Aviat Networks Announces Fourth Quarter and Fiscal 2016 Financial Results

PR Newswire

SANTA CLARA, Calif., Sept. 8, 2016

SANTA CLARA, Calif., Sept. 8, 2016 /PRNewswire/ --

Financial Highlights for Q4FY16

- Revenue of $58.3 million; Book to Bill > 1

- GAAP Gross Margin of 16.9%, a decline of 430 basis points year-over-year; Non-GAAP Gross Margin of 25.7%, an improvement of 440 basis points year-over-year

- GAAP Operating Expenses of $23.1 million, a reduction of $0.6 million or 2.6% year-over-year; Non-GAAP Operating Expenses of $21.1 million, a reduction of $1.9 million or 8.3% year-over-year

- GAAP Net Loss Attributable to Aviat Networks of $(15.2) million

- Non-GAAP Loss from Continuing Operations Attributable to Aviat Networks of $(6.4) million

- Adjusted EBITDA of $(4.5) million

Financial Highlights for FY16

- Revenue of $268.7 million; Book to Bill > 1

- GAAP Gross Margin of 23.0%, a decline of 100 basis points year-over-year; Non-GAAP Gross Margin of 24.9%, an improvement of 80 basis points year-over-year

- GAAP Operating Expenses of $89.2 million, a reduction of $17.5 million or 16.4% year-over-year; and Non-GAAP Operating Expenses of $85.0 million, a reduction of $14.3 million or 14.4% year-over-year

- GAAP Net Loss Attributable to Aviat Networks of $(29.9) million

- Non-GAAP Loss from Continuing Operations Attributable to Aviat Networks of $(19.4) million

- Adjusted EBITDA of $(11.5) million

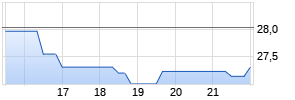

- Cash and cash equivalents at Fiscal 2016 year-end of $30.5 million

Aviat Networks, Inc. (NASDAQ: AVNW), ("Aviat Networks" or "the Company"), the leading expert in microwave networking solutions, today reported financial results for its fiscal 2016 fourth quarter and full year results for the fiscal year ended July 1, 2016.

Commenting on the Company's fiscal 2016 fourth quarter results, Michael Pangia, President and CEO of Aviat Networks stated, "Our fiscal fourth quarter came in as anticipated on an operating basis. We continued to execute our strategy to realign our organization and lower our cost structure while generating efficiencies throughout our business. During the fourth quarter, our book to bill was well above one, and we reported a 40% sequential increase in bookings, driven primarily by new Private Network contract wins in North America. While the international markets and our Mobile Operator segment continues to be challenged, we remain well positioned with our customers."

Mr. Pangia continued, "Given changes in the market, we continue to re-allocate resources and investment dollars to drive growth within the Private Network vertical near-term, while supporting our existing Mobile Operator customer base and investing for the future. We are also exploring strategic alternatives to improve the market position and profitability of our product offerings in the international marketplace, generate additional liquidity for the Company, and enhance our valuation."

Fiscal 2016 Fourth Quarter Results Comparisons

The Company reported total revenues of $58.3 million as compared to $87.7 million in the corresponding year-ago period. The decline in revenues was primarily attributed to lower overall spending by the Company's Mobile Operator customer base, as well as the timing associated with some Private Network projects coming to completion.

GAAP gross margins for the fiscal 2016 fourth quarter were 16.9% as compared to 21.2% in the fiscal 2015 fourth quarter, a reduction of approximately 430 basis points. The decrease in GAAP gross margins was primarily due to an inventory write-down of $5.1 million related to an older product line. Non-GAAP gross margins for the fiscal 2016 fourth quarter, excluding the impact of the inventory write down of $5.1 million and share-based compensation, were 25.7% as compared to 21.3% in the fiscal 2015 fourth quarter, an increase of approximately 440 basis points. The non-GAAP gross margin percentage improvement was primarily driven by reduced supply chain costs.

