American Homes 4 Rent Announces Pricing of Public Offering of 5.875% Series G Preferred Shares

PR Newswire

AGOURA HILLS, Calif., July 10, 2017

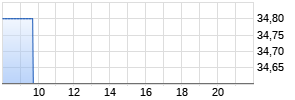

AGOURA HILLS, Calif., July 10, 2017 /PRNewswire/ -- American Homes 4 Rent (NYSE: AMH) (the "Company") today announced that it has priced its previously announced underwritten public offering of 4,600,000 of its 5.875% Series G Cumulative Redeemable Perpetual Preferred Shares (the "Series G Preferred Shares") raising gross proceeds of approximately $115 million, before deducting underwriting discounts and commissions and estimated offering expenses. The Series G Preferred Shares have an initial liquidation preference of $25 per share. The offering is expected to close on July 17, 2017, subject to customary closing conditions. The Company intends to apply to list the Series G Preferred Shares on the New York Stock Exchange under the symbol "AMHPRG." If the application is approved, the Company expects trading to commence within 30 days after initial delivery of the Series G Preferred Shares.

The Company will contribute the net proceeds from the offering to its operating partnership in exchange for Series G operating partnership units. The operating partnership intends to use the net proceeds from the contribution to repay indebtedness under the Company's revolving credit facility and term loan facility, to acquire single-family properties and for general corporate purposes, including repurchases of the Company's securities.

Wells Fargo Securities, Merrill Lynch, Pierce, Fenner & Smith Incorporated, and Raymond James are acting as joint book-running managers for the offering, Jefferies is acting as lead manager for the offering, and J.P. Morgan, Goldman Sachs & Co. LLC, US Bancorp, Citigroup, and Ramirez & Co., Inc. are acting as co-managers for the offering.

This press release shall not constitute an offer to sell or the solicitation of an offer to buy, nor shall there be any sale of these securities in any state or jurisdiction in which such an offer, solicitation or sale would be unlawful before registration or qualification thereof under the securities laws of any such state or jurisdiction.

The offering is being made pursuant to an effective shelf registration statement filed with the Securities and Exchange Commission (the "SEC") and only by means of a prospectus and prospectus supplement. Copies of the prospectus and final prospectus supplement relating to the offering may be obtained, when available, by visiting EDGAR on the SEC's website at www.sec.gov or from Wells Fargo Securities, LLC, Attention: WFS Customer Service, 608 2nd Avenue South, Suite 1000, Minneapolis, MN 55402, or via telephone (800) 645-3751, or via email wfscustomerservice@wellsfargo.com; Merrill Lynch, Pierce, Fenner & Smith Incorporated, Attention: Prospectus Department, NC1-004-03-43, 200 North College Street, 3rd Floor, Charlotte, North Carolina 28255-0001, or via telephone (800) 294-1322, or via email dg.prospectus_requests@baml.com; and Raymond James & Associates, Inc., Attention: Equity Syndicate, 880 Carillon Parkway, St. Petersburg, Florida 33716, or via telephone (800) 248-8863, or via email prospectus@raymondjames.com.

About American Homes 4 Rent

American Homes 4 Rent (NYSE: AMH) is a leader in the single-family home rental industry and "American Homes 4 Rent" is fast becoming a nationally recognized brand for rental homes, known for high quality, good value and tenant satisfaction. We are an internally managed Maryland real estate investment trust, or REIT, focused on acquiring, renovating, leasing, and operating single-family homes as rental properties. As of March 31, 2017, we owned approximately 48,336 single-family properties, in selected submarkets in 22 states.

Forward-Looking Statements

This press release contains "forward-looking statements." These forward-looking statements relate to beliefs, expectations or intentions and similar statements concerning matters that are not of historical fact and are generally accompanied by words such as "estimate," "project," "predict," "believe," "expect," "intend," "anticipate," "potential," "plan," "goal" or other words that convey the uncertainty of future events or outcomes. These forward-looking statements may include, but are not limited to, the Company's ability to complete the offering and the intended use of net proceeds. The Company has based these forward-looking statements on its current expectations and assumptions about future events. While the Company's management considers these expectations to be reasonable, they are inherently subject to risks, contingencies and uncertainties, most of which are difficult to predict and many of which are beyond the Company's control. These and other important factors, including "Risk Factors" disclosed in, or incorporated by reference into, the prospectus from the Company's Annual Report on Form 10-K for the year ended December 31, 2016 and in the Company's subsequent filings with the SEC, may cause the Company's actual results to differ materially from anticipated results expressed or implied by these forward-looking statements. Investors should not place undue reliance on these forward-looking statements.

Contact:

American Homes 4 Rent

Investor Relations

Phone: (855) 794-2447

Email: investors@ah4r.com

View original content with multimedia:http://www.prnewswire.com/news-releases/american-homes-4-rent-announces-pricing-of-public-offering-of-5875-series-g-preferred-shares-300485660.html

SOURCE American Homes 4 Rent

Mehr Nachrichten zur AMERN HOME.4 RENT A Aktie kostenlos abonnieren

(Mit der Bestellung akzeptierst du die Datenschutzhinweise)

Hinweis: ARIVA.DE veröffentlicht in dieser Rubrik Analysen, Kolumnen und Nachrichten aus verschiedenen Quellen. Die ARIVA.DE AG ist nicht verantwortlich für Inhalte, die erkennbar von Dritten in den „News“-Bereich dieser Webseite eingestellt worden sind, und macht sich diese nicht zu Eigen. Diese Inhalte sind insbesondere durch eine entsprechende „von“-Kennzeichnung unterhalb der Artikelüberschrift und/oder durch den Link „Um den vollständigen Artikel zu lesen, klicken Sie bitte hier.“ erkennbar; verantwortlich für diese Inhalte ist allein der genannte Dritte.