2018 LightStream Home Improvement Survey

PR Newswire

ATLANTA, March 1, 2018

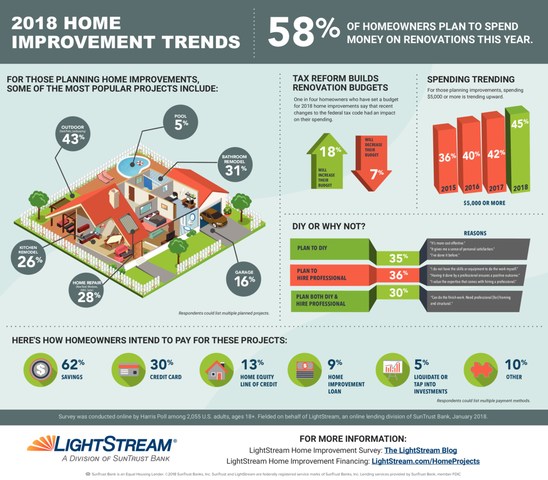

ATLANTA, March 1, 2018 /PRNewswire/ -- More than half (58 percent) of homeowners are planning to spend money on home improvement projects in 2018, according to the fifth annual LightStream Home Improvement Survey. LightStream is the national online lending division of SunTrust Banks, Inc. (NYSE: STI). Budgets for renovations are on the rise: among homeowners planning renovations, 45 percent will spend $5,000 or more — an all-time survey high. Those planning to spend $35,000 or more doubled from 2017.

The survey shows robust enthusiasm for renovation, as well as a thoughtful desire to balance a home's needs and the homeowners' budget, so they have the financial confidence to move forward. Specifically, the survey revealed the following trends:

- Home "Sweat" Home

The majority of homeowners plan to invest sweat equity, as 65 percent say they'll do at least some of the work themselves. The 18-34 group is particularly fond of do-it-yourself projects, with 70 percent planning to work on at least a portion of their renovation.

- Love of the Outdoors

The popularity of outdoor improvements remains strong. Projects such as decks, patios and landscaping rank at the top of the list for the fifth year in a row (43 percent), up five percent over 2017. Nearly a third (31 percent) of homeowners will tackle a bathroom remodel; more than one in four (26 percent) will redo a kitchen.

- Staying — and Aging — in Place

Only seven percent of homeowners are renovating to prepare their homes to be sold, the lowest percentage since 2015. Instead, 14 percent of homeowners across all age groups — not just baby boomers — are citing "aging in place" as a reason for making a home improvement. Even respondents aged 18 to 34 (11 percent) and 35 to 44 (10 percent) say they're renovating "to prepare my home so I can stay in it as I get older."

- Tax Reform Boosting Budgets

With recent passage of tax reform, homeowners have already begun calculating how the changes might affect what they spend on home improvements. One in four homeowners who have set a budget for renovation projects stated that tax reform has had an impact, with 18 percent increasing their budget and seven percent decreasing it.

- Paying for Projects

The majority of homeowners (62 percent) plan to pay for projects, at least in part, by using savings. Additional payment strategies were further revealed. Intent to fund through home equity lines of credit (HELOC) jumped from 10 to 13 percent. "U.S. economic growth and limited housing inventory have contributed to healthy home equity gains," said Ellen Koebler, SunTrust head of consumer solutions. "HELOCs can offer a financial solution for many homeowners, as accrued value may be available to tap for renovations."

At the same time, the percentage of people intending to use a home improvement loan has grown 29 percent from 2017 with 54 percent more 18- to 34-year-olds planning to fund projects through home improvement financing.

"Consumers are becoming more comfortable with home improvement loans because of the availability of higher loan amounts, speed of delivery and the overall flexibility they provide," said Todd Nelson, LightStream senior vice president. "That's one reason LightStream recently extended its financing terms to 144 months. It gives homeowners with excellent credit the option of paying loans back over a longer period of time while still enjoying competitive fixed rates and the ability to fund on the same day. And, like all LightStream loans, there are no pre-payment penalties should they decide to pay their loan off early."

Other financing options are being considered, as well. While overall, 30 percent of homeowners say they'll pay for some portion of their 2018 project with a credit card, 16 percent fewer homeowners aged 18 to 34 plan to use them compared to last year.

A comprehensive infographic highlighting the 2018 LightStream Home Improvement Survey is available to download. For more information about LightStream home improvement financing, visit LightStream.com/HomeProjects.

About LightStream, a division of SunTrust Bank

LightStream is a national online lending division of SunTrust Bank, providing loans for practically any purpose. LightStream's proprietary technology provides consumers with a virtually paperless loan application, underwriting, funding and servicing experience. LightStream financing is available in all 50 states; people need not have a SunTrust account in order to apply. Click here for important disclosures, including a payment example and information on same day funding, LightStream's Rate Beat Program and $100 Loan Experience Guarantee.

About the 2018 LightStream Home Improvement Survey

This year's survey was conducted online within the United States by Harris Poll on behalf of LightStream from Jan. 26 – 30, 2018 among 2,055 U.S. adults ages 18 and older (1,405 homeowners, among whom 808 plan to spend money on home improvements in 2018). The 2017 survey was conducted from Jan. 26 – 30, 2017 among 3,172 U.S. adults ages 18 and older (2,092 homeowners, among whom 1,238 planned to spend money on home improvements in 2017). The 2016 survey was conducted from Feb. 1 – 3, 2016 among 2,048 U.S. adults ages 18 and older (1,258 homeowners, among whom 763 planned to spend money on home improvements in 2016. The 2015 survey was conducted from Feb. 6 – 10, 2015 among 2,015 U.S. adults ages 18 and older (1,279 homeowners, among whom 693 planned to spend money on home improvements in 2015). The 2014 survey was conducted from March 6 – 10, 2014 among 1,291 homeowners ages 18+, among whom 684 planned to spend money on home improvements in 2014. These online surveys are not based on a probability sample and therefore no estimate of theoretical sampling error can be calculated. For complete survey methodology and calculations, contact Julie.Olian@LightStream.com.

| SunTrust Bank is an Equal Housing Lender. © 2018 SunTrust Banks, Inc. All rights reserved. SunTrust and LightStream are federally registered service marks of SunTrust Banks, Inc. All other trademarks are the property of their respective owners. |

![]() View original content with multimedia:http://www.prnewswire.com/news-releases/2018-lightstream-home-improvement-survey-300606630.html

View original content with multimedia:http://www.prnewswire.com/news-releases/2018-lightstream-home-improvement-survey-300606630.html

SOURCE SunTrust Banks, Inc.

Mehr Nachrichten zur Suntrust Banks Inc Aktie kostenlos abonnieren

(Mit der Bestellung akzeptierst du die Datenschutzhinweise)

Hinweis: ARIVA.DE veröffentlicht in dieser Rubrik Analysen, Kolumnen und Nachrichten aus verschiedenen Quellen. Die ARIVA.DE AG ist nicht verantwortlich für Inhalte, die erkennbar von Dritten in den „News“-Bereich dieser Webseite eingestellt worden sind, und macht sich diese nicht zu Eigen. Diese Inhalte sind insbesondere durch eine entsprechende „von“-Kennzeichnung unterhalb der Artikelüberschrift und/oder durch den Link „Um den vollständigen Artikel zu lesen, klicken Sie bitte hier.“ erkennbar; verantwortlich für diese Inhalte ist allein der genannte Dritte.