GAAP total operating expenses for the fiscal 2016 fourth quarter were $23.1 million as compared to $23.7 million reported in the fiscal 2015 fourth quarter, an improvement of $0.6 million or 2.6%. Non-GAAP total operating expenses for the fiscal 2016 fourth quarter, excluding the impact of restructuring charges and share-based compensation, were $21.1 million as compared to $23.0 million reported in the fiscal 2015 fourth quarter, an improvement of $1.9 million or 8.3%. The year-over-year improvement in both the GAAP total operating expenses and non-GAAP total operating expenses is a direct result of the Company's continuing focus on lowering its overall cost structure.

GAAP operating loss was $13.3 million for the fiscal 2016 fourth quarter as compared to a GAAP operating loss of $5.1 million for the comparable fiscal 2015 period. Non-GAAP operating loss was $6.1 million for the fiscal 2016 fourth quarter as compared to a Non-GAAP operating loss of $4.3 million for the comparable fiscal 2015 period. The Company reported a GAAP loss from continuing operations attributable to Aviat Networks of $15.2 million or a loss of $2.90 per diluted share and a Non-GAAP loss from continuing operations attributable to Aviat Networks of $6.4 million or a loss of $1.22 per diluted share. This compares to a GAAP loss from continuing operations attributable to Aviat Networks of $1.5 million or a loss of $0.29 per diluted share for the comparable year-ago period and a Non-GAAP loss from continuing operations attributable to Aviat Networks of $4.9 million or a loss of $0.94 per diluted share for the comparable year-ago period.

Adjusted EBITDA for the fiscal 2016 fourth quarter was $(4.5) million, compared with $(2.4) million in the year-ago quarter. In the fiscal 2016 fourth quarter, the Company incurred restructuring charges of $1.6 million, FX currency losses in Nigeria of $1.2 million and an inventory write-down of $5.1 million to an older product line. Additionally, the Company recorded a provision for income taxes of $0.8 million in the fiscal 2016 fourth quarter as compared to a benefit from income taxes of $3.7 million in the comparable year-ago period.

Cash and cash equivalents were $30.5 million as of July 1, 2016 as compared to $34.7 million as of July 3, 2015, a decline of $4.2 million. Collections in the fiscal 2016 fourth quarter were less than expected owing to several customers having difficulty obtaining U.S. dollars to pay the Company's invoices in their countries where central banks are restricting export payments in U.S. dollars. For the year, Aviat's cash used in operations was $0.1 million, which is inclusive of $3.3 million of restructuring cash expenses. Along with capital expenditures and investing activities ($1.8 million) and exchange rate changes ($2.3 million), the Company used $4.2 million during fiscal 2016.

A reconciliation of GAAP to non-GAAP financial measures for the fourth quarter of fiscal 2016 and the fiscal year 2016 along with the accompanying notes is provided on Table 3 below.

Customer Updates

During the fiscal 2016 fourth quarter, the Company was awarded several multi-year contracts with Private Network accounts leading to the substantial increase in bookings. As announced, Aviat secured $5.7 million in services orders from a customer in Nigeria, a $2.4 million turnkey project with the National Park Service, and a $5.0 million award from a leading Texas electrical utility. These were in addition to other awards secured by the Company.

Today, the Company also disclosed that it has been awarded approximately $38 million in new contracts for two large U.S. states, of which only $11 million was accounted for in Fiscal 2016 bookings. The first is a three-year contract with a value of approximately $28 million and represents a new customer for Aviat. For this large western state, Aviat will support all statewide mission-critical communications for public safety, first responders and various state agencies. The second, is a three-year $10 million contract with another western state, whereby the Company will provide radios, routers and its new AviatCloud automation platform, in addition to other services.

Mr. Pangia concluded, "We took several actions based on the market challenges encountered in fiscal 2016, which we believe should result in an improved fiscal 2017 for our Company and shareholders. To close fiscal 2016 and begin this year with a number of large, competitive contract awards has us excited about the growing opportunities ahead. Our goal remains to bring Aviat to profitability on an Adjusted EBITDA basis for Fiscal 2017. We look forward to reporting on our progress throughout the year."

