AmeriServ Financial Reports Earnings For The Third Quarter And First Nine Months Of 2017

PR Newswire

JOHNSTOWN, Pa., Oct. 17, 2017

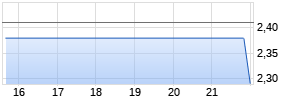

JOHNSTOWN, Pa., Oct. 17, 2017 /PRNewswire/ -- AmeriServ Financial, Inc. (NASDAQ: ASRV) reported third quarter 2017 net income available to common shareholders of $1,551,000, or $0.08 per diluted common share. This earnings performance represented an increase of $486,000, or 45.6%, from the third quarter of 2016 where net income available to common shareholders totaled $1,065,000, or $0.06 per diluted common share. For the nine-month period ended September 30, 2017, the Company reported net income available to common shareholders of $4,288,000, or $0.23 per diluted common share. This represents a significant improvement of $3.1 million from the nine-month period of 2016 where net income available to common shareholders totaled $1,145,000, or $0.06 per diluted common share. The following table highlights the Company's financial performance for both the three and nine month periods ended September 30, 2017 and 2016:

| | Third Quarter | Third Quarter | | Nine Months Ended | Nine Months Ended |

| | | | | | |

| Net income | $1,551,000 | $1,065,000 | | $4,288,000 | $1,160,000 |

| Net income available | $1,551,000 | $1,065,000 | | $4,288,000 | $1,145,000 |

| Diluted earnings per share | $ 0.08 | $ 0.06 | | $ 0.23 | $ 0.06 |

Jeffrey A. Stopko, President and Chief Executive Officer, commented on the 2017 financial results: "In the third quarter of 2017, the continued execution of our strategic plan generated increased earnings per share and more active capital returns to our shareholders. The strong growth in earnings resulted from a favorable combination of increased revenue, reduced non-interest expense and a controlled loan loss provision. This improved net income allowed us to exceed our strategic plan goal of returning 75% of our earnings for the first nine months of 2017 to our shareholders through accretive stock buybacks and cash dividends."

The Company's net interest income in the third quarter of 2017 increased by $431,000, or 5.1%, from the prior year's third quarter and for the first nine months of 2017 increased by $1.0 million, or 3.9%, when compared to the first nine months of 2016. The Company's net interest margin was 3.28% for the quarter and 3.27% for the first nine months of 2017 representing an improvement of 13 basis points from the prior year's third quarter and a four basis point improvement from the first nine months of 2016. The 2017 increase in net interest income is a result of a higher level of total earning assets and favorable balance sheet positioning which has contributed to the improved net interest margin performance. The Company continues to grow earning assets while also limiting increases in its cost of funds through disciplined deposit pricing. Specifically, for the quarter, the earning asset growth occurred in the investment securities portfolio while the loan portfolio remained relatively stable. Total investment securities averaged $175 million in the third quarter of 2017 which is $26.2 million, or 17.6%, higher than the $149 million average for the third quarter of 2016. Investment securities have also averaged $172 million for the nine-month time period which is $26.8 million, or 18.5%, higher than the nine month 2016 average. Total loans averaged $892 million in the third quarter of 2017 and for the nine month period, total loans averaged $894 million which is $6.4 million, or 0.7%, higher than the 2016 nine month average.

The growth in the investment securities portfolio is the result of management electing to diversify the mix of the investment securities portfolio through purchases of high quality corporate and taxable municipal securities. This revised strategy for securities purchases was facilitated by the increase in national interest rates that resulted in improved opportunities to purchase additional securities and grow the portfolio. As a result, interest on investments increased between the third quarter of 2017 and the third quarter of 2016 by $318,000 or 31.4% and increased in the first nine months of 2017 from the same time period in 2016 by $846,000 or 28.7%. The slight decrease in the loan portfolio when comparing the third quarter average in 2017 to last year's third quarter average was the result of accelerated prepayment activity along with new commercial loan production funding occurring late in the 2017 quarter. However, the growth demonstrated when comparing the nine- month average from 2017 to 2016 reflects the successful results of the Company's business development efforts, with an emphasis on generating all types of commercial business loans particularly through its loan production offices. Loan interest income increased by $393,000, or 4.2%, between the third quarter of 2017 and the third quarter of 2016 and also increased by $853,000, or 3.0%, in the first nine months of 2017 when compared to last year. The higher loan interest income results from new loans originating at higher yields due to the higher interest rates and also reflects the upward repricing of certain loans tied to LIBOR or the prime rate as both of these indices have moved up with the Federal Reserve's decision to increase the target federal funds interest rate by 25 basis points in December of 2016, March of 2017, and again in June of 2017. Overall, total interest income increased by $1.7 million, or 5.4%, in the first nine months of 2017.

