AMETEK Announces Strong First Quarter 2017 Results

PR Newswire

BERWYN, Pa., May 2, 2017

BERWYN, Pa., May 2, 2017 /PRNewswire/ -- AMETEK, Inc. (NYSE: AME) today announced its financial results for the three month period ended March 31, 2017.

AMETEK reported first quarter 2017 sales of $1.01 billion, a 7% increase compared to the first quarter of 2016. Operating income increased 6% to $220.3 million versus the prior year and operating margins were 21.9% in the quarter. Diluted earnings per share increased 5% to $0.60 from the first quarter of 2016.

"AMETEK achieved excellent results in the first quarter. Sales were up solidly on strong organic growth and the contributions from recently completed acquisitions," said David A. Zapico, AMETEK Chief Executive Officer. "We were pleased with the return to organic growth earlier in the year than anticipated. This growth, combined with outstanding operating performance across our businesses, enabled us to exceed our first quarter earnings expectations and raise our full year 2017 guidance."

Electronic Instruments Group (EIG)

In the first quarter of 2017, EIG sales were $619.8 million a 9% increase compared to the first quarter of 2016. EIG operating income was $156.7 million and operating margins were 25.3% in the quarter.

"EIG had a very good quarter with excellent sales and order growth. Sales were up 9% on strong core growth and the contribution from the acquisitions of Brookfield, ESP/SurgeX, Nu Instruments, HS Foils and Rauland-Borg. The higher sales combined with the benefits from our Operational Excellence initiatives drove solid performance with operating income up 10% and operating margins up 40 basis points versus the prior year," commented Mr. Zapico.

Electromechanical Group (EMG)

In the first quarter of 2017, EMG sales were $387.9 million, up 3% compared to the first quarter of 2016. EMG operating income was $79.4 million and operating margins were 20.5% in the quarter.

"EMG also had a very good quarter. Sales were up nicely driven by solid core growth across both our Differentiated and Floorcare businesses and the contribution from the acquisition of Laserage," noted Mr. Zapico.

ARIVA.DE Börsen-Geflüster

Weiter abwärts?

| Kurzfristig positionieren in Ametek | ||

|

MB87UM

| Ask: 2,28 | Hebel: 7,17 |

| mit moderatem Hebel |

Zum Produkt

| |

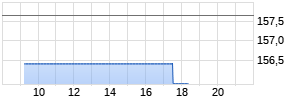

Kurse

|

2017 Outlook

"I am very pleased with our results to start the year. Our first quarter performance has positioned AMETEK for solid earnings growth in 2017. We believe the investments we are making in our businesses along with our continued execution of our Four Growth Strategies positions us well for long-term growth," commented Mr. Zapico.

"We expect 2017 sales will increase mid-single digits, with organic sales up low-single digits. We are increasing our 2017 earnings guidance range to $2.40 to $2.48 per diluted share, up 4% to 8% over 2016 adjusted diluted earnings per share. This is an increase from our previous guidance range of $2.34 to $2.46 per diluted share," he added.

"We expect second quarter 2017 sales to increase mid-single digits on a percentage basis compared to the same period last year. We estimate our earnings to be approximately $0.60 to $0.62 per diluted share, up 2% to 5% over last year's second quarter," concluded Mr. Zapico.

Guidance provided for the second quarter and for full year 2017 does not include the anticipated closure of the MOCON acquisition.

Conference Call

AMETEK will webcast its first quarter 2017 investor conference call on Tuesday, May 2, 2017, beginning at 8:30 AM ET. The live audio webcast will be available and later archived in the Investors section of www.ametek.com.

Corporate Profile

AMETEK is a leading global manufacturer of electronic instruments and electromechanical devices with annual sales of approximately $4.0 billion. AMETEK's Corporate Growth Plan is based on Four Key Strategies: Operational Excellence, Strategic Acquisitions, Global & Market Expansion and New Products. AMETEK's objective is double-digit percentage growth in earnings per share over the business cycle and a superior return on total capital. The common stock of AMETEK is a component of the S&P 500 Index.