Conference Call Details

Aviat Networks will host a conference call at 4:30 p.m. Eastern Time (ET) on September 8, 2016 to discuss its financial results for the fourth quarter and year-end of Fiscal 2016. To listen to the live conference call, please dial toll free 888-437-9274 (International toll-free number: 719-325-2381), access code 5229395, by 4:30 p.m. ET. Investors are invited to listen via webcast, which will be broadcast live and via replay approximately two hours after the call at http://investors.aviatnetworks.com/events.cfm.

Non-GAAP Measures and Comparative Financial Information

Aviat Networks, Inc. reports information in accordance with U.S. Generally Accepted Accounting Principles ("GAAP"). Management of Aviat Networks monitors gross margin, research and development expenses, selling and administrative expenses, operating loss, income tax provision, loss from continuing operations, basic and diluted net loss per share from continuing operations, adjusted losses before interest, tax, depreciation and amortization ("Adjusted EBITDA") adjusted to exclude certain costs, charges, gains and losses, on a non-GAAP basis for planning and forecasting results in future periods, and may use these measures for some management compensation purposes. These measures exclude certain costs, expenses, gains and losses as shown on the attached Reconciliation of Non-GAAP Financial Measures table (table 3). As a result, management is presenting these non-GAAP measures in addition to results reported in accordance with GAAP to better communicate underlying operational and financial performance in each period. Management believes these non-GAAP measures provide information that is useful to investors in understanding period-over-period operating results separate and apart from items that may, or could, have a disproportionate positive or negative impact on results in any given period. Management also believes that these non-GAAP measures enhance the ability of an investor to analyze trends in Aviat Networks' business and to better understand our performance. Aviat Networks' management does not, nor does it suggest that investors should, consider such non-GAAP financial measures in isolation from, or as a substitute for, financial information prepared in accordance with GAAP. Aviat Networks presents these non-GAAP financial measures in reporting its financial results to provide investors with an additional tool to evaluate its financial performance. Reconciliations of these non-GAAP financial measures with the most directly comparable financial measures calculated in accordance with GAAP are included in the tables below.

About Aviat Networks

Aviat Networks, Inc. (NASDAQ: AVNW) is a leading global provider of microwave networking solutions transforming communications networks to handle the exploding growth of IP-centric, multi-Gigabit data services. With more than one million systems sold over 140 countries, Aviat Networks provides LTE-proven microwave networking solutions to mobile operators, including some of the largest and most advanced 4G/LTE networks in the world. Public safety, utility, government and defense organizations also trust Aviat Networks' solutions for their mission-critical applications where reliability is paramount. In conjunction with its networking solutions, Aviat Networks provides a comprehensive suite of localized professional and support services enabling customers to effectively and seamlessly migrate to next generation Carrier Ethernet/IP networks. For more than 50 years, customers have relied on Aviat Networks' high performance and scalable solutions to help them maximize their investments and solve their most challenging network problems. Headquartered in Santa Clara, California, Aviat Networks operates in more than 100 countries around the world. For more information, visit www.aviatnetworks.com or connect with Aviat Networks on Twitter, Facebook and LinkedIn.

Forward-Looking Statements

The information contained in this document includes forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, Section 21E of the Securities Exchange Act and Section 27A of the Securities Act including Aviat Networks' beliefs and expectations regarding business conditions, customer positioning, future orders, bookings, new contracts, cost structure, profitability in fiscal 2017, realignment plans and review of strategic alternatives. All statements, trend analyses and other information contained herein about the markets for the services and products of Aviat Networks and trends in revenue, as well as other statements identified by the use of forward-looking terminology, including "anticipate," "believe," "plan," "estimate," "expect," "goal," "will," "see," "continue," "delivering," "view," and "intend," or the negative of these terms or other similar expressions, constitute forward-looking statements. These forward-looking statements are based on estimates reflecting the current beliefs of the senior management of Aviat Networks. These forward-looking statements involve a number of risks and uncertainties that could cause actual results to differ materially from those suggested by the forward-looking statements. Forward-looking statements should therefore be considered in light of various important factors, including those set forth in this document. Important factors that could cause actual results to differ materially from estimates or projections contained in the forward-looking statements include the following:

- continued price and margin erosion as a result of increased competition in the microwave transmission industry;

