Aberdeen Global Income Fund, Inc. Announces Performance Data And Portfolio Composition

PR Newswire

PHILADELPHIA, Oct. 20, 2017

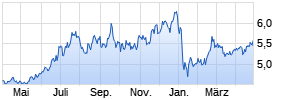

PHILADELPHIA, Oct. 20, 2017 /PRNewswire/ -- Aberdeen Global Income Fund, Inc. (the "Fund") (NYSE American: FCO), a closed-end bond fund, announced today its performance data and portfolio composition as of September 30, 2017.

The Fund's total returns for various periods through September 30, 2017 are provided below. (All figures are based on distributions reinvested at the dividend reinvestment price, and are stated net-of-fees):

| Period | NAV Total Return % | Market Price Total Return % | ||

| | Cumulative | Annualized | Cumulative | Annualized |

| Since Inception (March 1992) | 468.9 | 7.0 | 409.1 | 6.6 |

| 10-years | 63.7 | 5.1 | 71.2 | 5.5 |

| 5-years | 2.9 | 0.6 | -1.7 | -0.3 |

| 3-years | 7.6 | 2.5 | 11.6 | 3.7 |

| 1-year | 5.6 | 11.3 | ||

The Fund's returns, which are denominated in U.S. dollars, are affected by the performance of the U.S. dollar against the various currencies listed below.

As of September 30, 2017, the portfolio was invested as follows:

| | Currency Exposure % | Geographic Exposure % |

| Australia | 3.0 | 7.1 |

| United Kingdom | - | 3.1 |

| Canada | - | 1.2 |

| New Zealand | 4.9 | 7.3 |

| | | |

| United States | 66.8* | 22.6 |

| | | |

| Europe | 2.7 | 14.2** |

| Asia | 17.3 | 21.4 |

| Africa | 2.0 | 7.0 |

| Caribbean | - | 0.2 |

| Latin America | 3.3 | 15.9 |

*Of which 61.8% is invested in US$ denominated bonds issued by foreign issuers.

**Europe is comprised of: Eastern Europe 9.2% and Western Europe 5.0%.

As of September 30, 2017, the top ten holdings of the portfolio based on total assets were as follows:

| Holding | Coupon / Maturity | (%) |

| State of New South Wales Australia | 6.00%, 05/01/2030 | 4.8 |

| New Zealand Government Bond | 5.00%, 03/15/2019 | 4.1 |

| New Zealand Government Bond | 2.75%, 04/15/2025 | 2.9 |

| Queensland Treasury Corporation | 2.75%, 08/20/2027 | 2.4 |

| Russia Government Bond | 7.05%, 01/19/2028 | 1.9 |

| Argentina Government Bond | 7.50%, 04/22/2026 | 1.5 |

| Romania Government Bond | 6.13%, 01/22/2044 | 1.3 |

| Sri Lanka Government Bond | 10.60%, 09/15/2019 | 1.0 Werbung Mehr Nachrichten zum Fonds kostenlos abonnieren

E-Mail-Adresse

Bitte überprüfe deine die E-Mail-Adresse.

Benachrichtigungen von ARIVA.DE (Mit der Bestellung akzeptierst du die Datenschutzhinweise) -1  Vielen Dank, dass du dich für unseren Newsletter angemeldet hast. Du erhältst in Kürze eine E-Mail mit einem Aktivierungslink. Hinweis: ARIVA.DE veröffentlicht in dieser Rubrik Analysen, Kolumnen und Nachrichten aus verschiedenen Quellen. Die ARIVA.DE AG ist nicht verantwortlich für Inhalte, die erkennbar von Dritten in den „News“-Bereich dieser Webseite eingestellt worden sind, und macht sich diese nicht zu Eigen. Diese Inhalte sind insbesondere durch eine entsprechende „von“-Kennzeichnung unterhalb der Artikelüberschrift und/oder durch den Link „Um den vollständigen Artikel zu lesen, klicken Sie bitte hier.“ erkennbar; verantwortlich für diese Inhalte ist allein der genannte Dritte. Andere Nutzer interessierten sich auch für folgende News |