Total interest expense for the third quarter of 2017 increased by $280,000, or 14.2%, and increased by $692,000, or 12.1%, in the first nine months of 2017 when compared to 2016, due to higher levels of both deposit and borrowing interest expense. The Company experienced growth in deposits which we believe reflects the loyalty of our core deposit base that provides a strong foundation upon which this growth builds. Management's ability to acquire new core deposit funding from outside of our traditional market areas as well as our ongoing efforts to offer new loan customers deposit products were the primary reasons for this growth. Specifically, total deposits averaged $977 million for the first nine months of 2017 which is $29.9 million, or 3.2%, higher than the $947 million average for the first nine months of 2016. Deposit interest expense through nine months in 2017 increased by $583,000, or 14.7%, due to the higher balance of deposits along with certain indexed money market accounts repricing upward after the Federal Reserve interest rate increases. As a result of the solid deposit growth, the Company's loan to deposit ratio averaged 91.5% in the first nine months of 2017 which indicates that the Company has ample room to further grow its loan portfolio. The Company experienced a $109,000 increase in the interest cost for borrowings in the first nine months of 2017 primarily due to the immediate impact that the increases in the Federal Funds Rate had on the cost of overnight borrowed funds. In the first nine months of 2017, total average FHLB borrowed funds of $61.2 million remained relatively stable, increasing slightly by $339,000, or 0.6%.

The Company recorded a $200,000 provision for loan losses in the third quarter of 2017 compared to a $300,000 provision for loan losses in the third quarter of 2016. For the nine-month period in 2017, the Company recorded a $750,000 provision for loan losses compared to a $3,650,000 provision for loan losses in 2016 or a decrease of $2.9 million between years. Both, the loan loss provision and net charge-offs were at more typical levels this year than the substantially higher levels that were necessary early last year to resolve a troubled loan exposure to the energy industry. The provision recorded in 2017 supported commercial loan growth, a higher level of criticized loans and more than covered the low level of net loan charge-offs incurred in the first nine months of 2017. For the nine-month timeframe, the Company experienced net loan charge-offs of $336,000, or 0.05% of total loans in 2017 compared to net loan charge-offs of $3.8 million, or 0.58%, of total loans in 2016. Overall, the Company continued to maintain strong asset quality as its nonperforming assets totaled $5.4 million, or 0.60%, of total loans, at September 30, 2017. Total non-performing assets did increase by $3.0 million since the end of the second quarter due primarily to the transfer of one commercial credit exposure into non-accrual status. It is believed that the Company's loss exposure on this loan is limited because it is well secured with a low loan to value ratio. In summary, the allowance for loan losses provided 193% coverage of non-performing loans, and 1.15% of total loans, at September 30, 2017, compared to 612% coverage of non-performing loans, and 1.12% of total loans, at December 31, 2016.

Total non-interest income in the third quarter of 2017 decreased by $32,000, or 0.9%, from the prior year's third quarter, and for the first nine months of 2017 increased by $106,000, or 1.0%, when compared to the first nine months of 2016. For the third quarter of 2017, the decrease was due to lower revenue from mortgage related fees ($63,000) and residential mortgage loan sales into the secondary market ($43,000) as a result of reduced residential mortgage refinance activity in the third quarter of 2017. The reduced revenue more than offset a greater level of other income primarily from our financial services business unit by $87,000 as wealth management continues to be an important strategic focus of the Company. For the nine-month period, a $240,000 increase in financial services revenue, higher revenue from bank owned life insurance (BOLI) by $89,000 due to the second quarter receipt of a death claim, and a greater level of trust and investment advisory fees by $58,000 more than offset lower levels of service charges on deposits by $84,000, reduced mortgage related fees and residential mortgage loan sale gains by $101,000, and fewer gains realized from security sales by $62,000 in 2017.

