 500 company, BB&T is consistently recognized for outstanding client satisfaction by the U.S. Small Business Administration, Greenwich Associates and others. BB&T also has been named one of the World's Strongest Banks by Bloomberg Markets Magazine, one of the top three in the U.S. and in the top 15 globally. More information about BB&T and its full line of products and services is available at BBT.com.

To view the original version on PR Newswire, visit:http://www.prnewswire.com/news-releases/bbt-declares-first-quarter-dividends-300396015.html

SOURCE BB&T Corporation

ARIVA.DE Börsen-Geflüster

Weiter aufwärts?

| Kurzfristig positionieren in Truist Financial | ||

|

ME5BA5

| Ask: 0,58 | Hebel: 4,71 |

| mit moderatem Hebel |

Zum Produkt

| |

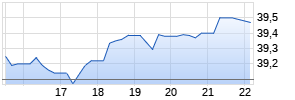

Kurse

|

Mehr Nachrichten zur Truist Financial Aktie kostenlos abonnieren

(Mit der Bestellung akzeptierst du die Datenschutzhinweise)

Hinweis: ARIVA.DE veröffentlicht in dieser Rubrik Analysen, Kolumnen und Nachrichten aus verschiedenen Quellen. Die ARIVA.DE AG ist nicht verantwortlich für Inhalte, die erkennbar von Dritten in den „News“-Bereich dieser Webseite eingestellt worden sind, und macht sich diese nicht zu Eigen. Diese Inhalte sind insbesondere durch eine entsprechende „von“-Kennzeichnung unterhalb der Artikelüberschrift und/oder durch den Link „Um den vollständigen Artikel zu lesen, klicken Sie bitte hier.“ erkennbar; verantwortlich für diese Inhalte ist allein der genannte Dritte.