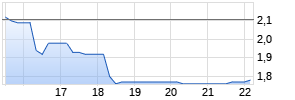

AeroCentury Corp. Earns $1.3 Million, or $0.81 per Share, in 3Q15; Portfolio Utilization Improves to 94%

PR Newswire

BURLINGAME, Calif., Nov. 9, 2015

BURLINGAME, Calif., Nov. 9, 2015 /PRNewswire/ -- AeroCentury Corp. (NYSE MKT: ACY), an independent aircraft leasing company, today reported earnings totaling $1.3 million, or $0.81 per diluted share, in the third quarter of 2015, compared to $1.4 million, or $0.87 per diluted share, in the second quarter of 2015. Third quarter profits reflect an improvement in utilization as the Company continues to adjust the composition of its portfolio of regional aircraft and engines. Following the $11.7 million non-cash, pre-tax write-down of certain older aircraft, the net loss in the third quarter of 2014 was $8.2 million, or ($5.34) per diluted share.

Net income improved to $3.4 million, or $2.17 per diluted share, for the first nine months of 2015, compared to a net loss of $11.8 million, or ($7.64) per diluted share, for the first nine months of 2014, which included $18.5 million of non-cash pre-tax write-downs on older equipment. All reported results are unaudited.

"Utilization improved to 94% in the third quarter, reflecting acquisitions made in 2014 and our success in re-leasing aircraft that were off lease in 2014," said Neal D. Crispin, President and Chief Executive Officer. "We continued to implement our strategy to reposition our portfolio by selling older aircraft. During the third quarter, we sold three aircraft pursuant to sales-type finance leases, which generated gains totaling $1.1 million and, in October, we sold an additional two aircraft for cash, for a $5.7 million gain. As buyers, we are carefully monitoring market conditions and are currently reluctant to purchase newer aircraft until pricing becomes more rational."

Third Quarter 2015 Highlights (at or for the period ended September 30, 2015, compared to June 30, 2015 and September 30, 2014):

- Average portfolio utilization increased to 94% during the third quarter of 2015, compared to 90% in the preceding quarter and 80% a year ago, reflecting the improved mix of assets in the lease portfolio.

- Total revenues decreased 17% to $7.8 million for the third quarter of 2015, compared to $9.4 million in the preceding quarter and increased 18% from $6.6 million in the year ago quarter.

- Operating lease revenues increased 3% to $6.5 million in the third quarter of 2015, compared to $6.3 million in the second quarter and grew 35% from $4.8 million a year ago. Operating lease revenue increased primarily because of higher utilization in the third quarter compared to prior periods. In addition, revenue from three aircraft purchased during 2014 and four assets that were off lease in the 2014 period, but on lease in the 2015 period, contributed to profitability. The effect of these increases was partially offset by the decrease in operating lease revenue from two assets that became subject to sales-type finance leases in the 2015 period, and now generate interest income rather than operating lease revenue.

- No maintenance reserves revenue, which is generated when long-term leases end, was recorded in either of the third quarters of 2015 or 2014. In the second quarter of 2015, one aircraft was returned generating $262,000 of maintenance reserves revenue.

- Three older aircraft were sold under sales-type finance leases in the third quarter of 2015, generating $1.1 million in gain on disposal of assets, compared to $2.7 million in the second quarter. During the third quarter of 2014, the Company sold three aircraft for cash, generating gains totaling $1.8 million.

- Total expenses decreased 19% to $5.9 million in the third quarter of 2015, as compared to $7.3 million in the preceding quarter, primarily due to lower maintenance costs for off-lease aircraft in the third quarter. Total expenses were down substantially from $19.2 million in the third quarter a year ago, which included $11.7 million of non-cash, pre-tax write-downs on certain older aircraft and $2.2 million of maintenance costs primarily related to preparing aircraft for re-lease.

- Operating margin and net margin increased to 25% and 16%, respectively, in the third quarter of 2015 from 22% and 15%, respectively, in the second quarter of 2015. During the third quarter of 2014, the Company had negative operating and net margins, reflecting non-cash write-downs and higher than normal re-leasing expenses.

- Book value per share totaled $24.75 at September 30, 2015, up 3% from $23.94 per share at June 30, 2015, and up 11% from $22.25 per share a year ago.

Currently, AeroCentury's portfolio consists of thirty-six aircraft, five of which are operating under sales-type finance leases, covering ten different aircraft types and five engines, compared to thirty-eight aircraft, one of which was operating under a sales-type finance lease, and five engines at September 30, 2014. At September 30, 2015, total assets were $191.3 million, compared to $172.8 million a year ago. The current customer base comprises fourteen airlines operating worldwide.

AeroCentury is an aircraft operating lessor and finance company specializing in leasing regional aircraft and engines utilizing triple net leases. The Company's aircraft and engines are leased to regional airlines and commercial users worldwide.

| Selected Financial Information (in thousands, except share and per share data) (Unaudited) | ||||||

| | | | | |||

| | For the Three Months Ended | | For the Nine Months Ended | |||

| | September 30, | June 30, | September 30, | | September 30, | September 30, |

| | 2015 | 2015 | 2014 | | 2015 | 2014 |

| | | | | | | |

| Revenues and other income: | | | | | | |

| Operating lease revenue | $6,511 | $6,332 | $4,815 | | $19,282 | $ 15,998 |

| Gain on disposal of assets | 1,095 | 2,682 | 1,809 | | 5,639 | 2,964 |

| Maintenance reserves revenue (1) | - | 262 | - | | 589 | 3,394 |

| Other income | 185 | 92 | 1 | | 277 | 152 |

| | 7,791 | 9,368 | 6,625 | | 25,787 | 22,508 |

| Expenses: | | | | | | |

| Depreciation | 2,282 | 2,322 | 1,731 | | 6,931 | 5,610 |

| Interest | 1,459 | 1,468 | 1,225 | | 4,805 | 3,793 |

| Management fees | 1,411 | 1,416 | 1,205 | | 4,261 | 3,865 |

| Professional fees and other | 529 | 471 | 1,136 | | 1,454 | 2,929 |

| Maintenance costs | 197 | 1,458 | 2,173 | | 3,037 | 5,820 |

| Provision for impairment | - | 148 | 11,719 | | 148 | 18,519 |

| | 5,878 | 7,283 | 19,189 | | 20,636 | 40,536 |

| Income/(loss) before income taxes | 1,913 | 2,085 | (12,564) Werbung Mehr Nachrichten zur AeroCentury Aktie kostenlos abonnieren

E-Mail-Adresse

Bitte überprüfe deine die E-Mail-Adresse.

Benachrichtigungen von ARIVA.DE (Mit der Bestellung akzeptierst du die Datenschutzhinweise) -1  Vielen Dank, dass du dich für unseren Newsletter angemeldet hast. Du erhältst in Kürze eine E-Mail mit einem Aktivierungslink. Hinweis: ARIVA.DE veröffentlicht in dieser Rubrik Analysen, Kolumnen und Nachrichten aus verschiedenen Quellen. Die ARIVA.DE AG ist nicht verantwortlich für Inhalte, die erkennbar von Dritten in den „News“-Bereich dieser Webseite eingestellt worden sind, und macht sich diese nicht zu Eigen. Diese Inhalte sind insbesondere durch eine entsprechende „von“-Kennzeichnung unterhalb der Artikelüberschrift und/oder durch den Link „Um den vollständigen Artikel zu lesen, klicken Sie bitte hier.“ erkennbar; verantwortlich für diese Inhalte ist allein der genannte Dritte. Andere Nutzer interessierten sich auch für folgende News | |||