Alexandria Real Estate Equities, Inc. Announces Public Offering of 6,100,000 Shares of Common Stock

PR Newswire

PASADENA, Calif., March 9, 2017

PASADENA, Calif., March 9, 2017 /PRNewswire/ -- Alexandria Real Estate Equities, Inc. (NYSE: ARE) announced today that it is commencing an underwritten public offering of 6,100,000 shares of common stock, of which 4,000,000 shares will be subject to the forward sale agreements described below. The Company expects to grant the underwriters a thirty-day option to purchase up to 915,000 additional shares.

J.P. Morgan, BofA Merrill Lynch and Citigroup are the joint book-running managers for the offering.

The Company expects to enter into forward sale agreements with JPMorgan Chase Bank, N.A., London Branch, Bank of America, N.A., and Citibank, N.A. (the "forward purchasers") with respect to 4,000,000 shares of its common stock (or an aggregate of 4,915,000 shares if the underwriters exercise their option to purchase additional shares in full). In connection with the forward sale agreements, the forward purchasers or their affiliates are expected to borrow and sell to the underwriters an aggregate of 4,000,000 shares of the common stock that will be delivered in this offering (or an aggregate of 4,915,000 shares if the underwriters exercise their option to purchase additional shares in full). Subject to its right to elect cash or net share settlement subject to certain conditions, the Company intends to deliver, upon physical settlement of such forward sale agreements on one or more dates specified by the Company occurring no later than March 9, 2018, an aggregate of 4,000,000 shares of its common stock (or an aggregate of 4,915,000 shares if the underwriters exercise their option to purchase additional shares in full) to the forward purchasers in exchange for cash proceeds per share equal to the applicable forward sale price, which will be the public offering price, less underwriting discounts and commissions, and will be subject to certain adjustments as provided in the forward sale agreements.

The Company will receive proceeds from its sale of shares of its common stock in this public offering, but it will not initially receive any proceeds from the sale of shares of its common stock by the forward purchasers. The Company expects to use the net proceeds from the sale of the shares of its common stock in this offering and any net proceeds it receives upon the future settlement of the forward sale agreements to fund pending and recently completed acquisitions, near-term highly leased development projects, the redemption of its outstanding Series E Preferred Stock, with any remaining proceeds being held for general working capital and other corporate purposes, including the reduction of the outstanding balance on the Company's unsecured senior line of credit, if any. Selling common stock through the forward sale agreements enables the Company to set the price of such shares upon pricing the offering (subject to certain adjustments), while delaying the issuance of the shares and the receipt of the net proceeds by the Company until the expected funding requirements described above have occurred.

The offering is being made pursuant to an effective registration statement on Form S-3 that was previously filed with the Securities and Exchange Commission. This press release does not constitute an offer to sell or the solicitation of an offer to buy any of the Company's common stock, nor shall there be any sale of the common stock in any state in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such state.

Copies of the prospectus supplement relating to this offering, when available, may be obtained by contacting: J.P. Morgan, Attention: Broadridge Financial Solutions, 1155 Long Island Avenue, Edgewood, NY 11717, telephone: (1-866-803-9204); BofA Merrill Lynch, NC1-004-03-43, 200 North College Street, 3rd floor, Charlotte, NC 28255-0001, Attn: Prospectus Department, Email: dg.prospectus_requests@baml.com; or Citigroup, c/o Broadridge Financial Solutions, 1155 Long Island Avenue, Edgewood, NY 11717 (Telephone: 800-831-9146).

Alexandria Real Estate Equities, Inc.

ARIVA.DE Börsen-Geflüster

Weiter aufwärts?

| Kurzfristig positionieren in Alexandria Real Estate | ||

|

ME4TJS

| Ask: 1,44 | Hebel: 4,77 |

| mit moderatem Hebel |

Zum Produkt

| |

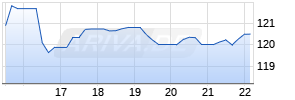

Kurse

|

Alexandria Real Estate Equities, Inc. is an urban office REIT uniquely focused on collaborative life science and technology campuses in AAA innovation cluster locations. Founded in 1994, Alexandria pioneered this niche and has since established a significant market presence in key locations, including Greater Boston, San Francisco, New York City, San Diego, Seattle, Maryland, and Research Triangle Park.

Forward-Looking Statements

This press release includes "forward-looking statements" within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Such forward-looking statements include, without limitation, statements regarding the Company's offering of common stock (including an option to purchase additional shares of common stock) and its intended use of the proceeds. These forward-looking statements are based on the Company's present intent, beliefs or expectations, but forward-looking statements are not guaranteed to occur and may not occur. Actual results may differ materially from those contained in or implied by the Company's forward-looking statements as a result of a variety of factors, including, without limitation, the risks and uncertainties detailed in its filings with the Securities and Exchange Commission. All forward-looking statements are made as of the date of this press release, and the Company assumes no obligation to update this information. For more discussion relating to risks and uncertainties that could cause actual results to differ materially from those anticipated in the Company's forward-looking statements, and risks and uncertainties to the Company's business in general, please refer to the Company's filings with the Securities and Exchange Commission, including its most recent annual report on Form 10-K.

To view the original version on PR Newswire, visit:http://www.prnewswire.com/news-releases/alexandria-real-estate-equities-inc-announces-public-offering-of-6100000-shares-of-common-stock-300421489.html

SOURCE Alexandria Real Estate Equities, Inc.

Mehr Nachrichten zur Alexandria Real Estate Aktie kostenlos abonnieren

(Mit der Bestellung akzeptierst du die Datenschutzhinweise)

Hinweis: ARIVA.DE veröffentlicht in dieser Rubrik Analysen, Kolumnen und Nachrichten aus verschiedenen Quellen. Die ARIVA.DE AG ist nicht verantwortlich für Inhalte, die erkennbar von Dritten in den „News“-Bereich dieser Webseite eingestellt worden sind, und macht sich diese nicht zu Eigen. Diese Inhalte sind insbesondere durch eine entsprechende „von“-Kennzeichnung unterhalb der Artikelüberschrift und/oder durch den Link „Um den vollständigen Artikel zu lesen, klicken Sie bitte hier.“ erkennbar; verantwortlich für diese Inhalte ist allein der genannte Dritte.