Forward-looking Information

Statements in this news release relating to future events, such as AMETEK's expected business and financial performance are "forward-looking statements." Forward-looking statements are subject to various factors and uncertainties that may cause actual results to differ significantly from expectations. These factors and uncertainties include AMETEK's ability to consummate and successfully integrate future acquisitions; risks associated with international sales and operations; AMETEK's ability to successfully develop new products, open new facilities or transfer product lines; the price and availability of raw materials; compliance with government regulations, including environmental regulations; changes in the competitive environment or the effects of competition in our markets; the ability to maintain adequate liquidity and financing sources; and general economic conditions affecting the industries we serve. A detailed discussion of these and other factors that may affect our future results is contained in AMETEK's filings with the U.S. Securities and Exchange Commission, including its most recent reports on Form 10-K, 10-Q and 8-K. AMETEK disclaims any intention or obligation to update or revise any forward-looking statements.

(Financial Information Follows)

| AMETEK, Inc. | |||

| Consolidated Statement of Income | |||

| (In thousands, except per share amounts) | |||

| (Unaudited) | |||

| | |||

| | Three Months Ended | ||

| | March 31, | ||

| | 2017 | | 2016 |

| Net sales | $1,007,682 | | $ 944,398 |

| Operating expenses: | | | |

| Cost of sales | 664,935 | | 623,681 |

| Selling, general and administrative | 122,449 | | 112,194 |

| Total operating expenses | 787,384 | | 735,875 |

| | | | |

| Operating income | 220,298 | | 208,523 |

| Other expenses: | | | |

| Interest expense | (24,516) | | (23,401) |

| Other, net | (4,360) | | (2,080) |

| Income before income taxes | 191,422 | | 183,042 |

| Provision for income taxes | 52,496 | | 48,872 |

| | | | |

| Net income | $ 138,926 | | $ 134,170 |

| | | | |

| Diluted earnings per share | $ 0.60 | | $ 0.57 |

| Basic earnings per share | $ 0.61 | | $ 0.57 |

| | | | |

| Weighted average common shares outstanding: | | | |

| Diluted shares | 231,004 | | 236,216 |

| Basic shares | 229,548 | | 234,983 |

| | | | |

| Dividends per share | $ 0.09 | | $ 0.09 |

| | | | |

| AMETEK, Inc. | |||

| Information by Business Segment | |||

| (In thousands) | |||

| (Unaudited) | |||

| | |||

| | Three Months Ended | ||

| | March 31, | ||

| | 2017 | | 2016 |

| Net sales: | | | |

| Electronic Instruments | $ 619,769 | | $ 568,956 |

| Electromechanical | 387,913 | | 375,442 |

| Consolidated net sales | $1,007,682 | | $ 944,398 |

| | | | |

| Income: | | | |

| Segment operating income: | | | |

| Electronic Instruments | $ 156,721 | | $ 141,832 |

| Electromechanical Werbung Mehr Nachrichten zur Ametek Aktie kostenlos abonnieren

E-Mail-Adresse

Bitte überprüfe deine die E-Mail-Adresse.

Benachrichtigungen von ARIVA.DE (Mit der Bestellung akzeptierst du die Datenschutzhinweise) -1  Vielen Dank, dass du dich für unseren Newsletter angemeldet hast. Du erhältst in Kürze eine E-Mail mit einem Aktivierungslink. Hinweis: ARIVA.DE veröffentlicht in dieser Rubrik Analysen, Kolumnen und Nachrichten aus verschiedenen Quellen. Die ARIVA.DE AG ist nicht verantwortlich für Inhalte, die erkennbar von Dritten in den „News“-Bereich dieser Webseite eingestellt worden sind, und macht sich diese nicht zu Eigen. Diese Inhalte sind insbesondere durch eine entsprechende „von“-Kennzeichnung unterhalb der Artikelüberschrift und/oder durch den Link „Um den vollständigen Artikel zu lesen, klicken Sie bitte hier.“ erkennbar; verantwortlich für diese Inhalte ist allein der genannte Dritte. Andere Nutzer interessierten sich auch für folgende News | |||