OM Group Announces Agreements To Exit Its Advanced Materials Business

PR Newswire

CLEVELAND, Jan. 21, 2013

CLEVELAND, Jan. 21, 2013 /PRNewswire/ -- OM Group, Inc. (NYSE: OMG) today announced a major step in its strategic evolution with the signing of definitive agreements to exit its Advanced Materials business. The transactions include the sale of the downstream portion of the business, including its cobalt refinery assets in Kokkola, Finland, to a joint venture to be held by Freeport-McMoRan Copper & Gold Inc. (NYSE: FCX), Lundin Mining Corporation (TSX: LUN) and La Generale des Carrieres et des Mines (Gecamines), for total potential consideration of up to $435 million, comprised of initial cash consideration of $325 million and potential future payments of up to an additional $110 million based on the business achieving certain revenue targets over a period of three years. The sale is expected to close before the end of April 2013, subject to customary closing conditions and regulatory approvals. OM Group also announced that its Board of Directors has authorized the repurchase of up to $50 million of its common shares.

"The divestiture of our cobalt business is the final step in exiting our legacy commodity businesses and is consistent with our strategy to move up the value chain into technology-based businesses with attractive growth prospects and more predictable earnings profiles," said Joe Scaminace, Chairman and CEO of OM Group. "Following the sale, the Company will be well-positioned to achieve its core strategic objectives with a strong balance sheet and a clear vision for the future. We plan to return capital to shareholders via our recently authorized share repurchase program, and we will continue to invest in our businesses to support our growth strategy."

The Company said the transactions better position it to achieve its core objectives to:

- Provide specialized, value-added solutions for its customers' complex applications and demanding requirements;

- Expand its leading positions in markets with attractive global growth trends, including automotive systems, electronic devices, aerospace, general industrial and renewable energy;

- Complement its organic growth with synergistic acquisitions; and

- Maximize total shareholder return through financial discipline, optimal deployment of capital, business growth and continued operational excellence.

Following the close of the sale, the Company expects to have total cash on-hand of over $500 million, which it expects to efficiently deploy to repay a substantial portion of its debt, repurchase up to $50 million of its shares, and support its strategy of profitable organic and strategic growth.

In connection with the sale, OM Group will transfer its equity interests in its DRC-based joint venture known as GTL to its joint venture partners, subject to a security interest in favor of OM Group with respect to the joint venture's performance of certain supply arrangements.

"I want to extend my appreciation to our Advanced Materials associates," said Mr. Scaminace. "They have a long track record of operational excellence and commitment to customer success. This transaction further strengthens the business by providing a committed raw material supply stream and support from one of the world's largest and most successful mining companies."

SHARE REPURCHASE PROGRAM ANNOUNCED

ARIVA.DE Börsen-Geflüster

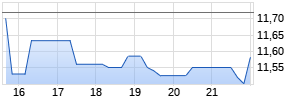

Kurse

|

|

|

|

OM Group also announced that its Board of Directors has authorized the repurchase of up to $50 million of its common shares. The Company may utilize various methods to effect the repurchases, which may include open market repurchases, negotiated block transactions, accelerated share repurchases or open market solicitations for shares, some of which may be effected through 10b5-1 Plans. Any repurchases would be funded from cash on hand or borrowings under the Company's credit facilities. The timing of repurchases will depend on several factors including market and business conditions, and the repurchases may be discontinued at any time. The authorization represents approximately 7% of the Company's current outstanding common shares based on last Friday's closing price.

"We believe the long-term intrinsic value of the Company, combined with our increased financial flexibility following the exit of the Advanced Materials business, create an attractive opportunity for repurchasing our shares," said Mr. Scaminace. "We believe we have available capital resources to pursue these share repurchases without disrupting our growth strategy, including synergistic acquisitions."

BUSINESS UPDATE

The Company also commented that market conditions remained difficult throughout the fourth quarter of 2012, particularly in Europe and in global consumer electronics markets. The Company reiterated its expectation for no rare earth pricing benefits in the fourth quarter of 2012 and stated that it now expects a significant lower-of-cost-or-market charge to principally reflect decreased rare earth prices.