- the impact of the volume, timing and customer, product and geographic mix of our product orders;

- our ability to meet financial covenant requirements which could impact, among other things, our liquidity;

- the timing of our receipt of payment for products or services from our customers;

- our ability to meet projected new product development dates or anticipated cost reductions of new products;

- our suppliers' inability to perform and deliver on time as a result of their financial condition, component shortages or other supply chain constraints;

- customer acceptance of new products;

- the ability of our subcontractors to timely perform;

- continued weakness in the global economy affecting customer spending;

- retention of our key personnel;

- our ability to manage and maintain key customer relationships;

- uncertain economic conditions in the telecommunications sector combined with operator and supplier consolidation;

- our failure to protect our intellectual property rights or defend against intellectual property infringement claims by others;

- the results of restructuring efforts;

- the ability to preserve and use our net operating loss carryforwards;

- the effects of currency and interest rate risks; and

- the impact of political turmoil in countries where we have significant business.

For more information regarding the risks and uncertainties for our business, see "Risk Factors" in our Form 10-K filed with the U.S. Securities and Exchange Commission ("SEC") on September 30, 2015 as well as other reports filed by Aviat Networks, Inc. with the SEC from time to time. Aviat Networks undertakes no obligation to update publicly any forward-looking statement for any reason, except as required by law, even as new information becomes available or other events occur in the future.

Financial Tables to Follow:

| Table 1

AVIAT NETWORKS, INC.

Fiscal Year 2016 Fourth Quarter Summary

CONSOLIDATED STATEMENTS OF OPERATIONS

(Unaudited) | |||||||||||

| | |||||||||||

| (In thousands, except per share amounts) | Quarter Ended | | Fiscal Year Ended | ||||||||

| July 1, 2016 | | July 3, 2015 | | July 1, 2016 | | July 3, 2015 | |||||

| Revenues: | | | | | | | | ||||

| Revenue from product sales | $ | 33,225 | | $ | 55,592 | | $ | 167,827 | | 214,874 | |

| Revenue from services | 25,027 | | 32,138 | | | 100,863 | | 121,004 | |||

| Total revenues | 58,252 | | 87,730 | | 268,690 | | 335,878 | ||||

| Cost of revenues: | | | | | | | | ||||

| Cost of product sales | 29,765 | | 44,100 | | 128,727 | | 163,890 | ||||

| Cost of services | 18,618 | | 25,002 | | 78,246 | | 91,298 | ||||

| Total cost of revenues | 48,383 | | 69,102 | | 206,973 | | 255,188 | ||||

| Gross margin | 9,869 | | 18,628 | | 61,717 | | 80,690 | ||||

| Operating expenses: | | | | | | | | ||||

| Research and development expenses | 5,057 | | 5,999 | | 20,806 | | 25,368 | ||||

| Selling and administrative expenses | 16,472 | | 17,434 | | 65,902 | | 76,005 | ||||

| Amortization of identifiable intangible assets Werbung Mehr Nachrichten zur Aviat Networks Inc Aktie kostenlos abonnieren

E-Mail-Adresse

Bitte überprüfe deine die E-Mail-Adresse.

Benachrichtigungen von ARIVA.DE (Mit der Bestellung akzeptierst du die Datenschutzhinweise) -1  Vielen Dank, dass du dich für unseren Newsletter angemeldet hast. Du erhältst in Kürze eine E-Mail mit einem Aktivierungslink. Hinweis: ARIVA.DE veröffentlicht in dieser Rubrik Analysen, Kolumnen und Nachrichten aus verschiedenen Quellen. Die ARIVA.DE AG ist nicht verantwortlich für Inhalte, die erkennbar von Dritten in den „News“-Bereich dieser Webseite eingestellt worden sind, und macht sich diese nicht zu Eigen. Diese Inhalte sind insbesondere durch eine entsprechende „von“-Kennzeichnung unterhalb der Artikelüberschrift und/oder durch den Link „Um den vollständigen Artikel zu lesen, klicken Sie bitte hier.“ erkennbar; verantwortlich für diese Inhalte ist allein der genannte Dritte. Andere Nutzer interessierten sich auch für folgende News | |||||||||||