The Company's total non-interest expense in the third quarter of 2017 decreased by $242,000, or 2.3%, when compared to the third quarter of 2016, and for the first nine months of 2017 decreased by $590,000, or 1.9%. The decrease in the third quarter of 2017 is attributed to lower levels of professional fees ($117,000) and other expenses ($98,000) as both of these expense categories were higher in 2016 due to costs associated with the resolution of a trust operations trading error. Also decreasing between quarters were equipment & occupancy expenses by a combined $98,000 due to the Company's ongoing profitability improvement initiatives. These favorable items more than offset higher salaries & employee benefits ($104,000) that resulted from increased health care costs and additional investment in talent, particularly in our wealth management division. For the nine-month period, the $590,000 decrease in non-interest expense in 2017 was attributable to the Company's ongoing efforts to control and reduce costs. Specifically, a branch consolidation and closure of an unprofitable loan production office were the primary reasons for occupancy expense decreasing by $136,000, or 6.5% and equipment costs declining by $68,000. Other expense is lower by $198,000 while professional fees declined by $159,000 for similar reasons mentioned above for the quarterly comparison. Reduced FDIC insurance by $88,000 also contributed to the favorable nine-month comparison. Overall, this continued focus on expense control and rationalization results in the efficiency ratio improving through nine months from 85.43% in 2016 to 81.30% in 2017. Finally, the Company recorded an income tax expense of $1.9 million, or an effective tax rate of 31.2%, in the first nine months of 2017. This compares to an income tax expense of $474,000, or an effective tax rate of 29.0%, for the first nine months of 2016.

The Company had total assets of $1.17 billion, shareholders' equity of $97.1 million, a book value of $5.31 per common share and a tangible book value of $4.66 per common share at September 30, 2017. In accordance with the common stock buyback program announced on January 24, 2017, the Company returned $2.8 million of capital to its shareholders through the repurchase of 686,360 shares of its common stock in the first nine months of 2017. This represents approximately 73% of the authorized common stock repurchase program. The Company continued to maintain strong capital ratios that exceed the regulatory defined well capitalized status.

This news release may contain forward-looking statements that involve risks and uncertainties, as defined in the Private Securities Litigation Reform Act of 1995, including the risks detailed in the Company's Annual Report and Form 10-K to the Securities and Exchange Commission. Actual results may differ materially.

| | | | NASDAQ: ASRV | | |

| | SUPPLEMENTAL FINANCIAL PERFORMANCE DATA | | |||

| | | | September 30, 2017 | | |

| | | (Dollars in thousands, except per share and ratio data) | |||

| | | | (Unaudited) | | |

| | | | | | |

| | | 2017 | | | |

| | | 1QTR | 2QTR | 3QTR | YEAR |

| | | | | | TO DATE |

| PERFORMANCE DATA FOR THE PERIOD: | | | | | |

| Net income | | 1,348 | 1,389 | 1,551 | 4,288 |

| Net income available to common shareholders | | 1,348 | 1,389 | 1,551 | 4,288 |

| | | | | | |

| PERFORMANCE PERCENTAGES (annualized): | | | | | |

| Return on average assets | | 0.47% | 0.48% | 0.53% | 0.49% |

| Return on average equity | | 5.74 | 5.81 | 6.37 | 5.98 |

| Net interest margin | | 3.27 | 3.27 | 3.28 | 3.27 |

| Net charge-offs as a percentage of average loans | | 0.04 | 0.01 | 0.11 | 0.05 |

| Loan loss provision as a percentage of average loans | | 0.10 | 0.14 | 0.09 | 0.11 |

| Efficiency ratio | | 82.04 | 81.47 | 80.42 | 81.30 |

| | | | | | |

| PER COMMON SHARE: | | | | | |

| Net income: | | | | | |

| Basic | | 0.07 | 0.07 | 0.08 | 0.23 |

| Average number of common shares outstanding | | 18,814 | 18,580 | 18,380 | 18,590 |

| Diluted | | 0.07 | 0.07 Werbung Mehr Nachrichten zur Ameriserv F Aktie kostenlos abonnieren

E-Mail-Adresse

Bitte überprüfe deine die E-Mail-Adresse.

Benachrichtigungen von ARIVA.DE (Mit der Bestellung akzeptierst du die Datenschutzhinweise) -1  Vielen Dank, dass du dich für unseren Newsletter angemeldet hast. Du erhältst in Kürze eine E-Mail mit einem Aktivierungslink. Hinweis: ARIVA.DE veröffentlicht in dieser Rubrik Analysen, Kolumnen und Nachrichten aus verschiedenen Quellen. Die ARIVA.DE AG ist nicht verantwortlich für Inhalte, die erkennbar von Dritten in den „News“-Bereich dieser Webseite eingestellt worden sind, und macht sich diese nicht zu Eigen. Diese Inhalte sind insbesondere durch eine entsprechende „von“-Kennzeichnung unterhalb der Artikelüberschrift und/oder durch den Link „Um den vollständigen Artikel zu lesen, klicken Sie bitte hier.“ erkennbar; verantwortlich für diese Inhalte ist allein der genannte Dritte. Andere Nutzer interessierten sich auch für folgende News | ||