"Business conditions became more challenging than expected in our recent fourth quarter, and these conditions persist at the beginning of 2013," said Mr. Scaminace. "As a result, we are now implementing a broad range of cost reduction initiatives. These actions will contribute to our near-term financial performance and improve our long-term cost structure, better positioning the Company as macroeconomic conditions improve. The sale of the Advanced Materials business further strengthens our balance sheet and provides the capacity and flexibility to support these operating improvements as well as our overall growth strategy." The Company plans to provide more a comprehensive business update during its regular fourth quarter investor conference call on February 19, 2013.

CONFERENCE CALL SCHEDULED FOR TOMORROW, JANUARY 22, 2013 AT 10:00 AM ET

OM Group has scheduled a conference call for tomorrow, January 22, 2013 at 10:00 AM ET for Mr. Scaminace and Chris Hix, Chief Financial Officer, to discuss the transaction with the investment community. The conference call will be available via webcast at www.omgi.com and by dialing +1-800-344-0734 (US/Canada) or +1-973-935-2082 and using the conference code #92004628. Replays of the call will be available on the Company's website or by dialing +1-855-859-2056 or +1-404-537-3406. Call materials will be available on the Investor Relations section of the Company's website before the call.

ABOUT OM GROUP

OM Group is a technology-based industrial growth company serving attractive global markets, including automotive systems, electronic devices, aerospace, general industrial and renewable energy. Its business platforms use innovative technologies and expertise to address customers' complex applications and demanding requirements. For more information, visit the Company's website at www.omgi.com.

FORWARD-LOOKING STATEMENTS

The foregoing discussion may include forward-looking statements for purposes of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Such forward-looking statements are based upon specific assumptions and are subject to uncertainties and factors relating to the company's operations and business environment, all of which are difficult to predict and many of which are beyond the control of the company. These uncertainties and factors could cause actual results of the company to differ materially from those expressed or implied in the forward-looking statements contained in the foregoing discussion. Such uncertainties and factors include: successful completion of the sale of our Advanced Materials business; successful execution of the GTL supply agreement signed in connection with the Advanced Materials sale; risks arising from uncertainty in worldwide economic conditions; extended business interruption at our facilities; fluctuations in the price and uncertainties in the supply of rare earth materials and other raw materials; our ability to identify, complete and integrate acquisitions aligned with our strategy; restrictive covenants in our Senior Secured Credit Facility which may affect our ability to operate our business successfully; indebtedness may impair our ability to operate our business successfully; changes in effective tax rates or adverse outcomes resulting from examination of our income tax returns; the majority of our operations are outside the United States, which subjects us to risks that may adversely affect our operating results; level of returns on pension plan assets and changes in the actuarial assumptions; the majority of our cash is generated and held outside the United States; the timing and amount of common share repurchases, if any; fluctuations in foreign exchange rates; unanticipated costs or liabilities for compliance with environmental regulation; changes in environmental, health and safety regulatory requirements; technological changes in our industry or in our customers' products; our ability to adequately protect or enforce our intellectual property rights; disruption of our relationship with key customers or any material adverse change in their businesses; and the risk factors set forth in Part 1, Item 1a of our Annual Report on Form 10-K for the year ended December 31, 2011.

SOURCE OM Group, Inc.

Mehr Nachrichten zur OM GRP INC. Aktie kostenlos abonnieren

(Mit der Bestellung akzeptierst du die Datenschutzhinweise)

Hinweis: ARIVA.DE veröffentlicht in dieser Rubrik Analysen, Kolumnen und Nachrichten aus verschiedenen Quellen. Die ARIVA.DE AG ist nicht verantwortlich für Inhalte, die erkennbar von Dritten in den „News“-Bereich dieser Webseite eingestellt worden sind, und macht sich diese nicht zu Eigen. Diese Inhalte sind insbesondere durch eine entsprechende „von“-Kennzeichnung unterhalb der Artikelüberschrift und/oder durch den Link „Um den vollständigen Artikel zu lesen, klicken Sie bitte hier.“ erkennbar; verantwortlich für diese Inhalte ist allein der genannte Dritte.